Question: can you show how to do this using the present value/future value tables and a timeline ? 6. A software firm has completed a new

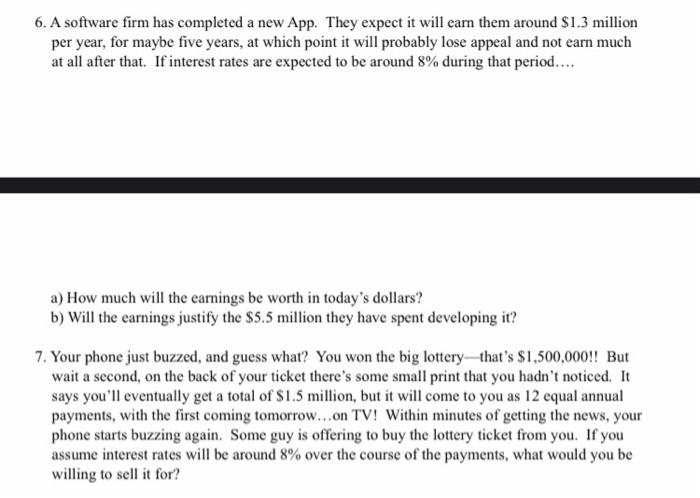

6. A software firm has completed a new App. They expect it will earn them around $1.3 million per year, for maybe five years, at which point it will probably lose appeal and not earn much at all after that. If interest rates are expected to be around 8% during that period.... a) How much will the earnings be worth in today's dollars? b) Will the earnings justify the $5.5 million they have spent developing it? 7. Your phone just buzzed, and guess what? You won the big lottery - that's $1,500,000! ! But wait a second, on the back of your ticket there's some small print that you hadn't noticed. It says you'll eventually get a total of $1.5 million, but it will come to you as 12 equal annual payments, with the first coming tomorrow...on TV! Within minutes of getting the news, your phone starts buzzing again. Some guy is offering to buy the lottery ticket from you. If you assume interest rates will be around 8% over the course of the payments, what would you be willing to sell it for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts