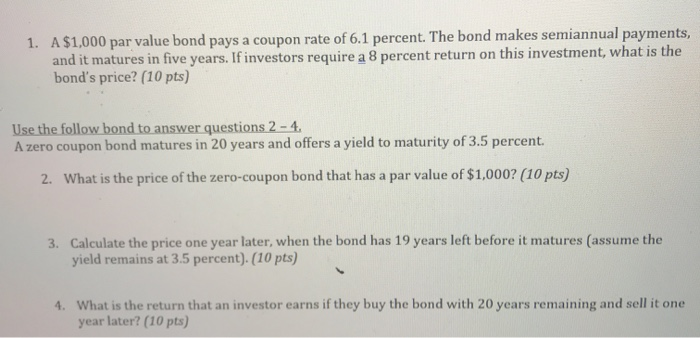

Question: can you show me how to answer the question using the calculator? A $1,000 par v and it matures in five years.If investors require a

A $1,000 par v and it matures in five years.If investors require a 8 percent return on this investment, what is the bond's price? (10 pts) alue bond pays a coupon rate of 6.1 percent. The bond makes semiannual payments, 1. A zero coupon bond matures in 20 years and offers a yield to maturity of 3.5 percent. What is the price of the zero-coupon bond that has a par value of $1,000? (10 pts) 2. Calculate the price one year later, when the bond has 19 years left before it matures (assume the yield remains at 3.5 percent).(10 pts) 3. 4. What is the return that an investor earns if they buy the bond with 20 years remaining and sell it one year later? (10 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts