Question: Can you show me step by step how to solve? Suppose the estimated linear probability model used by an FI to predict business loan applicant

Can you show me step by step how to solve?

Can you show me step by step how to solve?

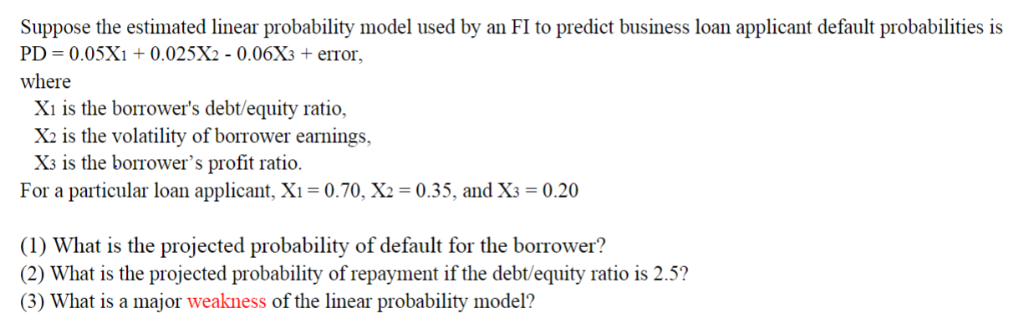

Suppose the estimated linear probability model used by an FI to predict business loan applicant default probabilities is PD0.05X1 + 0.025X2 - 0.06X3 + error where Xi is the borrower's debt/equity ratio, X2 is the volatility of borrower earnings, X3 is the borrower's profit ratio. For a paticular loan applicant, Xi 0.70, X2-0.35, and X 0.20 (1) What is the projected probability of default for the borrower? (2) What is the projected probability of repayment if the debt/equity ratio is 2.5? (3) What is a major weakness of the linear probability model

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock