Question: Suppose the estimated linear probability model used by an FI to predict business loan applicant default probabilities is PD = 0.03X +0.02X - 0.05X3 +

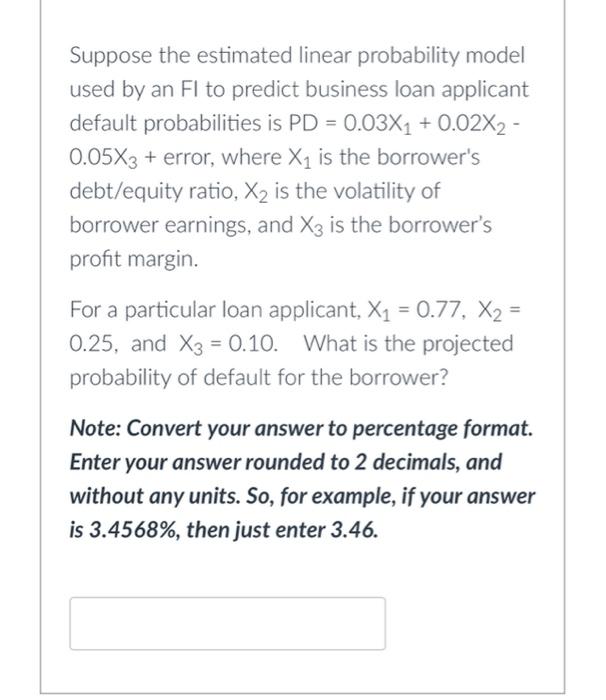

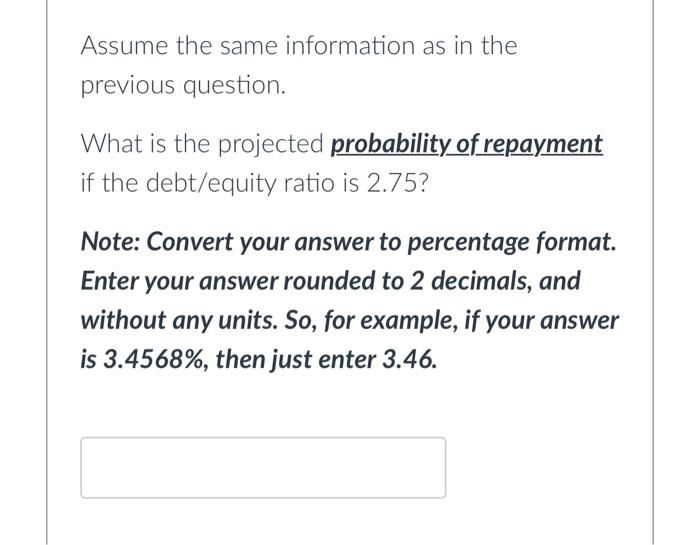

Suppose the estimated linear probability model used by an FI to predict business loan applicant default probabilities is PD = 0.03X +0.02X - 0.05X3 + error, where X is the borrower's debt/equity ratio, X is the volatility of borrower earnings, and X3 is the borrower's profit margin. For a particular loan applicant, X = 0.77, X = 0.25, and X3 = 0.10. What is the projected probability of default for the borrower? Note: Convert your answer to percentage format. Enter your answer rounded to 2 decimals, and without any units. So, for example, if your answer is 3.4568%, then just enter 3.46. Assume the same information as in the previous question. What is the projected probability of repayment if the debt/equity ratio is 2.75? Note: Convert your answer to percentage format. Enter your answer rounded to 2 decimals, and without any units. So, for example, if your answer is 3.4568%, then just enter 3.46

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts