Question: can you solve question 5 please Question 5 (2 points) Airways Corporation owned maintenance equipment with a $1120000 initial cost basis. Accumulated book depreciation with

can you solve question 5 please

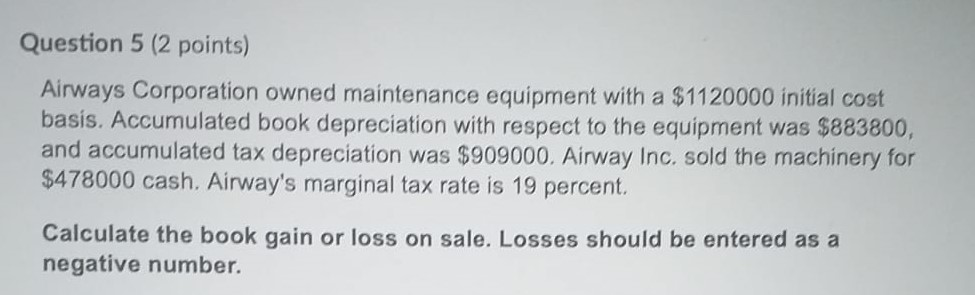

Question 5 (2 points) Airways Corporation owned maintenance equipment with a $1120000 initial cost basis. Accumulated book depreciation with respect to the equipment was $883800, and accumulated tax depreciation was $909000. Airway Inc. sold the machinery for $478000 cash. Airway's marginal tax rate is 19 percent. Calculate the book gain or loss on sale. Losses should be entered as a negative number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts