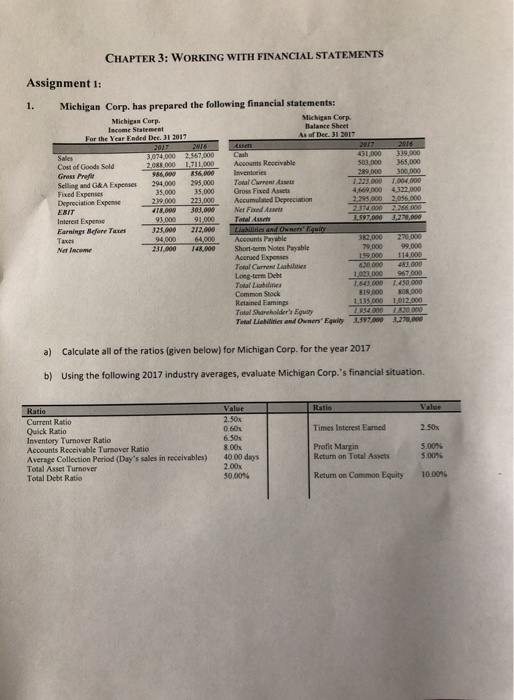

Question: can you type and be clear with answer S CHAPTER 3: WORKING WITH FINANCIAL STATEMENTS Assignment 1: 1. Michigan Corp. has prepared the following financial

S CHAPTER 3: WORKING WITH FINANCIAL STATEMENTS Assignment 1: 1. Michigan Corp. has prepared the following financial statements: Michigan Corp. Balance Sheet Michigan Corp. lacome Statement For the Year Endrd Dee. 31 201 074,000 2,567,000 Cash 2088.000 1.711000 Ascounts Receivable 986,000 856,000Invenories Sales Cost of Goods Seld 03,000 365,000 289.000 300,000 1.223,000 1.004,000 4,669,000 4,322000 Gress Prefit Selling and G&A Expenses 294,000 295,000 Total Fixed Expenses Carrent Asse 35,000 35,000 Gross Fixed Assets 18,090 303,000 Net Fxed Assets 325,000 212,000 31,000 148000 Short-serm Notes Payable 2,295,000 3 223,000 Accumalasod Depeeciation Depreciation Expen239,000 ERIT Interest Expense Earnings Before Taxes Total Assehs 382,000 270,000 79,000 99,000 159,000 114,000 20,000 483,000 023,000 967.000 ,643,000 1450.000 819,000 808,000 1,135,000 1,012,000 Net income Aocrued Expenses Total Carrent Liabuluies Long-lerm Debt Total Liabtdlines Common Stock Retained Eamings Total Shareholder's Equity Total Liahilinies and Owners Equity 3,270,00 3,597,000 Calculate all of the ratios (given below) for Michigan Corp. for the year 2017 a) Using the following 2017 industry averages, evaluate Michigan Corp.'s financial situation. b) Value 2.50 0.60x 6.50 8.00 Current Ratio Quick Ratio Inventory Turnover Ratio Accounts Receivable Tunover Ratio Average Collection Period (Day's sales in receivables) 40.00 days Total Asset Turnover Total Debt Ratio Times Interest Earned 2 50x Profit Margin Rcturn on Total Assets 5000% 5.00% 2.00x 50.00% Return on Common Equity 10.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts