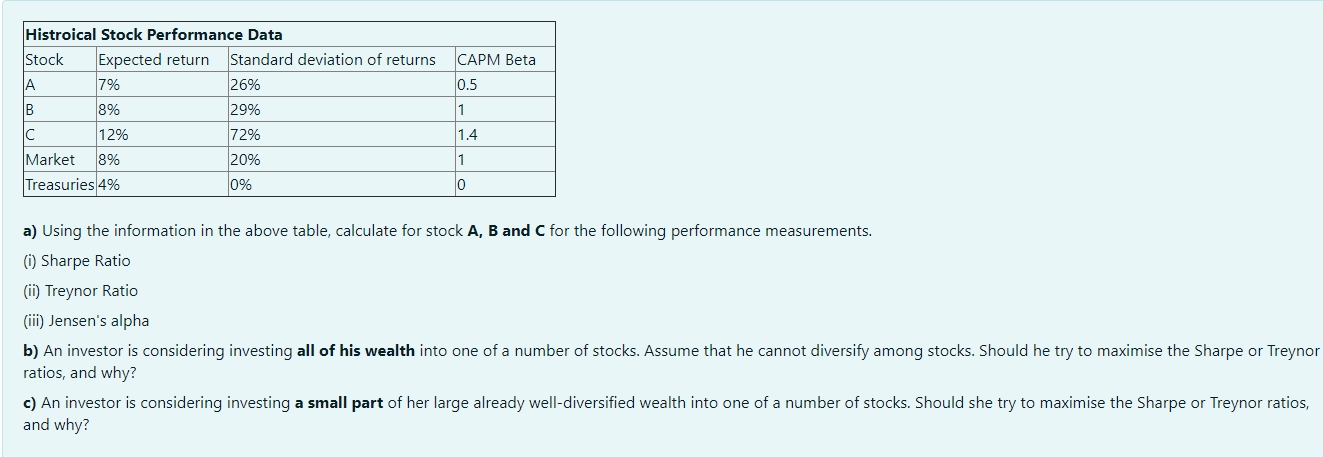

Question: CAPM Beta 0.5 Histroical Stock Performance Data Stock Expected return Standard deviation of returns A 7% 26% B 8% 29% C 12% 72% Market 8%

CAPM Beta 0.5 Histroical Stock Performance Data Stock Expected return Standard deviation of returns A 7% 26% B 8% 29% C 12% 72% Market 8% 20% Treasuries 4% 0% 1 1.4 1 0 a) Using the information in the above table, calculate for stock A, B and C for the following performance measurements. (0) Sharpe Ratio (ii) Treynor Ratio (iii) Jensen's alpha b) An investor is considering investing all of his wealth into one of a number of stocks. Assume that he cannot diversify among stocks. Should he try to maximise the Sharpe or Treynor ratios, and why? c) An investor is considering investing a small part of her large already well-diversified wealth into one of a number of stocks. Should she try to maximise the Sharpe or Treynor ratios, and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts