Question: Carlos Santana is the accountant and business manager mrate Distribuidora. What hires you as a financial analyst and consultant in the request for a loan.

Carlos Santana is the accountant and business manager mrate Distribuidora. What hires you as a financial analyst and consultant in the request for a loan. The company is requesting a five-year loan at a bank known in the community. The loan is to cancel the promissory note - "payable notes" of 2012 and to finance current assets, especially inventory of merchandise. Has then the following financial statements are presented.

INDUSTRIES RATIOS: INDUSTRIES AVERAGE

CURRENT RATIO 1.50

ACID TEST RATIO 1.20

AVERAGE COLLECTION PERIOD 30 DAYS

INVENTORY TURN/OVER 10.20 TIMES

DEBTS TO TOTAL ASSETS 24.50%

LONG TERM DEBTS TO TOTAL CAPITALIZATION 33%

TIMES INTEREST EARNED 2.50 TIME

GROSS PROFIT MARGIN 26%

OPERATING PROFIT MARGIN 17%

NET PROFIT MARGIN 7.50%

TOTAL ASSETS TURN/OVER 2.14 TIMES

FIXED ASSETS TURN/OVER 1.40 TIMES

OPERATING EARNINGS RETURN ON INVESTMENT 11.4%

RETURN ON TOTAL ASSETS 4.00%

RETURN ON COMMON EQUITY 9.50%

REQUERIDO:

1. RATIO ANALYSIS: EXCELLENCE, GOOD, AVERAGE, POOR, and DEFICIENT (personal appraisal)

2. COMMON SIZE ANALYSIS

A. INCOME STATEMENTS

B. BALANCE SHEETS

3. FUND STATEMENT ANALYSIS

4. ANALYZE THE LOAN REQUEST. WOULD YOU GRANT THE LOAN? EXPLAIN.

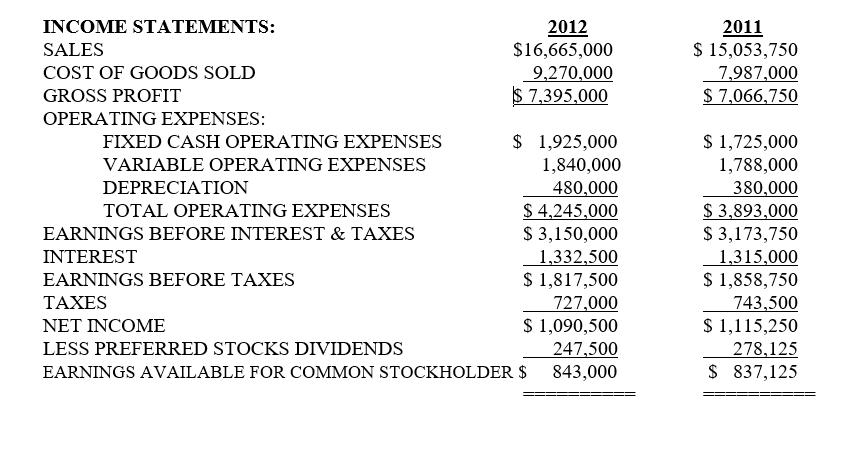

INCOME STATEMENTS: SALES COST OF GOODS SOLD GROSS PROFIT OPERATING EXPENSES: FIXED CASH OPERATING EXPENSES VARIABLE OPERATING EXPENSES DEPRECIATION 2012 $16,665,000 9,270,000 $ 7,395,000 $ 1,925,000 1,840,000 480,000 $ 4,245,000 $ 3,150,000 1,332,500 $ 1,817,500 727,000 $ 1,090,500 247,500 843,000 TOTAL OPERATING EXPENSES EARNINGS BEFORE INTEREST & TAXES INTEREST EARNINGS BEFORE TAXES TAXES NET INCOME LESS PREFERRED STOCKS DIVIDENDS EARNINGS AVAILABLE FOR COMMON STOCKHOLDER $ 2011 $ 15,053,750 7,987,000 $ 7,066,750 $ 1,725,000 1,788,000 380,000 $ 3,893,000 $ 3,173,750 1,315,000 $ 1,858,750 743,500 $ 1,115,250 278,125 $ 837,125

Step by Step Solution

3.42 Rating (142 Votes )

There are 3 Steps involved in it

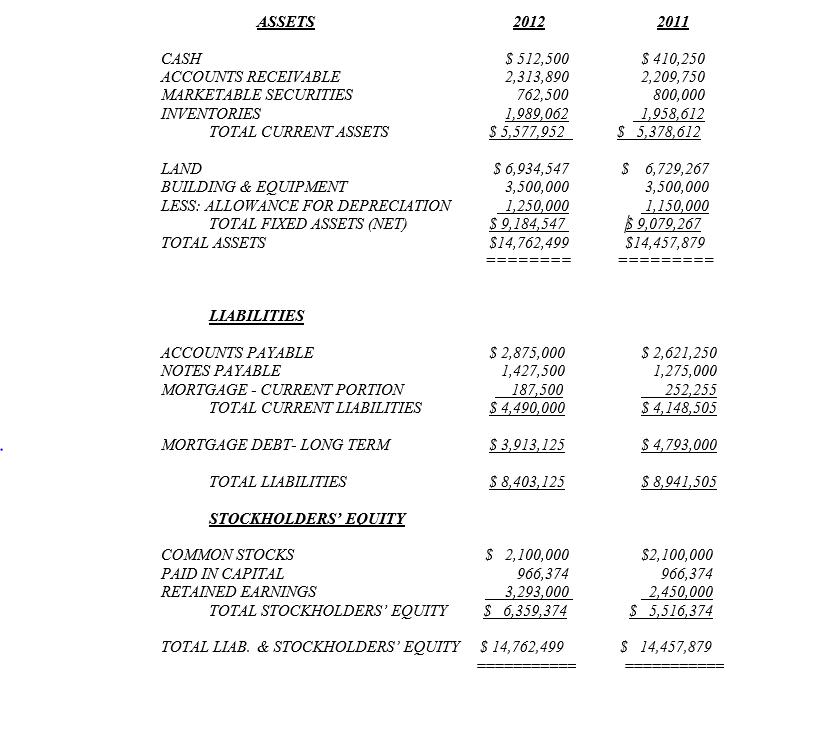

Assets Current assets Cash Accounts receivable Marketable securities Inventory Total current assets ... View full answer

Get step-by-step solutions from verified subject matter experts