Question: Case 1: PART - A (5 Marks) An aircraft crashed minutes after take-off, killing all people on board, raising questions about the safety of the

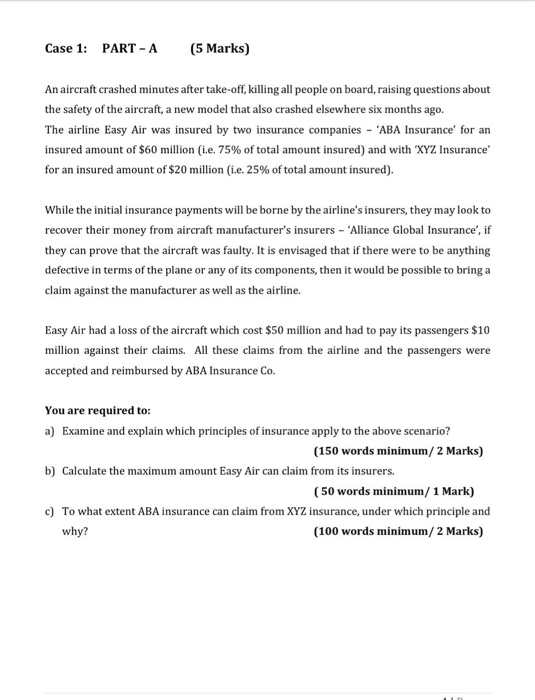

Case 1: PART - A (5 Marks) An aircraft crashed minutes after take-off, killing all people on board, raising questions about the safety of the aircraft, a new model that also crashed elsewhere six months ago The airline Easy Air was insured by two insurance companies - 'ABA Insurance for an insured amount of $60 million (i.e. 75% of total amount insured) and with XYZ Insurance' for an insured amount of $20 million (.e. 25% of total amount insured). While the initial insurance payments will be borne by the airlines insurers, they may look to recover their money from aircraft manufacturer's insurers - "Alliance Global Insurance', if they can prove that the aircraft was faulty. It is envisaged that if there were to be anything defective in terms of the plane or any of its components, then it would be possible to bring a claim against the manufacturer as well as the airline. Easy Air had a loss of the aircraft which cost $50 million and had to pay its passengers $10 million against their claims. All these claims from the airline and the passengers were accepted and reimbursed by ABA Insurance Co. You are required to: a) Examine and explain which principles of insurance apply to the above scenario? (150 words minimum/ 2 Marks) b) Calculate the maximum amount Easy Air can claim from its insurers. (50 words minimum/1 Mark) c) To what extent ABA insurance can claim from XYZ insurance, under which principle and why? (100 words minimum/2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts