Question: Case 1(24 Marks): ABC develops computer products for consumers in Australia. In June 2014, a team of analysts issued a research report that valued ABCs

Case 1(24 Marks):

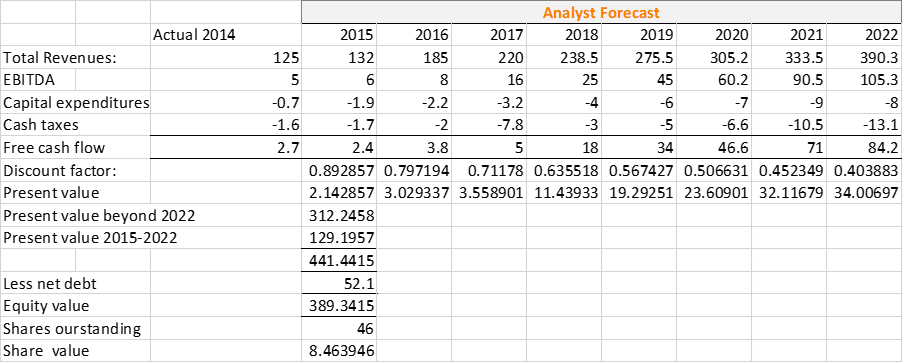

ABC develops computer products for consumers in Australia. In June 2014, a team of analysts issued a research report that valued ABCs stock at $8.46 per share, compared to the then-current market price of $11. The research reports discounted cash flow valuation table is reproduced below. The 2014 figures are as reported by ABC, but the 2015 through 2022 figures are analysts forecasts. Key assumptions include a weighted average cost of capital of 12%, cost of equity 9% and a perpetual growth rate of 1%. All dollar amounts are in millions except share value.

Required:

1, The analyst of ABC used the free cash flows to firm (FCFF) or free cash flow to equity (FCFE) to calculate the free cash flow in this case? And why? (2 points)

2, Compare the method the analysts of ABC used to calculate free cash flow in this case with the free cash flow method (the one that most suitable for the firm to use in Australia) . Is there any difference or not? Explain in detail. (3 marks)

3, What role does the 9% cost of equity play in the free cash flow valuation analysis in this case? How about the role of cost of equity in the abnormal earnings valuation analysis? (2 mark)

4, Explain in detail to someone unfamiliar with present value calculations about how the Present value 20152022(i.e., $129.1957) is computed. Please show your detailed calculation with explanations. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts