Question: CASE I: Testing market efficiency wiegesent study methods Instructions, Form a group of students and what your file via the ITC Shout of the file

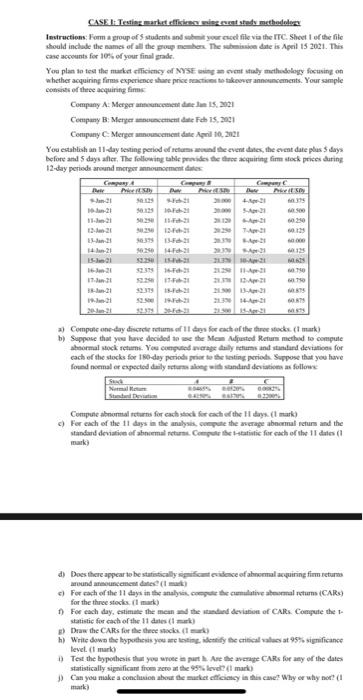

CASE I: Testing market efficiency wiegesent study methods Instructions, Form a group of students and what your file via the ITC Shout of the file should include the names of all the group members. The submission date is Apel 15 2021. This Case accounts for 10% of your final grade You plan to test the market efficimey of NYSE cent stay thodology focusing on whether acquiring firms experience share price reactices to takeover announcements. Your sample consists of three acquiring firme Company A. Mergerament de S. 221 Company B Meryer me date 15.01 Company Mergerocemente il 10, 2012 You establish an 11-day testing period of refuse event dates, the event date plus 3 days before and 5 days after. The following table prides the dire acquiring firm stock prices during 12-day periods around merger announcement de Copy PH PSD 1-21 15.21 21 22 12 20 0139 0:39 14.-21 5-21 14.20 35-F 3-21 239 15-12 a) Computene-day discrete return of langs for each of the three stock mark) b) Suppose that you have decided to the Moon Adjusted Return method to compute shoormal stock retums. You computed werage daily life and standard deviations for cach of the stocks for 180-day periode pe to the testing periods Suppose that you have found normal or expected daily strong with standard deviations as follows Nemale Compute abnormal returns for each stock fost cach of the days. (l mark) c) For each of the 11 days in the analysis compute the rage abnormal retum and the standard deviative of abnormal returne. Complete statistice for each of the 11 dates d) Dees there appear to be stafutically significantidence of abowiemal acquiring firm returns wound announcement dates (mark) c) Forcach of the 11 days in the analyser, coop the cumulative bormal return (CAR) for the three stocks mark) For each day, estimate the momente tanded deviation of CARs. Compute the statistic forcach of the 11 desk) g) Draw the CARs for the three stocks h) Write down the hypotheses you are ting, defy the critical values at 95% significance level. (mark) Test the hypothesis that you wrote in parte de average CARs for any of the dates statistically significant from zero at the level mark) Can you make a conclusion about the market ficcy in this case Whyer why not? mark) CASE I: Testing market efficiency wiegesent study methods Instructions, Form a group of students and what your file via the ITC Shout of the file should include the names of all the group members. The submission date is Apel 15 2021. This Case accounts for 10% of your final grade You plan to test the market efficimey of NYSE cent stay thodology focusing on whether acquiring firms experience share price reactices to takeover announcements. Your sample consists of three acquiring firme Company A. Mergerament de S. 221 Company B Meryer me date 15.01 Company Mergerocemente il 10, 2012 You establish an 11-day testing period of refuse event dates, the event date plus 3 days before and 5 days after. The following table prides the dire acquiring firm stock prices during 12-day periods around merger announcement de Copy PH PSD 1-21 15.21 21 22 12 20 0139 0:39 14.-21 5-21 14.20 35-F 3-21 239 15-12 a) Computene-day discrete return of langs for each of the three stock mark) b) Suppose that you have decided to the Moon Adjusted Return method to compute shoormal stock retums. You computed werage daily life and standard deviations for cach of the stocks for 180-day periode pe to the testing periods Suppose that you have found normal or expected daily strong with standard deviations as follows Nemale Compute abnormal returns for each stock fost cach of the days. (l mark) c) For each of the 11 days in the analysis compute the rage abnormal retum and the standard deviative of abnormal returne. Complete statistice for each of the 11 dates d) Dees there appear to be stafutically significantidence of abowiemal acquiring firm returns wound announcement dates (mark) c) Forcach of the 11 days in the analyser, coop the cumulative bormal return (CAR) for the three stocks mark) For each day, estimate the momente tanded deviation of CARs. Compute the statistic forcach of the 11 desk) g) Draw the CARs for the three stocks h) Write down the hypotheses you are ting, defy the critical values at 95% significance level. (mark) Test the hypothesis that you wrote in parte de average CARs for any of the dates statistically significant from zero at the level mark) Can you make a conclusion about the market ficcy in this case Whyer why not? mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts