Question: ******* please just solve the ( E and G ) CASE I: Testing market officiency using event study methodology Instructions: Fonn a group of 5

*******please just solve the ( E and G )

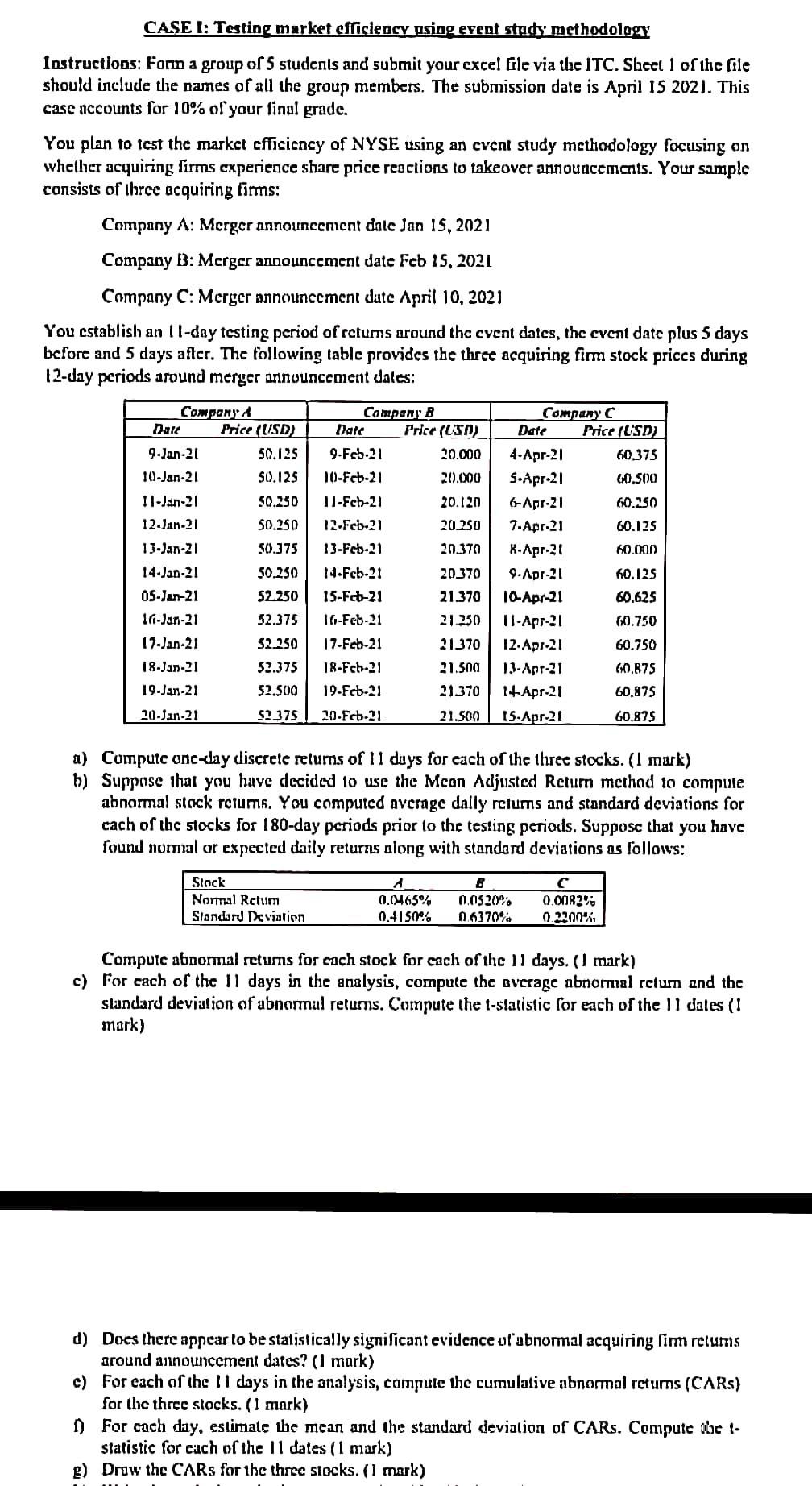

CASE I: Testing market officiency using event study methodology Instructions: Fonn a group of 5 studenls and submit your excel file via the ITC. Sheet I of the file should include the names of all the group members. The submission date is April 15 2021. This case nccounts for 10% of your final grade. You plan to test the market officiency of NYSE using an cvent study methodology focusing on whether acquiring firms experience share price reactions to takeover announcements. Your sample consists of three acquiring firms: Company A: Merger announcement dalc Jan 15, 2021 Company B: Merger announcement date Feb 15, 2021 Company C: Merger announcement date April 10, 2021 You establish an 11-day testing period of retums around the event datcs, the event date plus 5 days before and 5 days after. The following tablc provides the three acquiring fimm stock prices during 12-day periods around merger announcement dates: Company, Date Price (USD) 9-Jan-21 50.125 10-Jan-21 $0.125 Company B Date Price (USD) 9-Feb-21 20.000 10-Feb-21 20.000 11-Fch-21 20.120 12-Feb-21 20.250 13-Feb-21 20.370 50.250 11-Jan-21 12 Jan 21 50.250 13-Jan-21 50.375 50.250 Company C Date Price (USD) 4-Apr-21 60.375 S-Apr-21 60.500 6-Apr-21 60.250 7-Apr-21 60.125 R-Apr-21 60.000 9.Apr-21 60.125 10-Apr-21 60.625 11-Apr-21 (0.750 12. Apr.21 60.750 13-Apr-21 60.875 1+-Apr-21 60.875 15-Apr-21 60.875 14-Feb-21 52.250 52.375 14.Jan 21 OS-Jan-21 16-Jan-21 17-Jan-21 18-Jan-21 19-Jan-21 52.250 15-F2-21 16-Feb-21 17-Feb-21 18.Feb.21 19-Feb-21 20370 21.370 21.250 21370 21.500 21.370 21.500 52.375 52.500 52.375 20-Jan-21 20-Feb-21 a) Compute one-day discrete retums of 11 duys for cach of the three stocks. (1 mark) h) Suppose that you have decided to use the Mcan Adjusted Return method to compute abnormal stock retums. You computed average daily rctums and standard deviations for cach of the stocks for 180-day periods prior to the testing periods. Suppose that you have found normal or expected daily returns along with standard deviations as follows: Stock Nomal Rclum Standard Deviation d 0.0465% 0.41 50% 8 0,0520% 0.6370% 0.00820 0.2200%. Computc abnormal retums for each stock for cach of the 11 days. (1 mark) c) For cach of the 11 days in the analysis, compute the average abnormal retum and the standard deviation of abnormal returns. Compute the t-slatistic for each of the 11 dales (I mark) d) Does there appear to be statistically significant evidence of abnormal acquiring fimm retums around announcement dates? (1 mark) c) For cach of the 11 days in the analysis, compute the cumulative abnormal retums (CARS) for the three stocks. (1 mark) 1) For each day, estimate the mean and the standard deviation of CARs. Compute the lo statistic for each of the 11 dates (1 mark) g) Draw thc CARs for the three stocks. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts