Question: Case Study 1 Rabnud Media Inc ('Rabnud') is a multi-national conglomerate specialising in media entertainment. The company owns many diverse types of stock market quoted

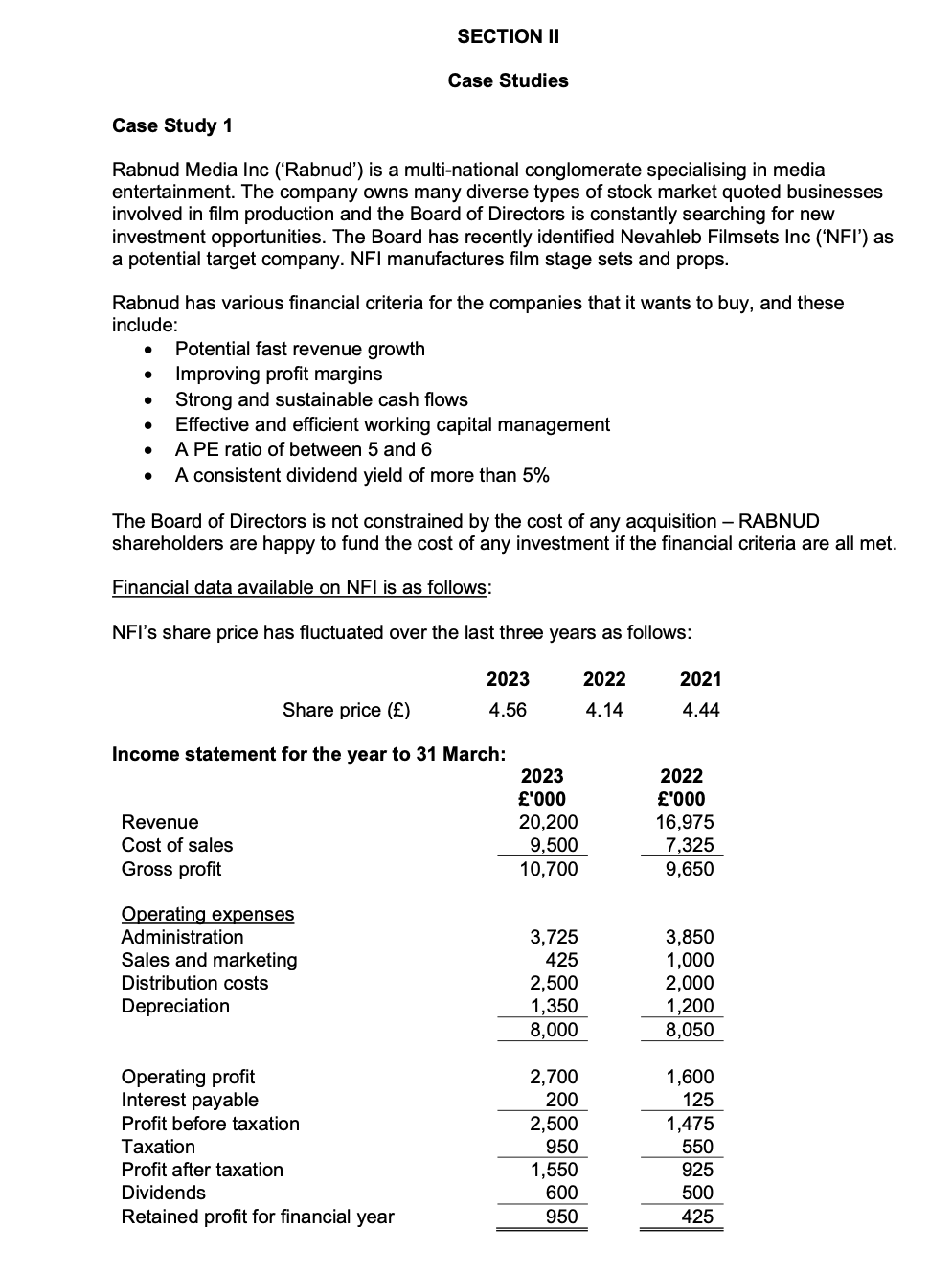

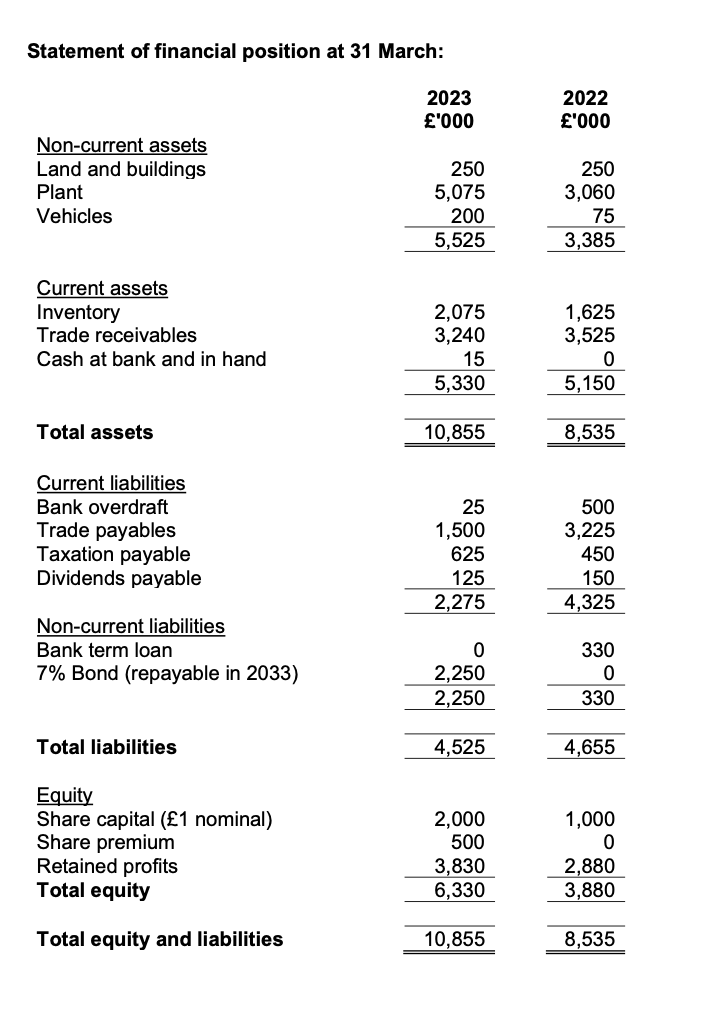

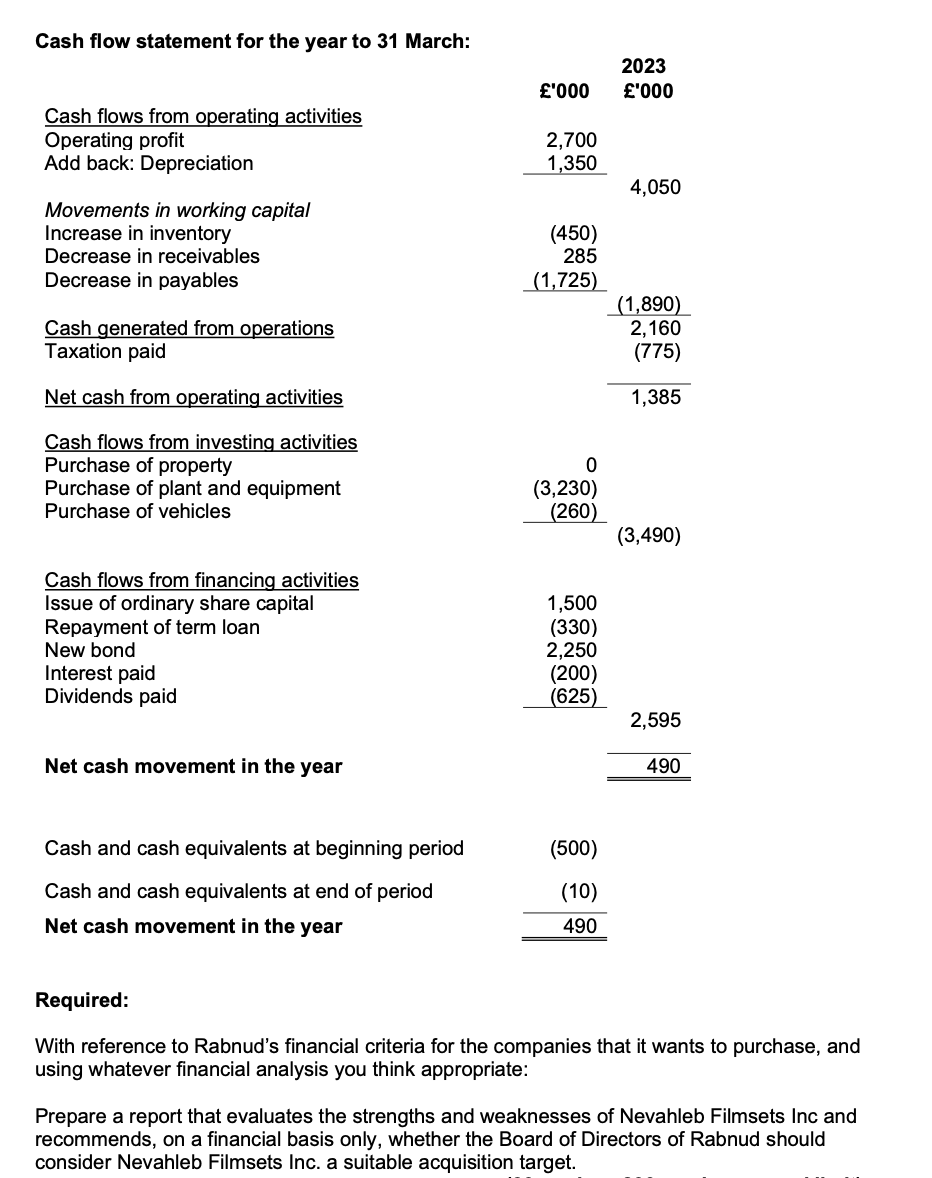

Case Study 1 Rabnud Media Inc ('Rabnud') is a multi-national conglomerate specialising in media entertainment. The company owns many diverse types of stock market quoted businesses involved in film production and the Board of Directors is constantly searching for new investment opportunities. The Board has recently identified Nevahleb Filmsets Inc ('NFI') as a potential target company. NFI manufactures film stage sets and props. Rabnud has various financial criteria for the companies that it wants to buy, and these include: - Potential fast revenue growth - Improving profit margins - Strong and sustainable cash flows - Effective and efficient working capital management - A PE ratio of between 5 and 6 - A consistent dividend yield of more than 5% The Board of Directors is not constrained by the cost of any acquisition - RABNUD shareholders are happy to fund the cost of any investment if the financial criteria are all met. Financial data available on NFI is as follows: Statement of financial position at 31 March: 20230002022000 Non-current assets Land and buildings Plant Vehicles \begin{tabular}{rr} 250 & 250 \\ 5,075 & 3,060 \\ 200 & 75 \\ \hline 5,525 & 3,385 \\ \hline \end{tabular} Current assets Inventory Trade receivables Cash at bank and in hand Total assets Current liabilities Bank overdraft Trade payables Taxation payable Dividends payable Non-current liabilities Bank term loan 7% Bond (repayable in 2033) Total liabilities \begin{tabular}{rrr} 25 & 500 \\ 1,500 & & 3,225 \\ 625 & & 450 \\ 125 & & 150 \\ \hline 2,275 & & 4,325 \\ \hline & & 330 \\ 0 & & 0 \\ \hline 2,250 & & 330 \\ \hline 2,250 & & \\ \hline & & 4,655 \\ \hline 4,525 & & \end{tabular} Equity Share capital (1 nominal) Share premium Retained profits Total equity Total equity and liabilities Pach flawe otatamant far tha wase ta 21 Morah. urchase, and using whatever financial analysis you think appropriate: Prepare a report that evaluates the strengths and weaknesses of Nevahleb Filmsets Inc and recommends, on a financial basis only, whether the Board of Directors of Rabnud should consider Nevahleb Filmsets Inc. a suitable acquisition target

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts