Question: Case study 2 James works as financial analysis for an e-bike manufacturer (Speedy S/B) located in Klebang, Perak. Currently, he is estimating the sales for

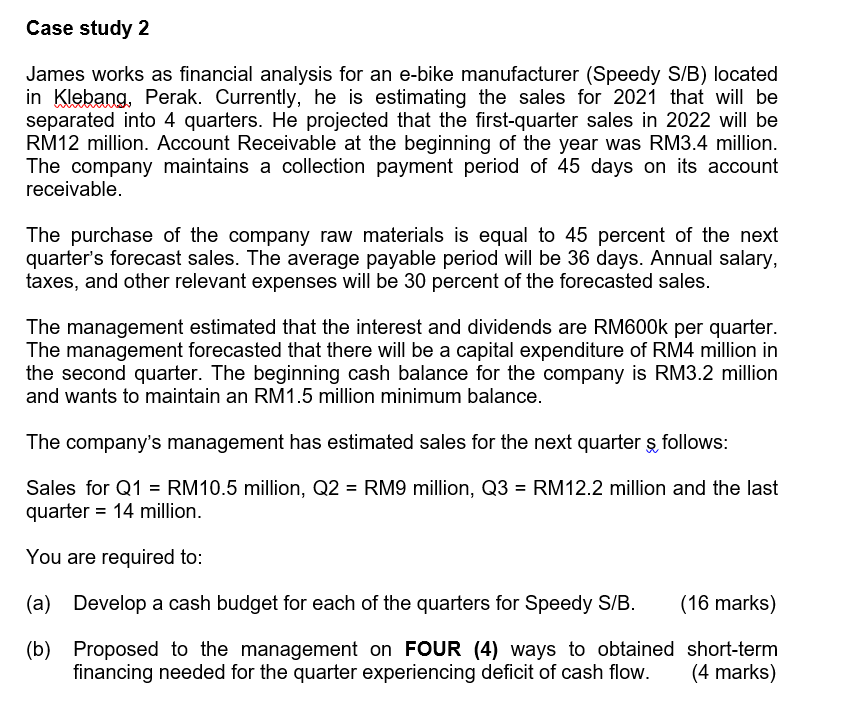

Case study 2 James works as financial analysis for an e-bike manufacturer (Speedy S/B) located in Klebang, Perak. Currently, he is estimating the sales for 2021 that will be separated into 4 quarters. He projected that the first-quarter sales in 2022 will be RM12 million. Account Receivable at the beginning of the year was RM3.4 million. The company maintains a collection payment period of 45 days on its account receivable. The purchase of the company raw materials is equal to 45 percent of the next quarter's forecast sales. The average payable period will be 36 days. Annual salary, taxes, and other relevant expenses will be 30 percent of the forecasted sales. The management estimated that the interest and dividends are RM600k per quarter. The management forecasted that there will be a capital expenditure of RM4 million in the second quarter. The beginning cash balance for the company is RM3.2 million and wants to maintain an RM1.5 million minimum balance. The company's management has estimated sales for the next quarter s follows: Sales for Q1 = RM10.5 million, Q2 = RM9 million, Q3 = RM12.2 million and the last quarter = 14 million. You are required to: (a) Develop a cash budget for each of the quarters for Speedy S/B. (16 marks) (b) Proposed to the management on FOUR (4) ways to obtained short-term financing needed for the quarter experiencing deficit of cash flow. (4 marks) Case study 2 James works as financial analysis for an e-bike manufacturer (Speedy S/B) located in Klebang, Perak. Currently, he is estimating the sales for 2021 that will be separated into 4 quarters. He projected that the first-quarter sales in 2022 will be RM12 million. Account Receivable at the beginning of the year was RM3.4 million. The company maintains a collection payment period of 45 days on its account receivable. The purchase of the company raw materials is equal to 45 percent of the next quarter's forecast sales. The average payable period will be 36 days. Annual salary, taxes, and other relevant expenses will be 30 percent of the forecasted sales. The management estimated that the interest and dividends are RM600k per quarter. The management forecasted that there will be a capital expenditure of RM4 million in the second quarter. The beginning cash balance for the company is RM3.2 million and wants to maintain an RM1.5 million minimum balance. The company's management has estimated sales for the next quarter s follows: Sales for Q1 = RM10.5 million, Q2 = RM9 million, Q3 = RM12.2 million and the last quarter = 14 million. You are required to: (a) Develop a cash budget for each of the quarters for Speedy S/B. (16 marks) (b) Proposed to the management on FOUR (4) ways to obtained short-term financing needed for the quarter experiencing deficit of cash flow. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts