Question: CASE STUDY 2: QUESTION 2 Fred is 23 years old and a medical student who lives at home with his widowed mother, Jane. Sadly, Fred's

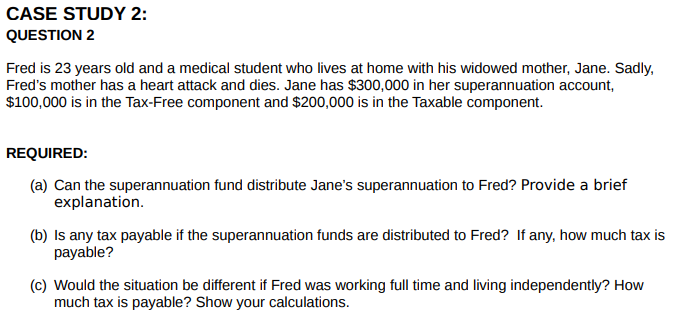

CASE STUDY 2: QUESTION 2 Fred is 23 years old and a medical student who lives at home with his widowed mother, Jane. Sadly, Fred's mother has a heart attack and dies. Jane has $300,000 in her superannuation account, $100,000 is in the Tax-Free component and $200,000 is in the Taxable component. REQUIRED: (a) Can the superannuation fund distribute Jane's superannuation to Fred? Provide a brief explanation. (b) Is any tax payable if the superannuation funds are distributed to Fred? If any, how much tax is payable? (c) Would the situation be different if Fred was working full time and living independently? How much tax is payable? Show your calculations. CASE STUDY 2: QUESTION 2 Fred is 23 years old and a medical student who lives at home with his widowed mother, Jane. Sadly, Fred's mother has a heart attack and dies. Jane has $300,000 in her superannuation account, $100,000 is in the Tax-Free component and $200,000 is in the Taxable component. REQUIRED: (a) Can the superannuation fund distribute Jane's superannuation to Fred? Provide a brief explanation. (b) Is any tax payable if the superannuation funds are distributed to Fred? If any, how much tax is payable? (c) Would the situation be different if Fred was working full time and living independently? How much tax is payable? Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts