Question: Case Study (60 points) Beverly Comes Full Circle Beverly Wyman, 33, took her job as supervisor very seriously. She may be new to the company,

Case Study (60 points)

Beverly Comes Full Circle

Beverly Wyman, 33, took her job as supervisor very seriously. She may be new to the company, but she believes that shes doing a good job. Beverly is in charge of the Consumer Credit Sales Group of the First Union National Bank. Her sales group was formed six (6) months ago to aggressively sell and market the banks various car, boat, and other personal loans. Beverly was promoted and became the group supervisor shortly after the group started, moving up from an assistant managers job in the nearby Credit Analysis Section. Some problems in the Analysis Section kept her longer than what was anticipated, and she joined her sales group after it had already started opening.

Three (3) years ago, Bob Watson, 41, was the chief credit analyst and Beverlys boss when she joined the bank. During that time, Bob was responsible for training all new junior analysts. Bob had long been a top credit analyst as he earned almost twice the net income as the next most productive employee in credit analysis. He was good with his job that the division manager had to ignore Bobs occasional moodiness. Bob was respected by many. However, he was also avoided due to his inconsistent work habits.

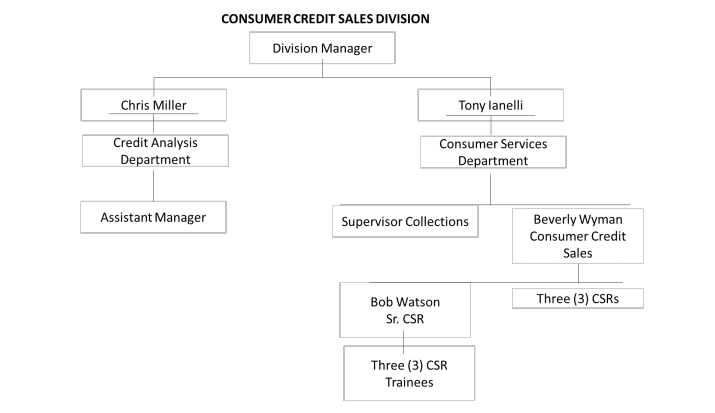

After Bobs divorce from his wife, his attitude problem and erratic work habits have worsened. Tony Ianelli, the department manager, decided to act on the matter and gave Bob a written disciplinary notice. However, almost nothing has changed as Bob remained indifferent toward his job. Because of Bobs incompetency, Tony transferred Bob to the newly formed Consumer Credit Sales group as a senior representative, which is being given to Beverly for supervision after some time. Now, Bob works under Beverly. The chart below shows the organization of First Unions Consumer Credit Sales Division.

Four (4) months after Beverly moved into the supervisory position, she faced a number of problems with Bob Watson. Bob only takes the easiest sales jobs and gives up quickly on the toughest. He also influences his trainees with his questionable work tactics. She believes that Bob could consistently be a top performer if only he could get over his attitude problem.

The most recent and crucial problem Beverly is faced with is Bobs indifference to her. Bob always complains about ideas that she and Tony have talked about. Bob is resistant to changing some of his practices and bringing them into accord with the newly revised Consumer Credit Protection Laws. This is Beverlys biggest problem because mistakes under this new law could cost the bank a lot of money in lawsuits and penalties.

Beverly had circulated a flier announcing the changes, but Bob did not seem to pick it up. Beverlys productivity is also being hampered because of Bobs attitude and Tony Ianellis inaction towards the issue. Beverly realizes that it is impossible to fire Bob as Tonys sensitivity to front-office pressure to keep Bob around is getting in the way.

One afternoon, Beverly is sitting at her desk while checking Bobs Sales Progress Report. She shakes her head problematically as she notes the errors and wonders what she needs to do.

Answer the following questions (4 items x 15 points):

1. What are the issues that Beverly faces as a supervisor? Identify the specific performance improvement results she should seek.

2. Do you agree that Bob should be transferred to another department if he does not perform well? If you are Tony, what would you have done differently?

3. How would you address the case with HR planning?

4. Given Bobs career stage, what steps should Beverly do to save or improve Bobs declining performance?

CONSUMER CREDIT SALES DIVISION Division Manager Chris Miller Tony lanelli Credit Analysis Department Consumer Services Department Assistant Manager Supervisor Collections Beverly Wyman Consumer Credit Sales Three (3) CSRS Bob Watson Sr. CSR Three (3) CSR TraineesStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts