Question: 1. Analyzed the following issues: Identify the problems. What are the major problems? Suggest solutions to the major problems. Recommended the best solution to be

1. Analyzed the following issues:

- Identify the problems.

- What are the major problems?

- Suggest solutions to the major problems.

- Recommended the best solution to be implemented.

2. Minimum 5 case questions with answer

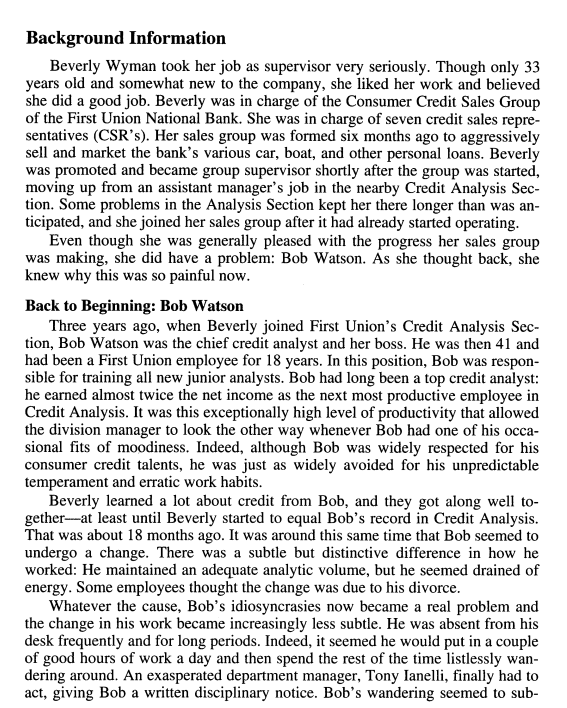

Background Information Beverly Wyman took her job as supervisor very seriously. Though only 33 years old and somewhat new to the company, she liked her work and believed she did a good job. Beverly was in charge of the Consumer Credit Sales Group of the First Union National Bank. She was in charge of seven credit sales repre- sentatives (CSR's). Her sales group was formed six months ago to aggressively sell and market the bank's various car, boat, and other personal loans. Beverly was promoted and became group supervisor shortly after the group was started, moving up from an assistant manager's job in the nearby Credit Analysis Sec- tion. Some problems in the Analysis Section kept her there longer than was an- ticipated, and she joined her sales group after it had already started operating. Even though she was generally pleased with the progress her sales group was making, she did have a problem: Bob Watson. As she thought back, she knew why this was so painful now. Back to Beginning: Bob Watson Three years ago, when Beverly joined First Union's Credit Analysis Sec- tion, Bob Watson was the chief credit analyst and her boss. He was then 41 and had been a First Union employee for 18 years. In this position, Bob was respon- sible for training all new junior analysts. Bob had long been a top credit analyst: he earned almost twice the net income as the next most productive employee in Credit Analysis. It was this exceptionally high level of productivity that allowed the division manager to look the other way whenever Bob had one of his occa- sional fits of moodiness. Indeed, although Bob was widely respected for his consumer credit talents, he was just as widely avoided for his unpredictable temperament and erratic work habits. Beverly learned a lot about credit from Bob, and they got along well to- gether---at least until Beverly started to equal Bob's record in Credit Analysis. That was about 18 months ago. It was around this same time that Bob seemed to undergo a change. There was a subtle but distinctive difference in how he worked: He maintained an adequate analytic volume, but he seemed drained of energy. Some employees thought the change was due to his divorce. Whatever the cause, Bob's idiosyncrasies now became a real problem and the change in his work became increasingly less subtle. He was absent from his desk frequently and for long periods. Indeed, it seemed he would put in a couple of good hours of work a day and then spend the rest of the time listlessly wan- dering around. An exasperated department manager, Tony Ianelli, finally had to act, giving Bob a written disciplinary notice. Bob's wandering seemed to sub- side, but his underlying attitudeapathy, indifference, hostility--became even stronger Beverly Becomes Supervisor All these problems with Bob occurred before Beverly was made supervisor. Tony explained the situation to Beverly before he hired her, because Bob had now been transferred a second time to the newly formed Consumer Credit Sales group as senior representative. He was given the temporary duty of running the sales group until the permanent supervisor-soon revealed as being Beverly- arrived. Bob's job was the same kind of position he had filled in Credit Analy- sis: to train the sales reps in Beverly's sales group. But now, he was working for Beverly instead of Beverly for him. During the job interview, Tony told Beverly: "We considered Bob for the credit sales manager's job, but decided we just didn't think he would work out as a supervisor at this time. We did think that more responsibility might be what he needs, though, so we made him senior representative." Tony told Beverly that as senior representative, Bob would have the three newest sales reps work directly for him as trainees. Thus, Beverly would super- vise Bob and the other three CSR's directly; she would supervise the three trainee reps indirectly through Bob. The chart below shows the organization of First Union's Consumer Credit Sales Division. CONSUMER CREDIT SALES DIVISION Division Manager Chris Miller Tony lanelli Credit Analysis Department Consumer Services Department Assistant Manager Supervisor Collections Beverly Wyman Consumer Credit Sales Bob Watson Sr. CSR 3 CSR's 3 CSR trainees Four months after Beverly moved into the supervisory position, she was fac- ing a number of problems with Bob Watson. She believed that Bob could con- sistently be a top performer if only he could get over this "attitude problem." She thought that although Bob realized he blew his chance for a management job because of his erratic performance, he still felt cheated. He applied for other jobs in the bank at every opportunity. He still did an average job, although his sales performance had been falling for the past few months. Beverly was also concerned about his work method: He seemed to do the easiest sales jobs first and then give up too quickly on the more demanding and challenging opportu- nities. So, while he still performed fairly well, his work was just not up to his potential. Beverly was experiencing other difficulties with Bob, too. She was alarmed at the way his attitude was affecting the three trainees that worked under him. She sensed their resentment of her. A recent incidence was still troubling her. She had asked Bob to explain to the trainees a new procedure that all the CSR's had to follow. Beverly felt it was a good system and had hoped that Bob would introduce it well. However, she was distressed to overhear one of the trainees complain about the "crappy, stupid new procedure" they had to complete. Bev- erly could only imagine how Bob must have explained it. Another of Beverly's concerns was Bob's almost total indifference to her. She could remember a number of times that Bob had gone around her to talk with Tony directly about some questions or concerns. The rest of the time, he seemed to ignore the plans she and Tony made. When asked for his input, he usually complained that the idea would never work. In particular, he seemed totally resistant to changing some of his practices and bringing them into accord with the newly revised Consumer Credit Protec- tion Laws. Potentially this was Beverly's biggest problem because mistakes un- der this new law could have cost the bank a lot of money in lawsuits and penalties. She had circulated a flier announcing the changes to all employees, but Bob had not appeared to pick it up. With his experience and ability, Bob was able to work in the gray area between super-selling and regulatory violation fairly easily. He did not to seem to appreciate the danger in which he was put- ting the Bank, though, and his trainees were picking up his questionable tactics. Altogether, Bob was consuming an enormous amount of Beverly's time and energy. Her productivity was being hampered by Bob's continual problems. Even worse, Tony Ianelli seemed unwilling to take any drastic action, and Bev- erly felt her ability to act was limited by Tony's sensitivity to "front-office" pressure to keep Bob around. Even though she had not yet broached the subject with Tony, firing Bob did not seem possible. As her fourth month as a supervisor drew to a close, Beverly sat at her desk, looking at one of Bob's recent sales reports. She shook her head slowly, notic- ing more of the same errors. Beverly knew that although the problem was not an emergency, it needed correcting. Beverly wondered to herself: "What can I doStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock