Question: Case Study Established on 14 January 1981 as Mountain Bhd, the Company when it became a public listed company on 1 April 1994. Mountain berhad

Case Study

Established on 14 January 1981 as Mountain Bhd, the Company when it became a public listed company on 1 April 1994. Mountain berhad made its debut on the Second Board of Bursa Malaysia Securities Berhad (Bursa Securities) on 16 February 1995 and subsequently on 7 January 1999, was elevated to the Main Board of Bursa Securities.

Over the years, with continuous hard work, perseverance, and beliefs in management productivity and efficiency, Mountain Berhad has elevated its standing and solid reputation in the construction industry both local and abroad. As a team, we strived through the period of slow economic growth in the mid-1980s, as well as the financial crisis in the late 90s. These periods have not only strengthened our position in the construction and property industry but also propelled us into expanding our products and services to include project management, construction design and value engineering.

Over a period of 35 years, the company has completed more than 300 Construction Projects valued at RM5.7 billion with global presence in the Middle East, India, Vietnam and Malaysia and has delivered in excess of 11,000 units of residential and commercial properties amounting to gross development value of RM2.4 billion. Our construction capabilities and track records are recognized both locally and abroad.

A highly acclaimed organisation with the drive to achieve greater heights, Mountain Berhad is moving forward with a Vision to be a true leader in the fields of Engineering & Construction, Property Development and Management known for its Innovation and Excellence. It is the objective of the group to constantly provide excellent quality products and valuable services to our clients, and at the same time, create a better quality of life for the society. As a responsible corporate citizen, we are invariably committed to good governance and upholding shareholders value.

You are appointed as financial analyst of the Mountain Sdn. Bhd. You are required to prepare a report to management of the company on how the management of the company can survive in very challenging situation. The report should contain:

- Performance of the cash flow of the company

- Calculate the suitable ratio for the company

- Overall analyses on ratio as calculated in (b) for the company

- Using the information in (a) and (c), the report provides the suggestion to the company on the issue arise

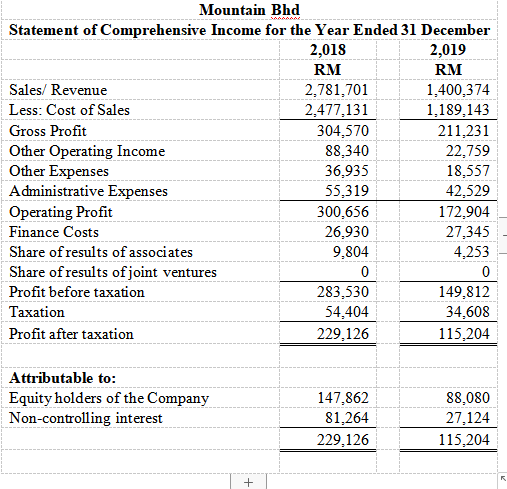

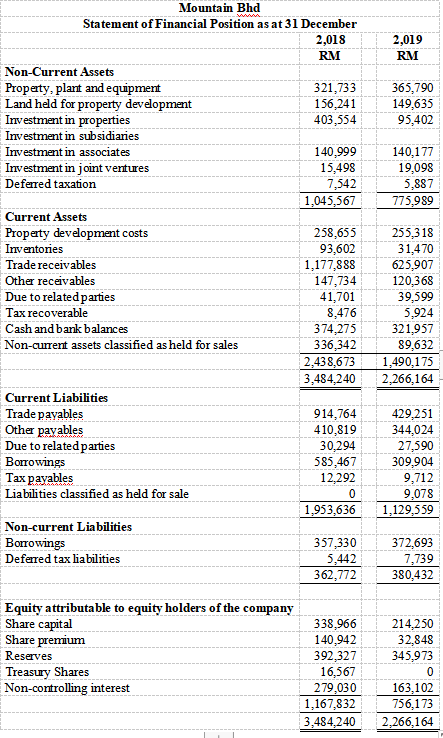

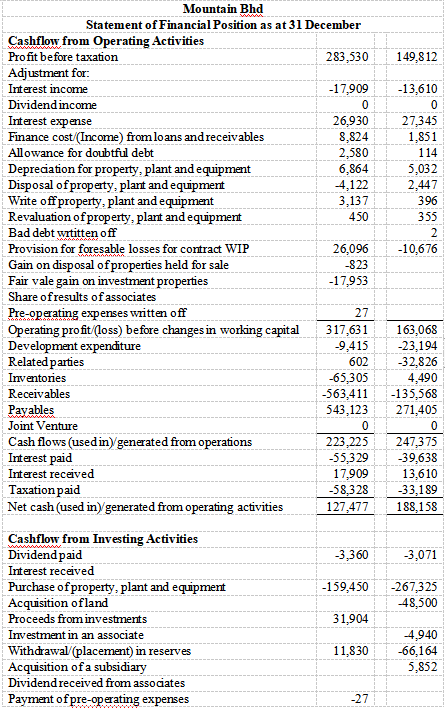

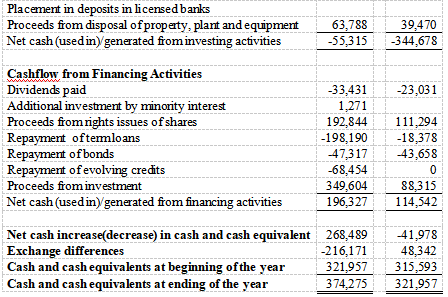

Mountain Bhd Statement of Comprehensive Income for the Year Ended 31 December 2,018 2,019 RM RM Sales/ Revenue 2,781,701 1.400,374 Less: Cost of Sales 2,477,131 1,189,143 Gross Profit 304,570 211.231 Other Operating Income 88,340 22,759 Other Expenses 36,935 18,557 Administrative Expenses 55,319 42,529 Operating Profit 300,656 172,904 Finance Costs 26,930 27,345 Share of results of associates 9,804 4,253 Share of results of joint ventures 0 0 Profit before taxation 283,530 149,812 Taxation 54.404 34,608 Profit after taxation 229.126 115,204 Attributable to: Equity holders of the Company Non-controlling interest 147.862 81.264 229.126 88,080 27.124 115,204 + 2,019 RM 365,790 149,635 95,402 140,177 19,098 5,887 775,989 Mountain Bhd Statement of Financial Position as at 31 December 2,018 RM Non-Current Assets Property, plant and equipment 321,733 Land held for property development 156,241 Investment in properties 403,554 Investment in subsidiaries Investment in associates 140,999 Investment in joint ventures 15,498 Deferred taxation 7,542 1,045,567 Current Assets Property development costs 258,655 Inventories 93,602 Trade receivables 1,177,888 Other receivables 147,734 Due to related parties 41,701 Tax recoverable 8,476 Cash and bank balances 374,275 Non-current assets classified as held for sales 336,342 2,438,673 3,484,240 Current Liabilities Trade payables 914,764 Other payables 410,819 Due to related parties 30,294 Borrowings 585,467 Tax payables 12,292 Liabilities classified as held for sale 0 1,953,636 Non-current Liabilities Borrowings 357,330 Deferred tax liabilities 5,442 362,772 255,318 31,470 625,907 120,368 39,599 5,924 321,957 89,632 1,490,175 2,266,164 429,251 344,024 27,590 309,904 9,712 9,078 1,129,559 372,693 7,739 380,432 Equity attributable to equity holders of the company Share capital Share premium Reserves Treasury Shares Non-controlling interest 338,966 140,942 392,327 16,567 279,030 1,167,832 3,484,240 214,250 32,848 345,973 0 163,102 756,173 2,266,164 149,812 -13,610 0 27,345 1,851 114 5,032 2,447 396 355 2 -10,676 Mountain Bhd Statement of Financial Position as at 31 December Cashflow from Operating Activities Profit before taxation 283,530 Adjustment for Interest income -17,909 Dividend income 0 Interest expense 26,930 Finance cost/(Income) from loans and receivables 8,824 Allowance for doubtful debt 2,580 Depreciation for property, plant and equipment 6,864 Disposal of property, plart and equipment 4,122 Write off property, plant and equipment 3,137 Revaluation of property, plant and equipment 450 Bad debt written off Provision for foresable losses for contract WIP 26,096 Gain on disposal of properties held for sale -823 Fair vale gain on investment properties -17,953 Share of results of associates Pre-operating expenses written off 27 Operating profit/(loss) before changes in working capital 317,631 Development expenditure -9,415 Related parties 602 Inventories -65,305 Receivables -563,411 Payables 543,123 Joint Venture Cash flows (used in generated from operations 223,225 Interest paid -55,329 Interest received 17,909 Taxation paid -58,328 Net cash (used in) generated from operating activities 127,477 163,068 -23,194 -32,826 4,490 -135,568 271,405 0 247,375 -39,638 13,610 -33,189 188,158 0 -3,360 -3,071 -159,450 -267,325 48,500 Cashflow from Investing Activities Dividend paid Interest received Purchase of property, plant and equipment Acquisition ofland Proceeds from investments Investment in an associate Withdrawal (placement) in reserves Acquisition of a subsidiary Dividend received from associates Payment of pre-operating expenses 31,904 11,830 4,940 -66,164 5,852 -27 Placement in deposits in licensed banks Proceeds from disposal of property, plant and equipment Net cash (used in) generated from investing activities 63,788 -55,315 39,470 -344,678 -23,031 Cashflow from Financing Activities Dividends paid -33,431 Additional investment by minority interest 1,271 Proceeds from rights issues of shares 192,844 Repayment oftemmloans -198,190 Repayment of bonds -47,317 Repayment of evolving credits -68,454 Proceeds from investment 349,604 Net cash (used in, generated from financing activities 196,327 Net cash increase(decrease) in cash and cash equivalent 268,489 Exchange differences -216,171 Cash and cash equivalents at beginning of the year 321,957 Cash and cash equivalents at ending of the year 374,275 111,294 -18,378 -43,658 0 88,315 114,542 41,978 48,342 315,593 321,957

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts