Question: CASE STUDY Financial Statements for Walmart Stores Inc, and Macy's Inc. Takle 3 . 7 coatains be fiasacial resuls for Walmart and Macy's for 2

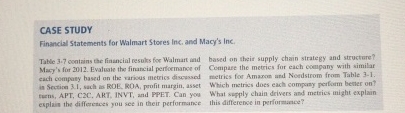

CASE STUDY

Financial Statements for Walmart Stores Inc, and Macy's Inc.

Takle coatains be fiasacial resuls for Walmart and Macy's for Evaluaie the firancial pertormance of eact compony based on the various metrics disposand in Sectire sach is BOE. ROA, profit marzin, asset terens,

APT CC ART, INVT, and PPET. Can you explain the differesces you set in their performanse

based on their supply chain strategy and structure? Cempase the metries for each conpany with similar metrics for Amsson und Nendsirom from Table Which metrics does each compony perform benter on What supply chain drivers and metrics might explain this difference in perfurmance?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock