Question: Case study: Willen Ltd Note: For the purposes of this case study, you should assume that Willen Ltd traded normally throughout 2020 and that the

Case study:

Willen Ltd

Note: For the purposes of this case study, you should assume that Willen Ltd traded normally throughout 2020 and that the COVID-19 pandemic and associated lockdown did not occur.

Sisters Zara and Sofia come from a family that has been in the cosmetics business for over 70 years. Zara and Sofia decided to start their own business in their hometown, Edinburgh, and formed Willen Ltd in 2012, specialising in supplying high quality cosmetic products. The company procures these products from national and international suppliers and then packs the products for sale to various local businesses and on online platforms.

Zara and Sofia are the major shareholders of Willen Ltd owning 70% of the shares and the rest of the shares are owned by their Uncle Sameer, who also acts as the financial adviser to Willen Ltd.

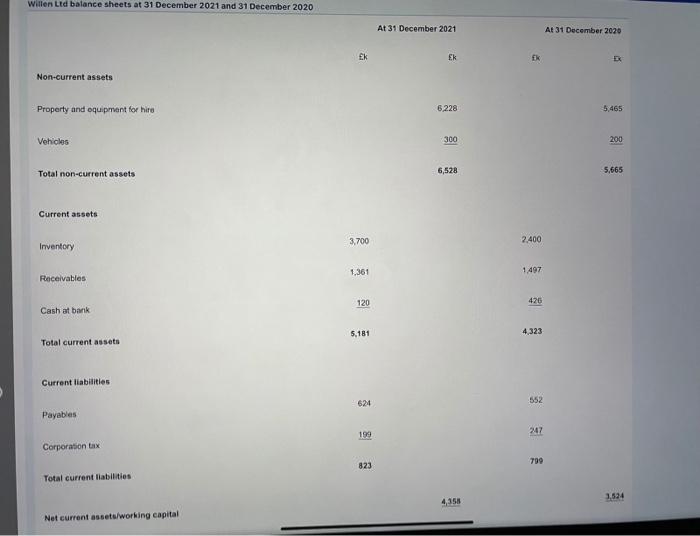

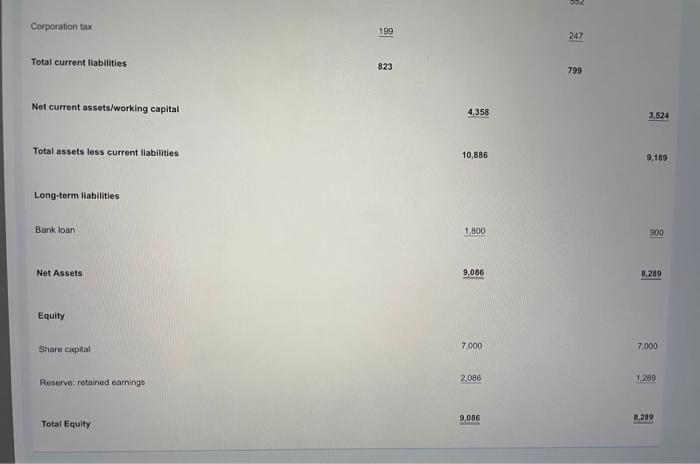

Willen Ltd started out on a small scale with just Zara and Sofia running and managing all aspect of the business from operations to marketing to finance. The business expanded gradually over the course of 8 years that saw a number of warehouses and distribution centres opened to store the products and deal with the returns. Most of the expansion was financed by long-term loans from banks and out of retained earnings. Occasionally, Zara and Sofia also rely on short-term loans such as overdrafts.

Willen Ltd has always taken pride in its reputation for high quality and a loyal local customer base, mostly due to its exceptional customer service. Its success has been through a combination of recommendations by satisfied customers and by marketing and advertising.

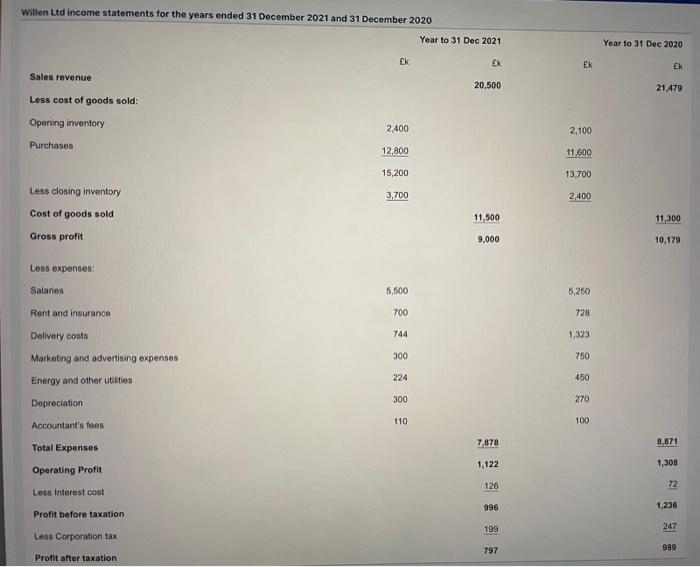

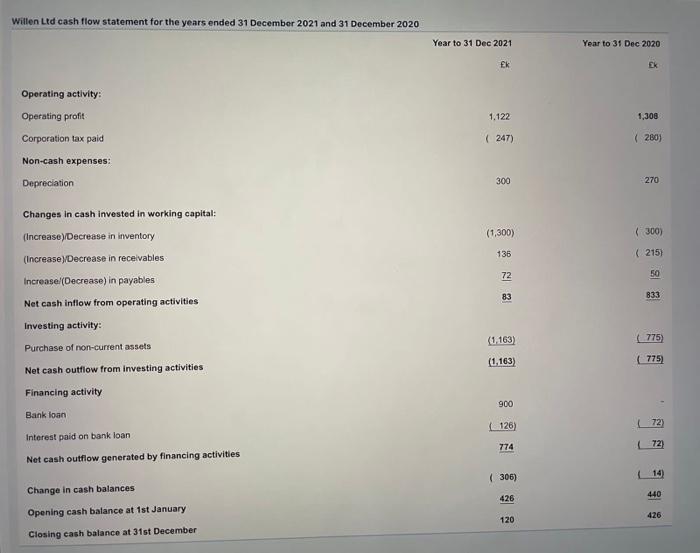

Willen Ltd has been profitable for most of its existence. Over the past few years, with the exception of the current year, revenues have increased on average by 8% per annum. In the year ending 31 December 2020 the company achieved a return on equity of 13.5%. The companys financial performance has significantly benefited from a surge in demand for one of its specialist skin care product line over the years, however, the demand for this is starting to flatten out.

Zara, with a huge passion for the environment, has recently introduced environmentally friendly products. She continues to promote these products, with a hope that the demand for these will gradually increase, even though they offer lower margins. Zara proposed to extend the business in this direction and source more locally produced products. To do so, Willen Ltd required another bank loan to fund the expansion. Zara and Sofia both agreed on this, given historically low rates of interest, and took out a loan of 900,000 from the bank at an interest rate of 6% in 2021.

Uncle Sameer, however, had reservations and was not in favour of another bank loan. He is concerned about how the business has been doing recently, its profitability and financial health. Uncle Sameer wishes to understand more about the latest financial statements, any trends indicated by an analysis of the financial statements and the implications of the recent bank loan taken out by Willen Ltd.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock