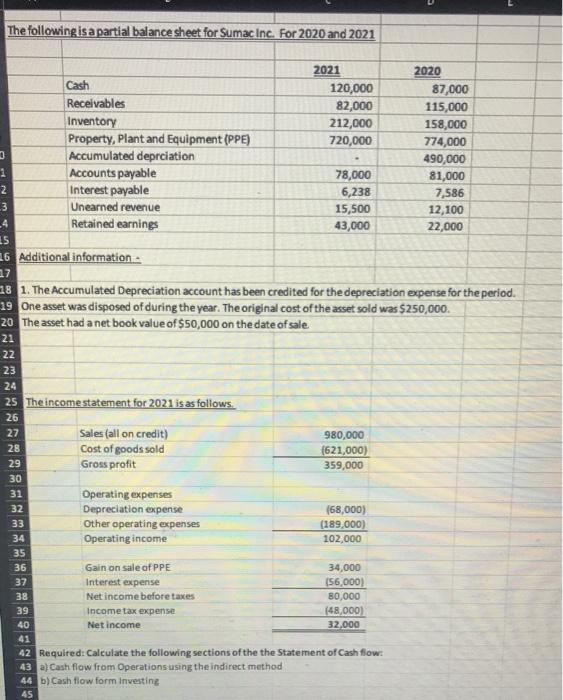

Question: Cash Flow from Operations using Indirect Method and Cash Flow Form Investing The following is a partial balance sheet for Sumac Inc. For 2020 and

The following is a partial balance sheet for Sumac Inc. For 2020 and 2021 2021 2020 Cash 120,000 87,000 Receivables 82,000 115,000 Inventory 212,000 158,000 Property, Plant and Equipment (PPE) 720,000 774,000 3 Accumulated deprciation 490,000 1 Accounts payable 78,000 81,000 2 Interest payable 6,238 7,586 -3 Unearned revenue 15,500 12,100 4 Retained earnings 43,000 22,000 15 26 Additional information - 17 18 1. The Accumulated Depreciation account has been credited for the depreciation expense for the period. 19 One asset was disposed of during the year. The original cost of the asset sold was $250,000 20 The asset had a net book value of $50,000 on the date of sale 21 22 23 24 25 The income statement for 2021 is as follows 26 27 Sales (all on credit) 980,000 28 Cost of goods sold (621,000) 29 Gross profit 359,000 30 31 Operating expenses 32 Depreciation expense (68,000) 33 Other operating expenses (189,000) 34 Operating income 102,000 35 36 Gain on sale of PPE 34,000 37 Interest expense 156,000) Net income before taxes 80,000 39 Income tax expense (48,000) 40 Net income 32,000 41 42 Required: Calculate the following sections of the the Statement of Cash flow. 43 a)Cash flow from Operations using the indirect method 44 b) Cash flow form Investing 45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts