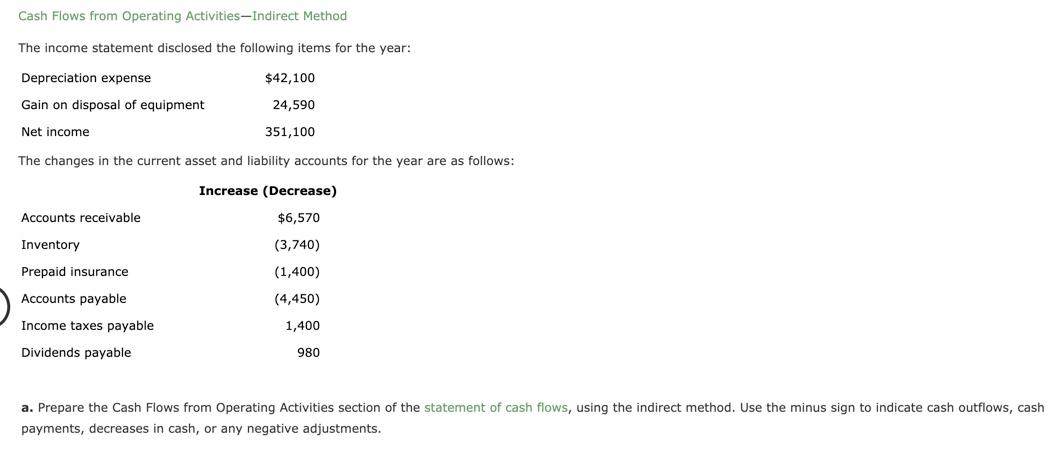

Question: Cash Flows from Operating Activities-Indirect Method The income statement disclosed the following items for the year: $42,100 Depreciation expense Gain on disposal of equipment 24,590

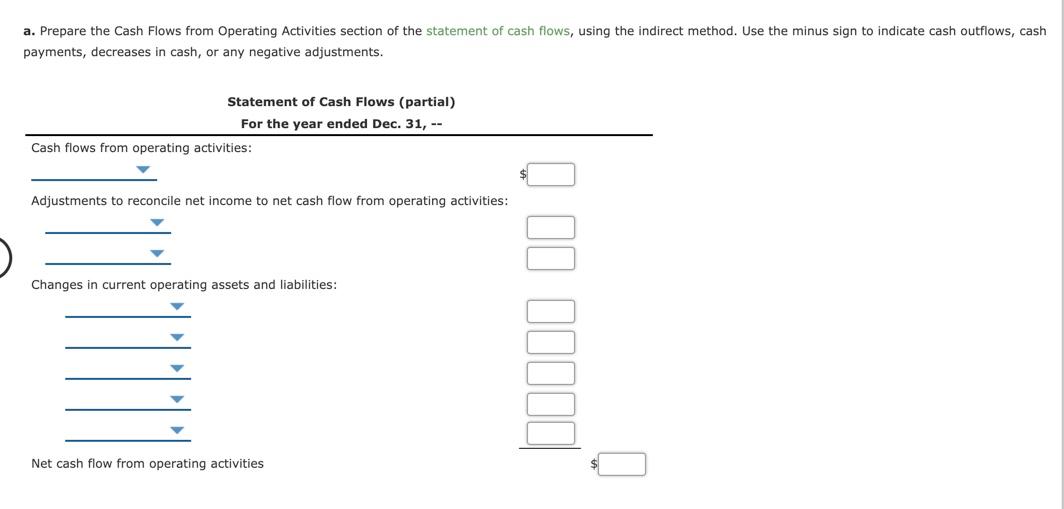

Cash Flows from Operating Activities-Indirect Method The income statement disclosed the following items for the year: $42,100 Depreciation expense Gain on disposal of equipment 24,590 Net income 351,100 The changes in the current asset and liability accounts for the year are as follows: Increase (Decrease) Accounts receivable $6,570 Inventory (3,740) (1,400) Prepaid insurance Accounts payable (4,450) Income taxes payable 1,400 Dividends payable 980 a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) For the year ended Dec. 31, -- Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activities: Changes in current operating assets and liabilities: Net cash flow from operating activities o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts