Question: Cash flows from operations may not be sufficient for a firm to keep up with growth-related financing needs, or the firm may not be able

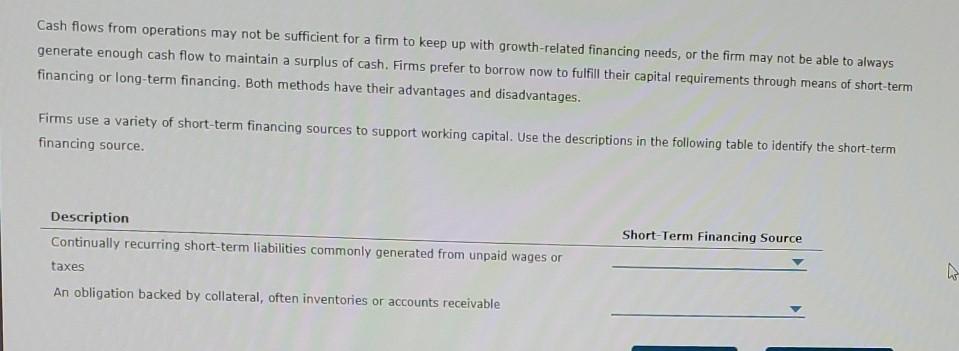

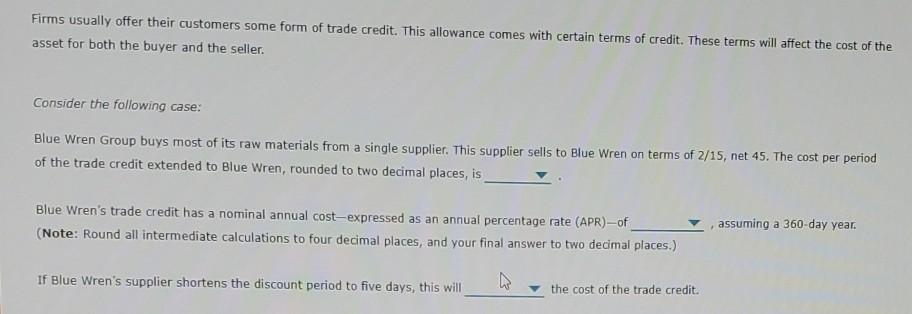

Cash flows from operations may not be sufficient for a firm to keep up with growth-related financing needs, or the firm may not be able to always generate enough cash flow to maintain a surplus of cash. Firms prefer to borrow now to fulfill their capital requirements through means of short-term financing or long-term financing. Both methods have their advantages and disadvantages. Firms use a variety of short-term financing sources to support working capital. Use the descriptions in the following table to identify the short-term financing source. Description Continually recurring short-term liabilities commonly generated from unpaid wages or taxes Short-Term Financing Source An obligation backed by collateral, often inventories or accounts receivable Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit. These terms will affect the cost of the asset for both the buyer and the seller. Consider the following case: Blue Wren Group buys most of its raw materials from a single supplier. This supplier sells to Blue Wren on terms of 2/15, net 45. The cost per period of the trade credit extended to Blue Wren, rounded to two decimal places, is Blue Wren's trade credit has a nominal annual cost-expressed as an annual percentage rate (APR)-of (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) assuming a 360-day year. If Blue Wren's supplier shortens the discount period to five days, this will the cost of the trade credit. Cash flows from operations may not be sufficient for a firm to keep up with growth-related financing needs, or the firm may not be able to always generate enough cash flow to maintain a surplus of cash. Firms prefer to borrow now to fulfill their capital requirements through means of short-term financing or long-term financing. Both methods have their advantages and disadvantages. Firms use a variety of short-term financing sources to support working capital. Use the descriptions in the following table to identify the short-term financing source. Description Continually recurring short-term liabilities commonly generated from unpaid wages or taxes Short-Term Financing Source An obligation backed by collateral, often inventories or accounts receivable Firms usually offer their customers some form of trade credit. This allowance comes with certain terms of credit. These terms will affect the cost of the asset for both the buyer and the seller. Consider the following case: Blue Wren Group buys most of its raw materials from a single supplier. This supplier sells to Blue Wren on terms of 2/15, net 45. The cost per period of the trade credit extended to Blue Wren, rounded to two decimal places, is Blue Wren's trade credit has a nominal annual cost-expressed as an annual percentage rate (APR)-of (Note: Round all intermediate calculations to four decimal places, and your final answer to two decimal places.) assuming a 360-day year. If Blue Wren's supplier shortens the discount period to five days, this will the cost of the trade credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts