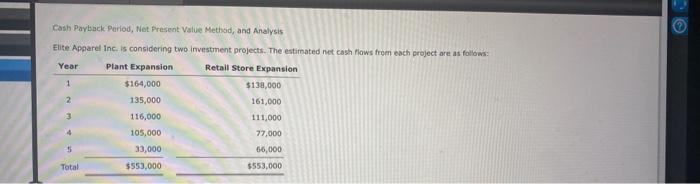

Question: Cash Payback Pariod, Net Present Value Method, and Analysis Elite.Apgarel inc. is considering two investment projects. The estirnated net eash flows from each project are

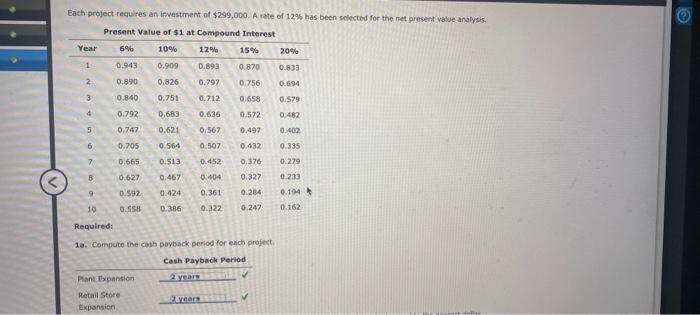

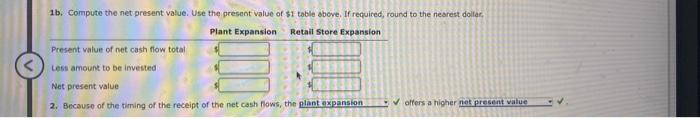

Cash Payback Pariod, Net Present Value Method, and Analysis Elite.Apgarel inc. is considering two investment projects. The estirnated net eash flows from each project are as follows: Each project requires an investment of $299,000. A rate of 12% bas been selected for the net presect value analysis. Required: 13. Compute the cash poyback period for each project, 1b. Compute the net present value. Use the present value of \$1 table above. If required, round to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts