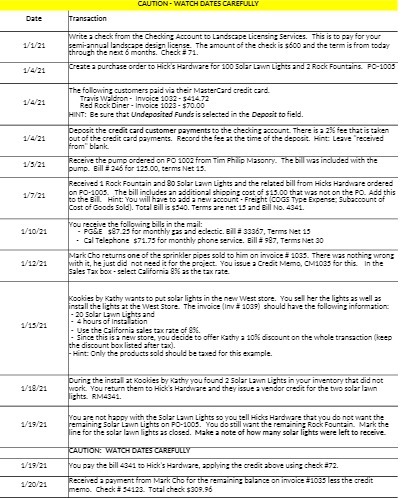

Question: CAUTION - WATCH DATES CAREFULLY Date Transaction Write : check from the Chadoing Account to Landscape Licensing Services. This is to pay for your 1/1/21

CAUTION - WATCH DATES CAREFULLY Date Transaction Write : check from the Chadoing Account to Landscape Licensing Services. This is to pay for your 1/1/21 semi-annual landscape design license. The amount of the check is $800 and the tem is from today through the next 6 months. Check # 71. 1/4/21 Create a purchase order to Hick's Hardware for 100 Solar Lawn Lights and 2 Rock Fountains. PO-1005 The following customers paid via their MasterCard credit card. 1/4/21 Travis Waldron- Invoice 1082 - $41472 Red Rock Diner - Invoice 1023 - $70.00 HINT: Be sure that Undeposited Funds is selected in the Deposit to field. Deposit the credit card customer payments to the checking account. There is a 206 fee that is taken 1/4 21 but of the credit card payments. Record the fee at the time of the deposit. Hint Lewe received from" blank 1/521 Receive the pump ordered on FO 1002 from Tim Philip Masonry. The bill was included with the pump. Bill # 346 for 125.00, terms Net 15 Received 1 Rock Fountain and 20 Solar Lewm Lights and the related bill from Hicks Hardware ordered 1/7/21 on PO-1005. The bill includes an additional shipping cost of $15.00 that was not on the FO. Add this to the Bill Hint: You will have to add a new account . Freight (0OGG Type Expense, Subaccount of Cost of Goods Sold]. Total Bill is $340. Terms are net 15 and Bill No. 4341. ou receive the following bills in the mail: 1/10/21 . PGME $87 25 for monthly gas and eclectic. Bill # 33367, Terra Net 19 Cal Telephone $71.75 for monthly phone service. Bill # 987, Terms Net 30 Mark Cho returns one of the sprinkler pipes sold to him on invoice # 1083. There was nothing wrong 1/17/21 with it, he just did not need it for the project. You issue a Credit Memo, CM1085 for this. In the Sales Tax box - select California 836 as the tax rate. Kookies by Kathy wants to put solar lights in the new West store. You sell her the lights as well as notall the lights at the West Store. The invoice (Inv # 1039) should have the following information - 20 Solar Lawn Lights and 1/15/21 - 4 hours of Installation - Use the California sales tax rate of &.. - Since this is a new store, you decide to offer Kathy = 1026 discount on the whole transaction (keep the discount box listed after tax). - Hint: Only the products sold should be taxed for this example. During the install at Kookies by Kathy you found 2 Solar Lawn Lights in your inventory that did not 1/18/21 work. You return them to Hicks Hardware and they issue : vendor credit for the two solar lawn lights. RM4341. you are not happy with the 3 h the Solar Lewin Lights so you well Hicks Hardware that you do not want the 1/19/21 emaining Solar Lawn Lights on PO-1005. You do still want the remaining Rock Fountain. Mark the line for the solar lawn lights as closed. Make a note of how many solar lights were left to receive. CAUTION: WATCH DATES CAREFULLY 1/19/21 You pay the bill 4341 to Hick's Hardware, applying the credit above using check #72. 1/20/21 Received a parywent from Mark Cho for the remaining balance on imvoice #1085 less the credit memo. Check # 54123. Totalcheck $309.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts