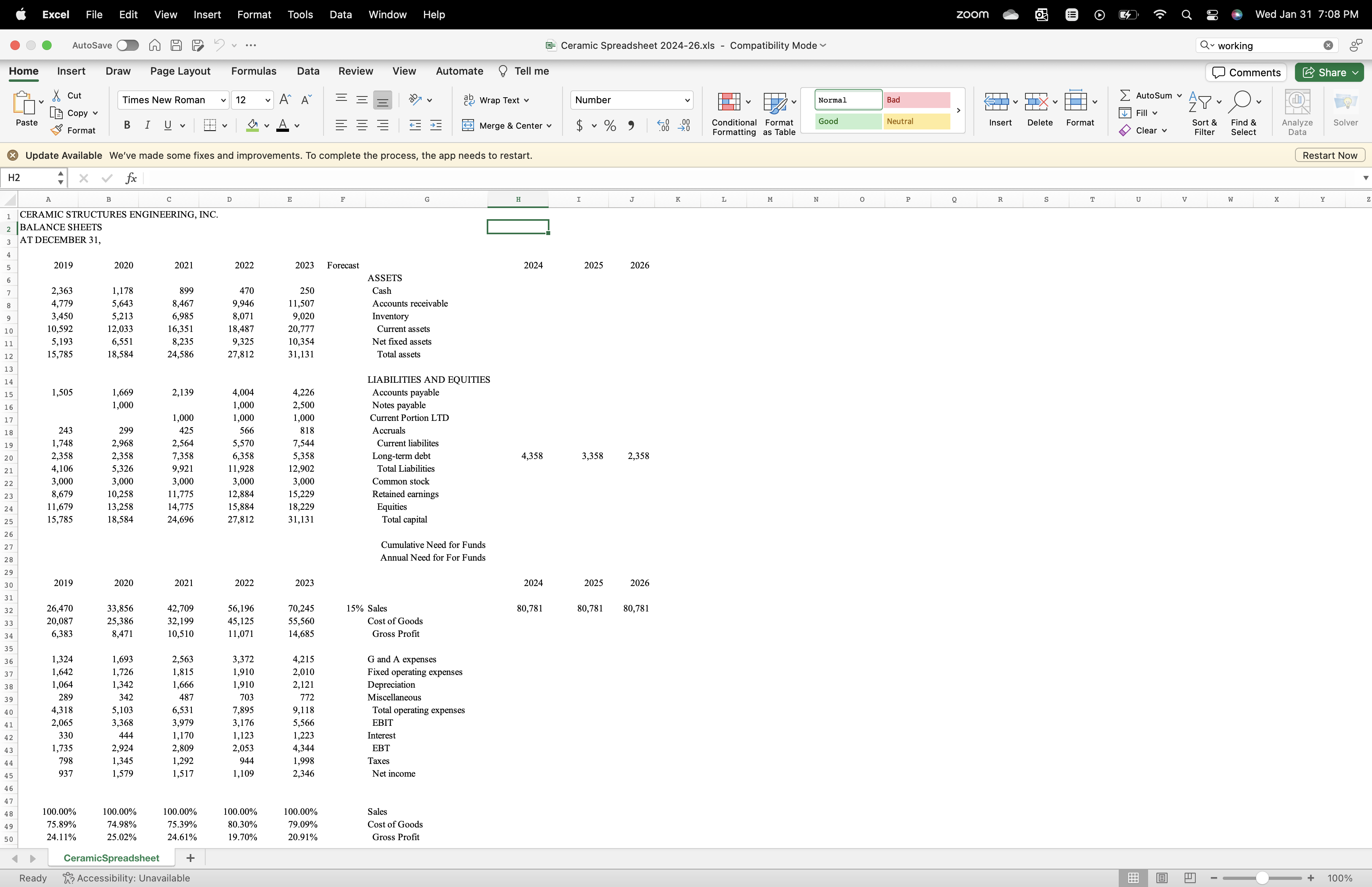

Question: Ceramic Structures has experienced rapid growth over the past several years. Sales are expected to grow at 1 5 % per year for the next

Ceramic Structures has experienced rapid growth over the past several years. Sales are expected

to grow at per year for the next three years. Sales growth has been fueled by aggressive

pricing as well as increased use of ceramics in high performance engines.

Asset growth has been financed by internal funds as well as the increased use of debt. At the end

of the debt was restructured with a new sevenyear loan with principal payments of

$ million per year. In addition a $ million working capital line was negotiated in It

was increased to $ million in and $ million in Interest is charged at prime

For class, we will use

Cash balances will be kept around $ and the credit line will average $ million.

Prepare proforma statements for Ceramic and determine their need for funds for the

years

Why is there a need for funds when Ceramic is generating a profit?

If expected sales growth fell to per year, what would be Ceramic's need for funds?

What would happen to Ceramic's need for funds if accounts receivable increased to

of sales?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock