Question: Ch 05: Assignment - Financial Options Back to Assignment Attempts Keep the Highest/3 7. The Black-Scholes option pricing model The Black-Scholes option pricing model (OPM)

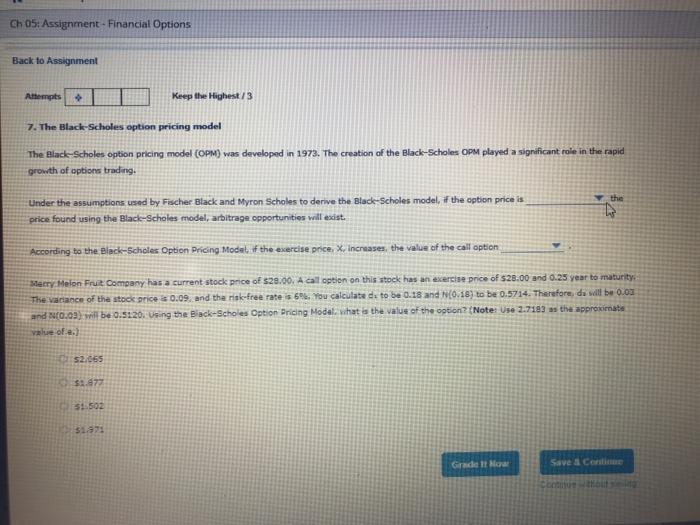

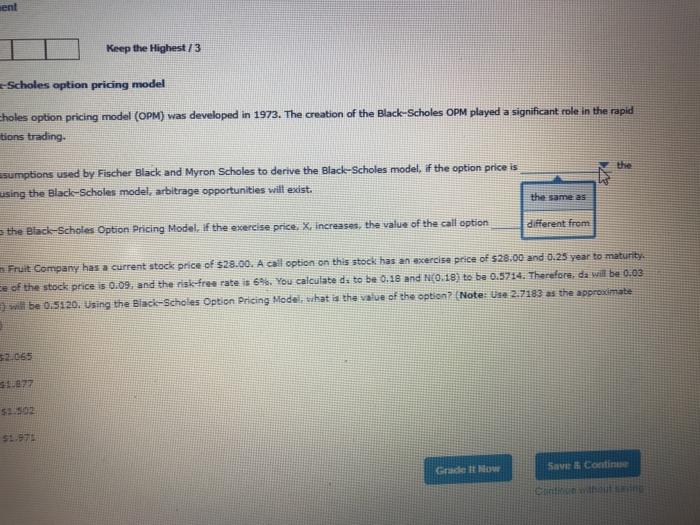

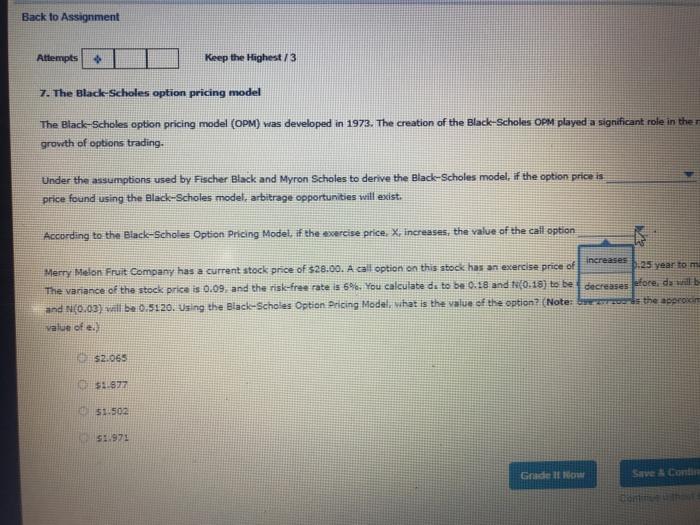

Ch 05: Assignment - Financial Options Back to Assignment Attempts Keep the Highest/3 7. The Black-Scholes option pricing model The Black-Scholes option pricing model (OPM) was developed in 1973. The creation of the Black-Scholes OPM played a significant role in the rapid growth of options trading. the Under the assumptions used by Fischer Black and Myron Scholes to derive the Black-Scholes model, if the option price is price found using the Black-Scholes model, arbitrage opportunities will exist. According to the Black-Scholes Option Pricing Model of the exercise price, X. Increases, the value of the call option Setry Melon Fruit Company has a current stock price of $29.00. A call option on this stock has an exercise price of $20.00 and 0.25 year to maturity The variance of the stock price 30.09. and the risk-free rate is 66. You calculated to be 0.18 and N[6.18) to be 0.5714. Therefore, da will be 0.01 and 1(0.01) will be 0.5120 Vaing the Black-Scholes Option Pricing Model what's the value of the option? (Note: 166 2.7183 as the approximate value of.. CIS2065 51.502 $1971 Grade It or Save Can ent Keep the Highest/3 Scholes option pricing model Choles option pricing model (OPM) was developed in 1973. The creation of the Black-Scholes OPM played a significant role in the rapid tions trading. Esumptions used by Fischer Black and Myron Scholes to derive the Black-Scholes model, if the option price is using the Black-Scholes model, arbitrage opportunities will exist the same as different from the Black-Scholes Option Pricing Model if the exercise price Xo increases, the value of the call option Fruit Company has a current stock price of $28.00. A call option on this stock has an exercise price of $28.00 and 0.25 year to maturity ce of the stock price is 0.09, and the risk-free rate 6%. You calculated to be 0.18 and NO.18) to be 0.3714. Therefore, da will be 0.03 will be 0.5120. Using the Black-Scholes Option Pricing Model, what is the value of the option? (Note: Use 2.7183 as the approximate 52.065 SL Get our Save Continue Back to Assignment Attempts Keep the Highest/3 7. The Black-Scholes option pricing model The Black-Scholes option pricing model (OPM) was developed in 1973. The creation of the Black-Scholes OPM played a significant role in the growth of options trading. Under the assumptions used by Fischer Black and Myron Scholes to derive the Black-Scholes model, if the option price is price found using the Black-Scholes model, arbitrage opportunities will exist. According to the Black-Scholes Option Pricing Model, if the exercise price, X, increases, the value of the call option increases Merry Melon Fruit Company has a current stock price of $28.00. A call option on this stock has an exercise price of 25 year to me The variance of the stock price is 0.09. and the risk-free rate is 6%. You calculate de to be 0.18 and 1(0.15) to be decreases efore, da will be and N(0.03) vall be 0.5120. Using the Black-Scholes Option Pricing Model, what is the value of the option? (Note: the are value of e. 52.065 1577 $1.502 S1971 Gadell Save Can

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts