Question: PLEASE ANSWER THE ENTIRE QUESTION. It is not helpful if you only answer part of it! 7. The Black-Scholes option pricing model The Black-Scholes option

PLEASE ANSWER THE ENTIRE QUESTION. It is not helpful if you only answer part of it!

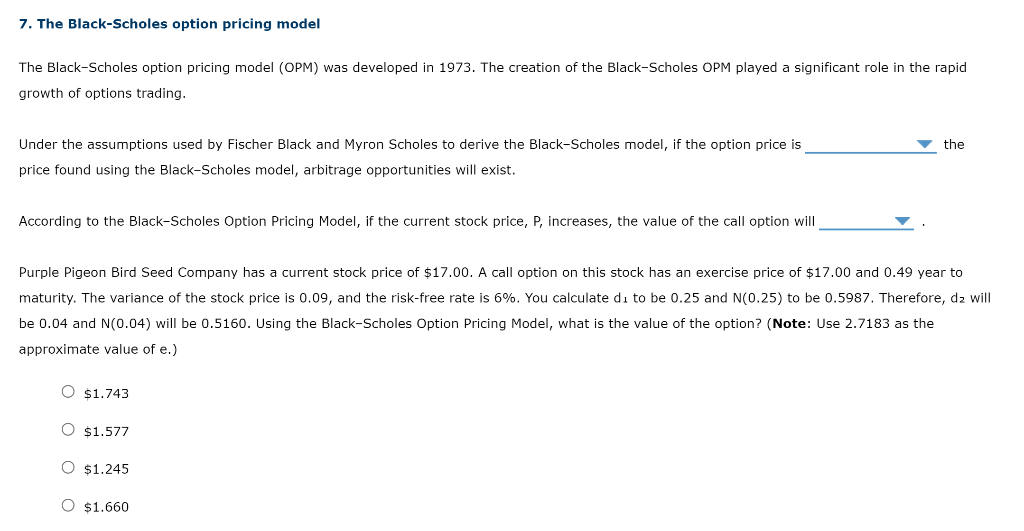

7. The Black-Scholes option pricing model The Black-Scholes option pricing model (OPM) was developed in 1973. The creation of the Black-Scholes OPM played a significant role in the rapid growth of options trading. the Under the assumptions used by Fischer Black and Myron Scholes to derive the Black-Scholes model, if the option price is price found using the Black-Scholes model, arbitrage opportunities will exist. According to the Black-Scholes Option Pricing Model, if the current stock price, P, increases, the value of the call option will Purple Pigeon Bird Seed Company has a current stock price of $17.00. A call option on this stock has an exercise price of $17.00 and 0.49 year to maturity. The variance of the stock price is 0.09, and the risk-free rate is 6%. You calculate di to be 0.25 and N(0.25) to be 0.5987. Therefore, d2 will be 0.04 and N(0.04) will be 0.5160. Using the Black-Scholes Option Pricing Model, what is the value of the option? (Note: Use 2.7183 as the approximate value of e.) O $1.743 O $1.577 O $1.245 O $1.660

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts