Question: Ch 09: End-of-Chapter Problems - Stocks and Their Valuation CONSTANT GROWTH Your broker offers to sell you some shares of Bahnsen & Co. common stock

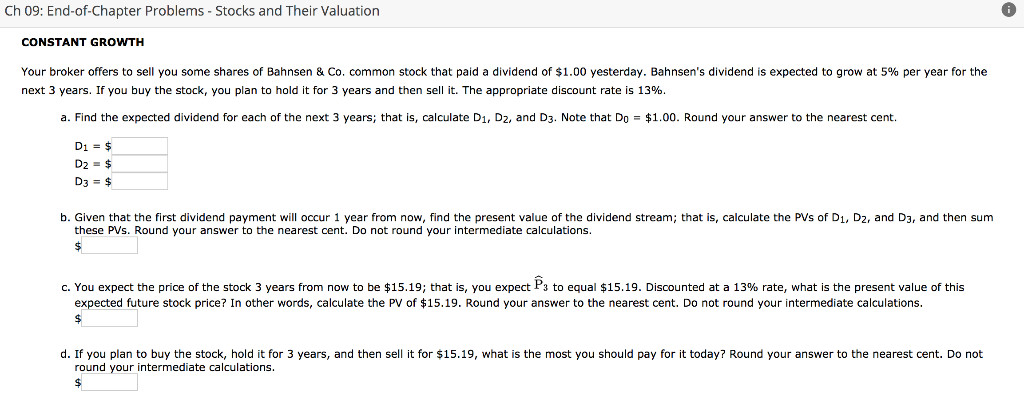

Ch 09: End-of-Chapter Problems - Stocks and Their Valuation CONSTANT GROWTH Your broker offers to sell you some shares of Bahnsen & Co. common stock that paid a dividend of $1.00 yesterday. Bahnsen's dividend is expected to grow at 5% per year for the next 3 years. If you buy the stock, you plan to hold it for 3 years and then sell it. The appropriate discount rate is 13%. a. Find the expected dividend for each of the next 3 years, that is, calculate D1, D2, and D3. Note that D= $1.00. Round your answer to the nearest cent. D1 = $ D2 = $ b. Given that the first dividend payment will occur 1 year from now, find the present value of the dividend stream; that is, calculate the PVs of D1, D2, and D3, and then sum these PVs. Round your answer to the nearest cent. Do not round your intermediate calculations c You expect the price of the stock 3 years from now to be $15.19; that is, you expect s to equal $15.19. Discounted at a L36 rate, what is the present value of this expected future stock price? In other words, calculate the PV of $15.19. Round your answer to the nearest cent. Do not round your intermediate calculations. d. If you plan to buy the stock, hold it for 3 years, and then sell it for $15.19, what is the most you should pay for it today? Round your answer to the nearest cent. Do not round your intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts