Question: Ch. 1810 points total (1 point each problem) You currently hold a portfolio that has SPY, MSFT, AAPL, and WFC in it. You are considering

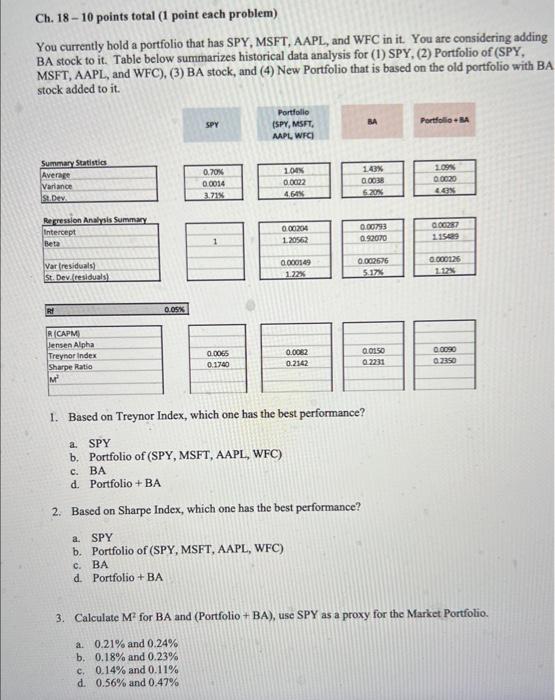

Ch. 1810 points total (1 point each problem) You currently hold a portfolio that has SPY, MSFT, AAPL, and WFC in it. You are considering adding BA stock to it. Table below summarizes historical data analysis for (1) SPY, (2) Portfolio of (SPY, MSFT, AAPL, and WFC), (3) BA stock, and (4) New Portfolio that is based on the old portfolio with BA stock added to it. 1. Based on Treynor Index, which one has the best performance? a. SPY b. Portfolio of (SPY, MSFT, AAPL, WFC) c. BA d. Portfolio + BA 2. Based on Sharpe Index, which one has the best performance? a. SPY b. Portfolio of (SPY, MSFT, AAPL, WFC) c. BA d. Portfolio + BA 3. Calculate M2 for BA and (Portfolio + BA), use SPY as a proxy for the Market Portfolio. a. 0.21% and 0.24% b. 0.18% and 0.23% c. 0.14% and 0.11% d. 0.56% and 0.47%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts