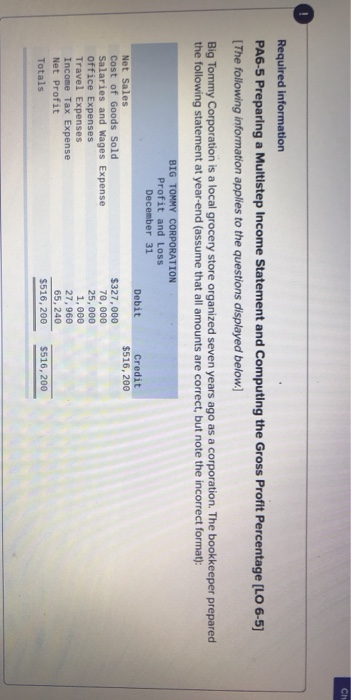

Question: Ch Required information PA6-5 Preparing a Multistep Income Statement and Computing the Gross Profit Percentage [LO 6-5) [The following information applies to the questions displayed

Ch Required information PA6-5 Preparing a Multistep Income Statement and Computing the Gross Profit Percentage [LO 6-5) [The following information applies to the questions displayed below.) Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format): BIG TOMMY CORPORATION Profit and Loss December 31 Debit Credit $516,200 Net Sales Cost of Goods Sold Salaries and Wages Expense Office Expenses Travel Expenses Income Tax Expense Net Profit Totals $327,000 70,000 25,000 1,000 27,960 65, 240 $516,200 $516, 200 References PA6-5 Part 2 2. Compute the gross profit percentage. (Round your answer to 1 decimal place.) Gross Profit Percentage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts