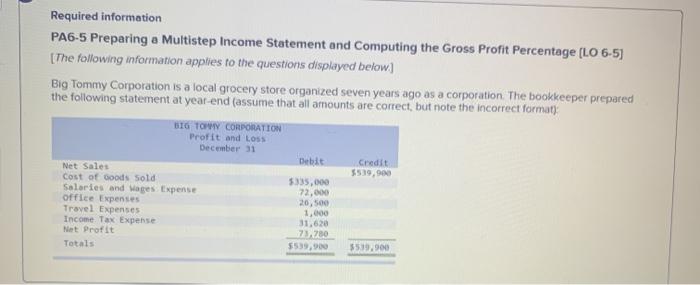

Question: Required information PA6-5 Preparing a Multistep Income Statement and Computing the Gross Profit Percentage (LO 6-5) [The following information applies to the questions displayed below)

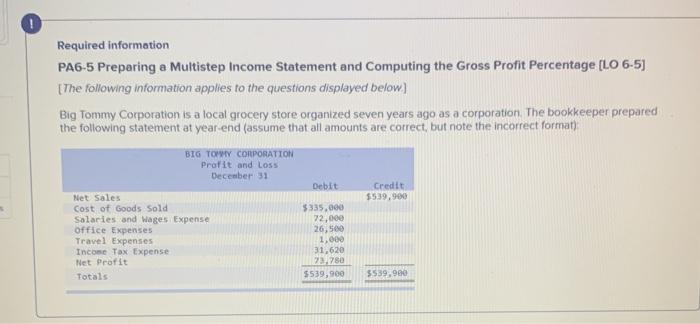

Required information PA6-5 Preparing a Multistep Income Statement and Computing the Gross Profit Percentage (LO 6-5) [The following information applies to the questions displayed below) Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format) 116 TOWY CORPORATION Profit and Loss December 31 Debit Credit 5539,900 $335,000 72,000 Net Sales Cost of Goods Sold Salaries and Wages Expense office Expenses Travel Expenses Income Tax Expense Net Profit Totals 1,000 31,620 7,200 $539,900 $39.900 PA6-5 Part 1 Required: 1. Prepare a properly formatted multistep income statement that would be used for external reporting purposes BIG TOMMY CORPORATION Income Statement Required information PA6-5 Preparing a Multistep Income Statement and Computing the Gross Profit Percentage (LO 6-5) [The following information applies to the questions displayed below) Big Tommy Corporation is a local grocery store organized seven years ago as a corporation The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format) BIG TOWY CORPORATION Profit and Loss December 31 Debit Credit $539,900 Net Sales Cost of Goods Sold Salaries and Wages Expense Office Expenses Travel Expenses Income Tax Expense Net Profit Totals $335.000 72,000 26,500 1,000 31,620 23.780 $539,900 3539.900 PA6-5 Part 2 2. Compute the gross profit percentage (Round your answer to 1 decimal place.) Gross Profit Percentage %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts