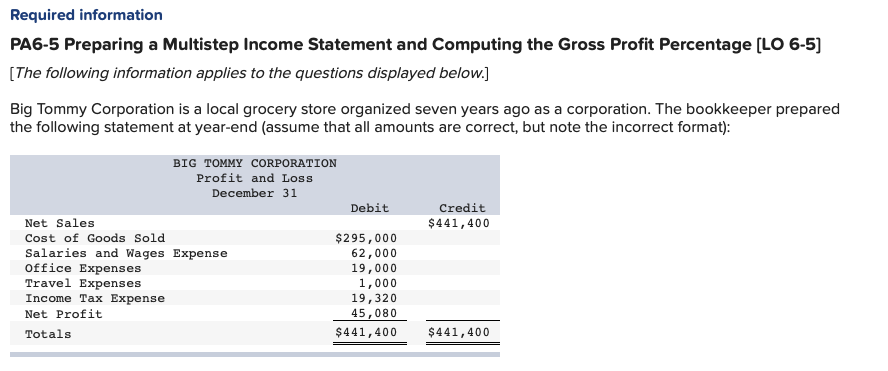

Question: Required information PA6-5 Preparing a Multistep Income Statement and Computing the Gross Profit Percentage [LO 6-5] [The following information applies to the questions displayed below.]

![Gross Profit Percentage [LO 6-5] [The following information applies to the questions](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66df3c42688fb_98666df3c420e539.jpg)

![displayed below.] Big Tommy Corporation is a local grocery store organized seven](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66df3c42e44f1_98666df3c4297448.jpg)

Required information PA6-5 Preparing a Multistep Income Statement and Computing the Gross Profit Percentage [LO 6-5] [The following information applies to the questions displayed below.] Big Tommy Corporation is a local grocery store organized seven years ago as a corporation. The bookkeeper prepared the following statement at year-end (assume that all amounts are correct, but note the incorrect format): BIG TOMMY CORPORATION Profit and Loss December 31 Debit Credit $441,400 Net Sales Cost of Goods Sold Salaries and Wages Expense Office Expenses Travel Expenses Income Tax Expense Net Profit Totals $295,000 62,000 19,000 1,000 19,320 45,080 $441,400 $441,400 PA6-5 Part 1 Required: 1. Prepare a properly formatted multistep income statement that would be used for external reporting purposes. Answer is complete but not entirely correct. $ 441,400 -295,000 146,400 BIG TOMMY CORPORATION Income Statement For the Year Ended December 31 Net Sales Cost of Goods Sold Gross Profit Expenses Salaries and Wages Expense Office Expenses Travel Expense Other Operating Expenses Income from Operations Income Tax Expense 62,000 19,000 1,000 82,000 X (19,320) Net Income $ 64,400 2. Compute the gross profit percentage. (Round your answer to 1 decimal place.) Gross Profit Percentage %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts