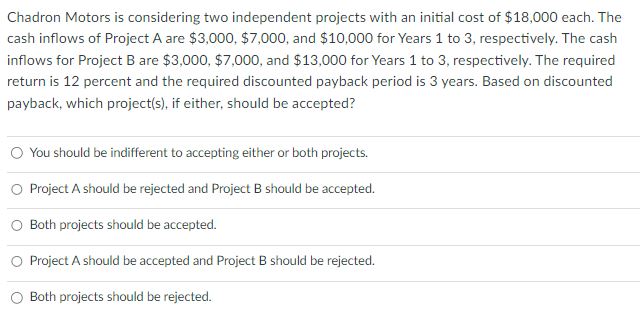

Question: Chadron Motors is considering two independent projects with an initial cost of $ 1 8 , 0 0 0 each. The cash inflows of Project

Chadron Motors is considering two independent projects with an initial cost of $ each. The

cash inflows of Project A are $$ and $ for Years to respectively. The cash

inflows for Project B are $$ and $ for Years to respectively. The required

return is percent and the required discounted payback period is years. Based on discounted

payback, which projects if either, should be accepted?

You should be indifferent to accepting either or both projects.

Project A should be rejected and Project B should be accepted.

Both projects should be accepted.

Project A should be accepted and Project B should be rejected.

Both projects should be rejected.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock