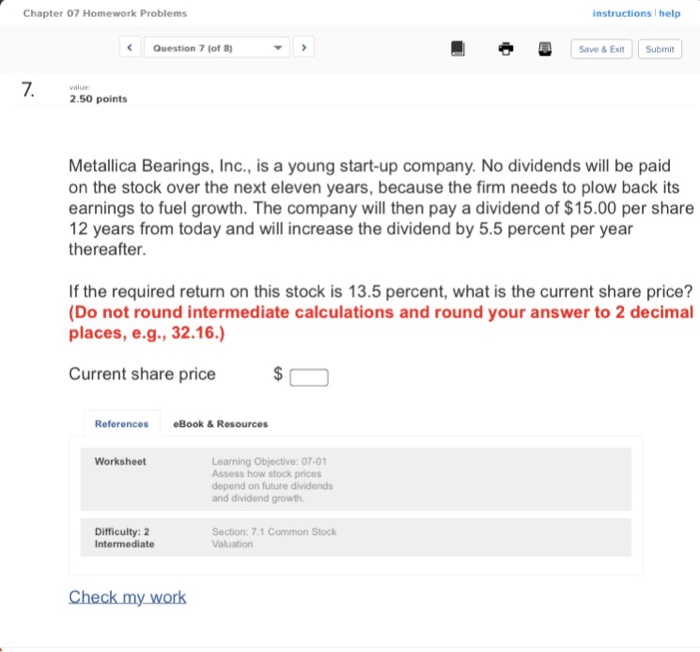

Question: Chapter 07 Homework Problems instructions help Question 7 (of 8) Save & Exit Submit value 2.50 points Metallica Bearings, Inc., is a young start-up company.

Chapter 07 Homework Problems instructions help Question 7 (of 8) Save & Exit Submit value 2.50 points Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next eleven years, because the firm needs to plow back its earnings to fuel growth. The company will then pay a dividend of $15.00 per share 12 years from today and will increase the dividend by 5.5 percent per year thereafter. If the required return on this stock is 13.5 percent, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current share price References eBook & Resources Worksheet Learning Objective: 07-01 Assess how stock prices depend on future dividends and dividend growth Difficulty: 2 Intermediate Section: 7.1 Common Stock Valuation Check my work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts