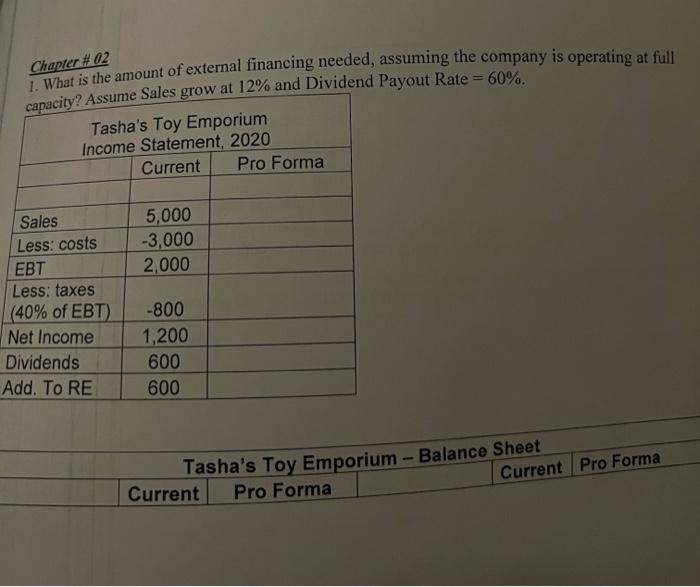

Question: Chapter # 1. What is the amount of external financing needed, assuming the company is operating at full capacity? Assume Sales grow at 12% and

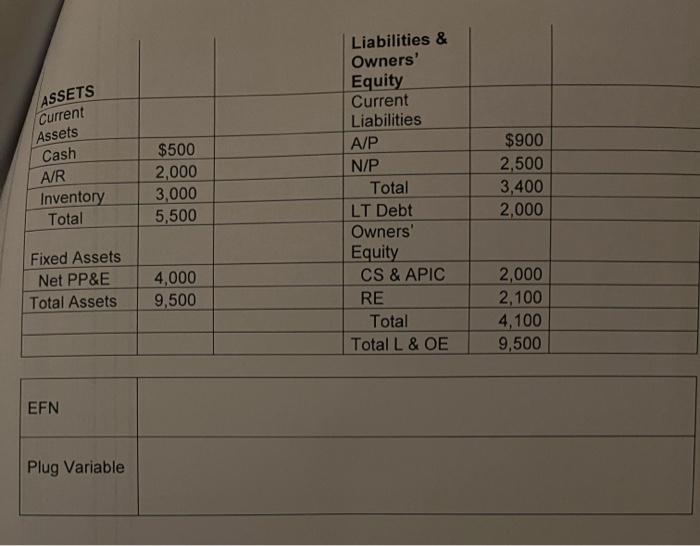

Chapter # 1. What is the amount of external financing needed, assuming the company is operating at full capacity? Assume Sales grow at 12% and Dividend Payout Rate = 60%. Tasha's Toy Emporium Income Statement, 2020 Current Pro Forma 5,000 -3,000 2,000 Sales Less: costs EBT Less: taxes (40% of EBT) Net Income Dividends Add. To RE -800 1,200 600 600 Tasha's Toy Emporium - Balance Sheet Current Pro Forma Current Pro Forma ASSETS Current Assets Cash A/R $500 2,000 3,000 5,500 Liabilities & Owners' Equity Current Liabilities A/P N/P Total LT Debt Owners Equity CS & APIC RE Total Total L & OE $900 2,500 3,400 2,000 Inventory Total Fixed Assets Net PP&E Total Assets 4,000 9,500 2,000 2,100 4,100 9,500 EFN Plug Variable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts