Question: Is it correct? Chapter # 02 1. What is the amount of external financing needed, assuming the company is operating at full capacity? Assume Sales

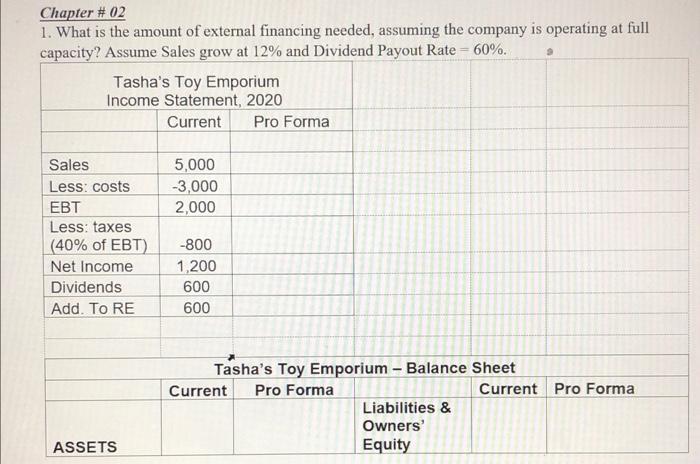

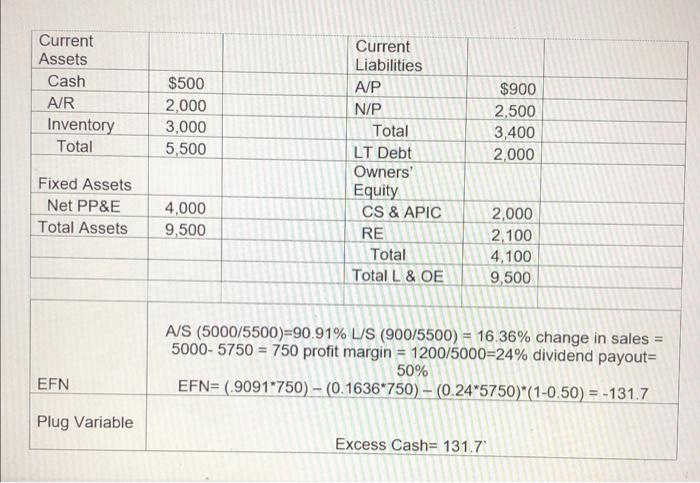

Chapter # 02 1. What is the amount of external financing needed, assuming the company is operating at full capacity? Assume Sales grow at 12% and Dividend Payout Rate = 60%. Tasha's Toy Emporium Income Statement, 2020 Current Pro Forma 5,000 -3,000 2,000 Sales Less: costs EBT Less: taxes (40% of EBT) Net Income Dividends Add. To RE -800 1,200 600 600 Tasha's Toy Emporium - Balance Sheet Current Pro Forma Current Pro Forma Liabilities & Owners Equity ASSETS Current Assets Cash A/R Inventory Total Current Liabilities A/P N/P $500 2,000 3,000 5,500 $900 2,500 3,400 2.000 Fixed Assets Net PP&E Total Assets 4,000 9,500 Total LT Debt Owners' Equity CS & APIC RE Total Total L & OE 2,000 2.100 4,100 9,500 A/S (5000/5500)=90.91% L/S (900/5500) = 16.36% change in sales = 5000- 5750 = 750 profit margin = 1200/5000=24% dividend payout= 50% EFN= (.9091*750) (0.1636*750) - (0.24*5750)*(1-0.50) = -131.7 EFN Plug Variable Excess Cash= 131.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts