Question: Chapter 12 Basic Homework ebook Calculator Printem L. Bowers and V. Lipscomb are partners in Begant Event Consultants, Bowers and Upscomb share income equally, M.

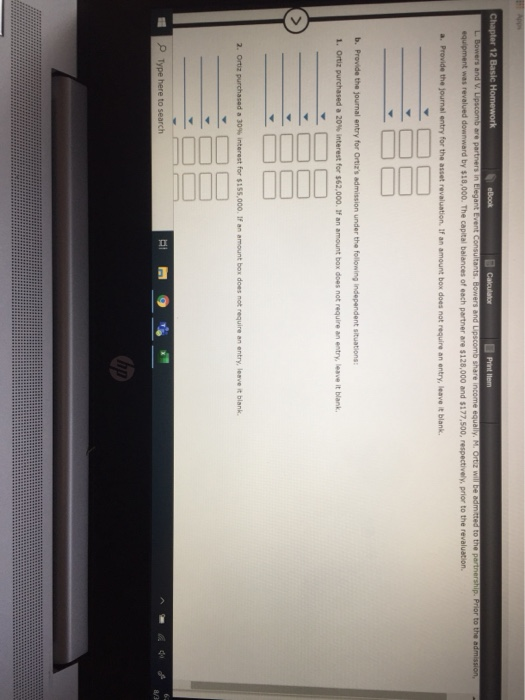

Chapter 12 Basic Homework ebook Calculator Printem L. Bowers and V. Lipscomb are partners in Begant Event Consultants, Bowers and Upscomb share income equally, M. Ortz will be admitted to the partnership. Prior to the admission, equipment was revalued downward by $10,000. The capital balances of each partner are $128,000 and $177,500, respectively, prior to the revaluation a. Provide the journal entry for the asset revaluation. If an amount box does not require an entry, leave it blank. Ill 110 b. Provide the journal entry for Ortiz's admission under the following independent situations 1. Ortiz purchased a 20% interest for $62,000. If an amount box does not require an entry, leave it blank, dll. Till 101 2. Ortiz purchased a 30% interest for $155.000. If an amount box does not require an entry, leave it blank. Type here to search BI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts