Question: Chapter 12: Homework 1. EAR LO 124 Classify each of the following performance measures into the balanced Scorecard perspective to which it relates: financial perspective,

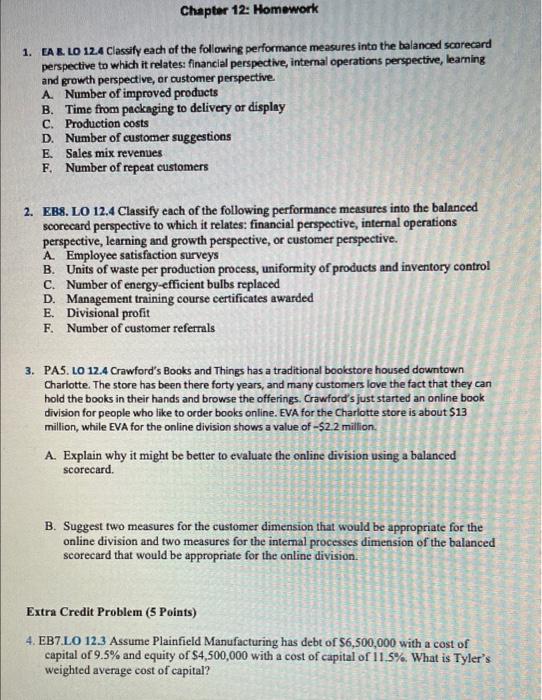

Chapter 12: Homework 1. EAR LO 124 Classify each of the following performance measures into the balanced Scorecard perspective to which it relates: financial perspective, internal operations perspective, learning and growth perspective, or customer perspective A. Number of improved products B. Time from packaging to delivery or display C. Production costs D. Number of customer suggestions E. Sales mix revenues F. Number of repeat customers 2. EB8. LO 12.4 Classify each of the following performance measures into the balanced scorecard perspective to which it relates: financial perspective, internal operations perspective learning and growth perspective, or customer perspective. A. Employee satisfaction surveys B. Units of waste per production process, uniformity of products and inventory control C. Number of energy-efficient bulbs replaced D. Management training course certificates awarded E. Divisional profit F. Number of customer referrals 3. PAS. LO 12.4 Crawford's Books and Things has a traditional bookstore housed downtown Charlotte. The store has been there forty years, and many customers love the fact that they can hold the books in their hands and browse the offerings. Crawford's just started an online book division for people who like to order books online. EVA for the Charlotte store is about $13 million, while EVA for the online division shows a value of -$2.2 million A. Explain why it might be better to evaluate the online division using a balanced scorecard. B. Suggest two measures for the customer dimension that would be appropriate for the online division and two measures for the internal processes dimension of the balanced scorecard that would be appropriate for the online division. Extra Credit Problem (5 Points) 4. EB7.LO 12.3 Assume Plainfield Manufacturing has debt of $6,500,000 with a cost of capital of 9.5% and equity of $4,500,000 with a cost of capital of 11.5%. What is Tyler's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts