Question: Chapter 16 i Saved Help Save & Exit Submit Check my work 13 A newly issued bond has a maturity of 10 years and pays

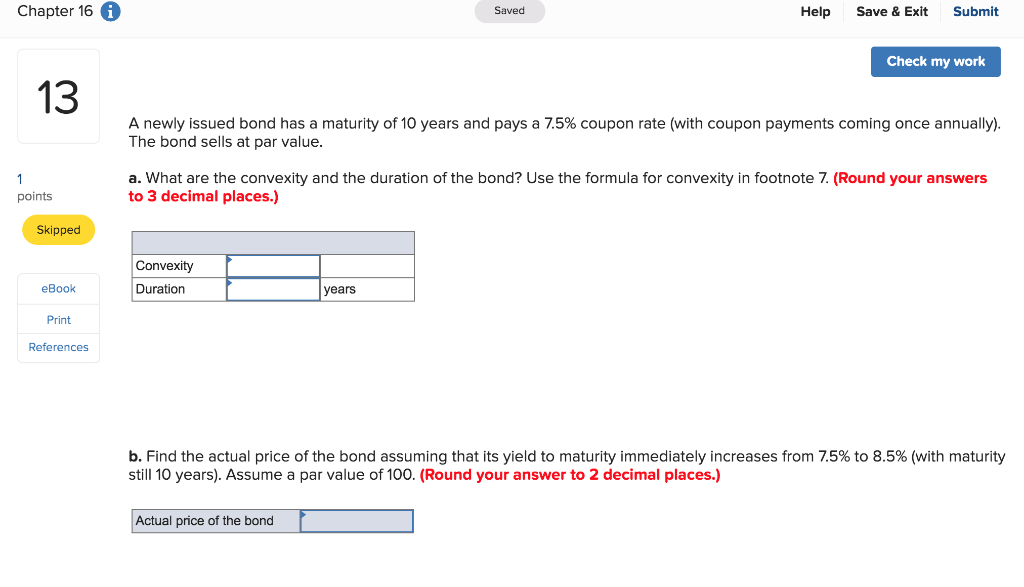

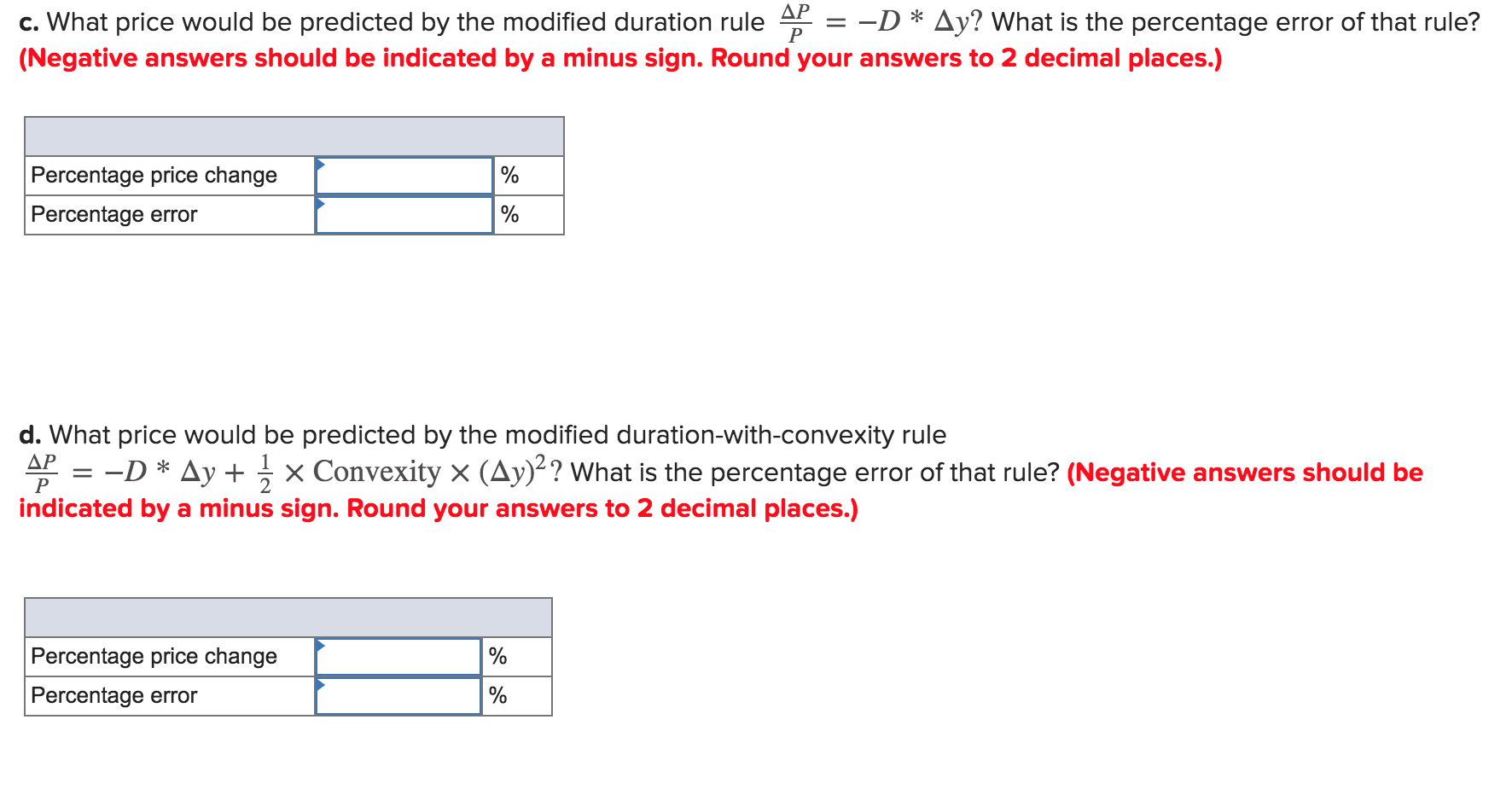

Chapter 16 i Saved Help Save & Exit Submit Check my work 13 A newly issued bond has a maturity of 10 years and pays a 7.5% coupon rate (with coupon payments coming once annually). The bond sells at par value. a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7. (Round your answers to 3 decimal places.) points Skipped Convexity Duration eBook years Print References b. Find the actual price of the bond assuming that its yield to maturity immediately increases from 7.5% to 8.5% (with maturity still 10 years). Assume a par value of 100. (Round your answer to 2 decimal places.) Actual price of the bond c. What price would be predicted by the modified duration rule AP = -D * Ay? What is the percentage error of that rule? (Negative answers should be indicated by a minus sign. Round your answers to 2 decimal places.) Percentage price change Percentage error d. What price would be predicted by the modified duration-with-convexity rule 4 = -D * Ay + 1 x Convexity X (Ay)2 ? What is the percentage error of that rule? (Negative answers should be indicated by a minus sign. Round your answers to 2 decimal places.) Percentage price change Percentage error

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts