Question: CHAPTER 16 Problem 1 An entity received a government grant under the following independent situations 1. An entity received a grant of P30,000.00 from the

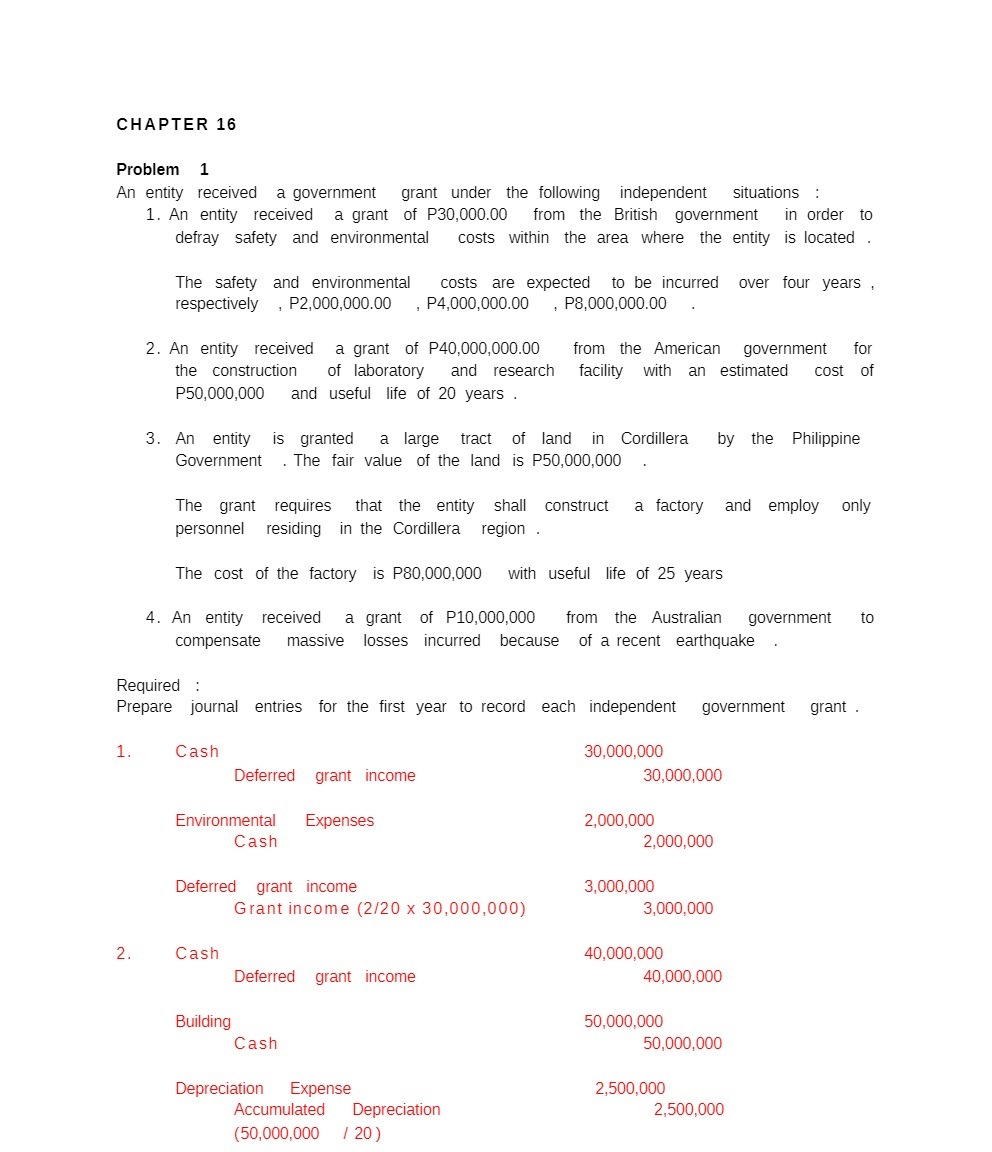

CHAPTER 16 Problem 1 An entity received a government grant under the following independent situations 1. An entity received a grant of P30,000.00 from the British government in order to defray safety and environmental costs within the area where the entity is located . The safety and environmental costs are expected to be incurred over four years , respectively ,P2,000,000.00 ,P4,000,000.00 ,P8,000,000.00 2. An entity received a grant of P40,000,000.00 from the American government for the construction of laboratory and research facility with an estimated cost of P50,000,000 and useful life of 20 years . 3. An entity is granted a large tract of land in Cordillera by the Philippine Government .The fair value of the land is P50,000,000 The grant requires that the entity shall constmct a factory and employ only personnel residing in the Cordillera region. The cost of the factory is P80000000 with useful life of 25 years 4. An entity received a grant of P10,000,000 from the Australian govemment to compensate massive losses incurred because of a recent earthquake Required Prepare journal entries for the first year to record each independent government grant. 1. C a s h 30,000,000 Deferred grant income 30,000,000 Environmental Expenses 2,000,000 C a s h 2,000,000 Deferred grant income 3,000,000 Grantincome (2f20 x 30,000,000) 3,000,000 2. C a s h 40,000,000 Deferred grant income 40,000,000 Building 50,000,000 C as h 50,000,000 Depreciation Expense 2,500,000 Accumulated Depreciation 2,500,000 (50,000,000 r 20)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts