Question: Chapter 17: Financial Statement Analysis es, 18.3Marshall common stock was $82.60 on December 31, 20Y2 ays PR 17-4A Measures of liquidity, solvency, and profitability The

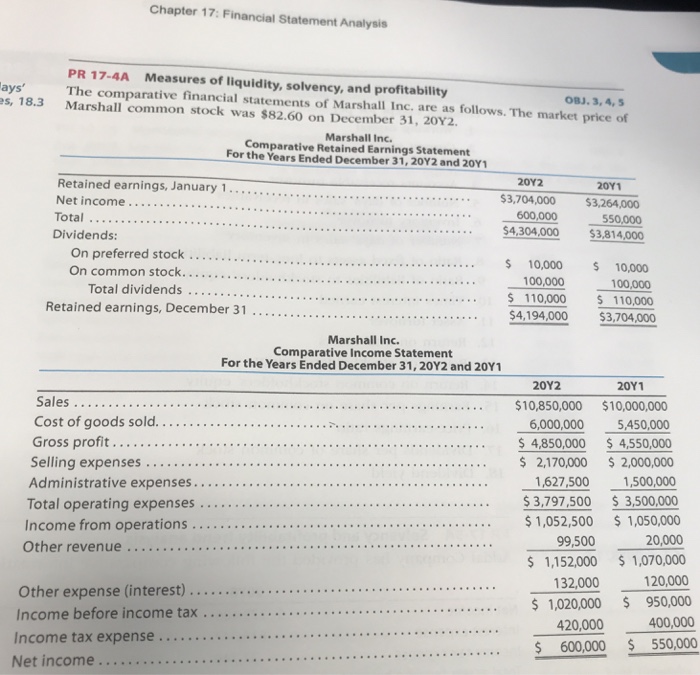

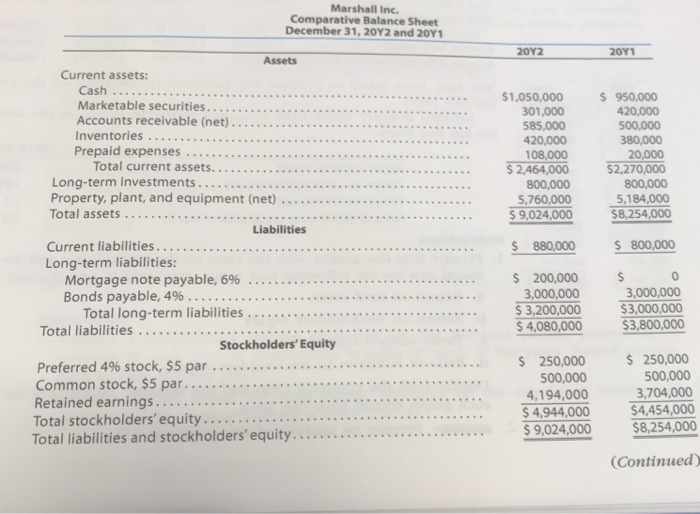

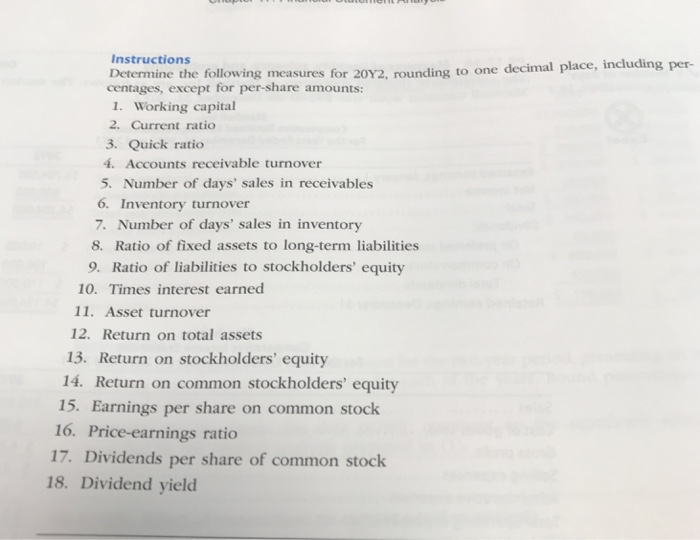

Chapter 17: Financial Statement Analysis es, 18.3Marshall common stock was $82.60 on December 31, 20Y2 ays PR 17-4A Measures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of OBJ.3,4, Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1.... Net income. $3,704,000 $3.264,000 550,000 4,304,000 $3,814,000 600,000 Dividends: 10,000 10,000 100,000 100,000 $ 110,000 S 110,000 $4,194,000 $3,704,000 Retained earnings, December 31. .. . Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 10,850,000 $10,000,000 6,000,000 5,450,000 $ 4,850,000 $ 4,550,000 $ 2,170,000 2,000,000 1,627,500 1,500,000 $3.797 500 $3,500,00 99,500 20,000 1,152,000 $1,070,000 120,000 132,000 1,020,000 $ 950,000 420,000400,00 . . . . . . . . . . . .. Income before income tax Income tax expense Net income $ 600,000 550,000

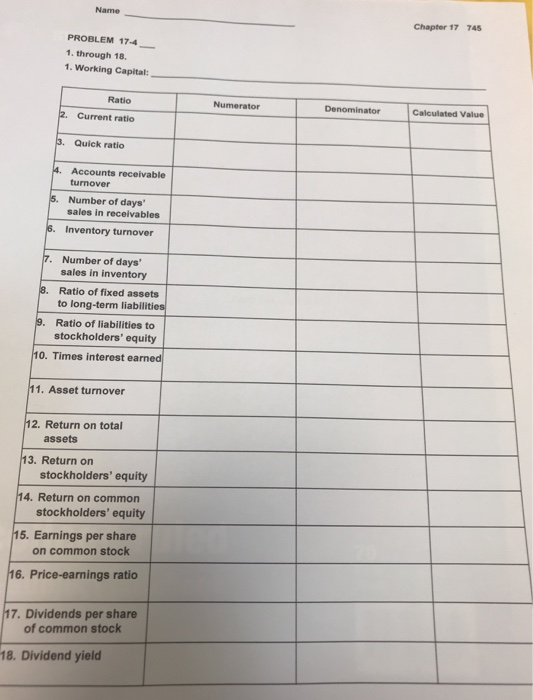

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts