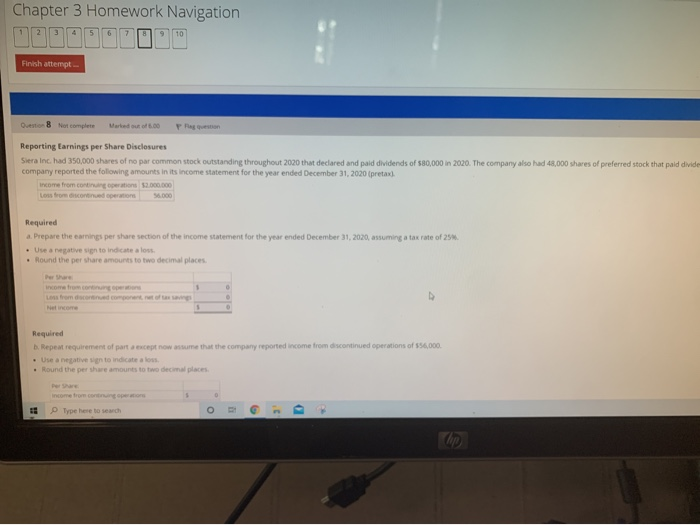

Question: Chapter 3 Homework Navigation QURBEUTODE Finish attempt Q Not complete Marted out of 6.00 Phon Reporting Earnings per Share Disclosures Siera Inc had 350,000 shares

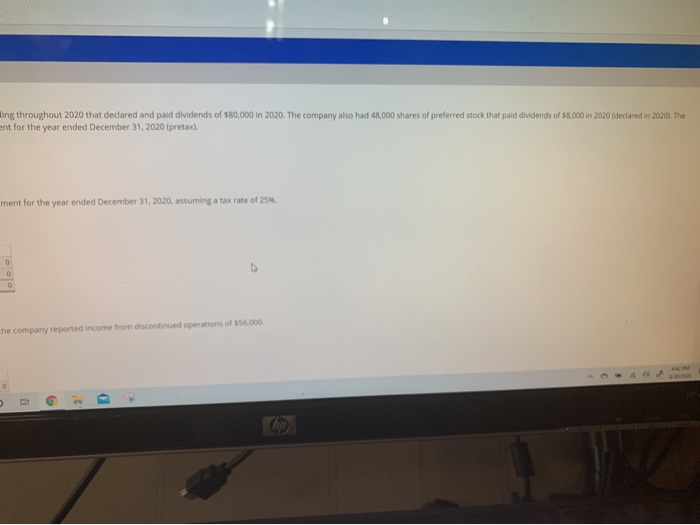

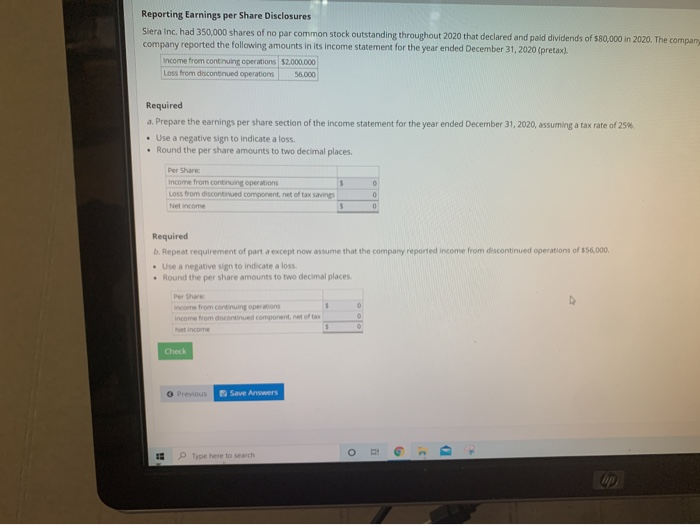

Chapter 3 Homework Navigation QURBEUTODE Finish attempt Q Not complete Marted out of 6.00 Phon Reporting Earnings per Share Disclosures Siera Inc had 350,000 shares of no par common stock outstanding throughout 2020 that declared and paid dividends of 580,000 in 2020. The company also had 48,000 shares of preferred stock that paid divide company reported the following amounts in its income statement for the year ended December 31, 2020 (pretax). Income from coming operations $2.000.000 Los from continued operations Required a. Prepare the earnings per share section of the income statement for the year ended December 31, 2020, assuming a tax rate of 25. Use a negative in to indicate a los Round the per share amounts to two decimal places. Der har from decote component of a Required b. Repeat requirement of part except now assume that the company reported income from discontinued operations of $56,000 Use a negativento indicate a los . Round the per share amounts to two decimal places 5 income from compris Type here to search ing throughout 2020 that declared and paid dividends of $80,000 in 2020. The company also had 48,000 shares of preferred stock that paid dividends of $8.000 in 2020 (declared in 20201 The ent for the year ended December 31, 2020 (pretax). ment for the year ended December 31, 2020, assuming a tax rate of 25%. 0 che company reported income from discontinued operations of 556,000, 0 Reporting Earnings per Share Disclosures Siera Inc. had 350,000 shares of no par common stock outstanding throughout 2020 that declared and paid dividends of $80,000 in 2020. The company company reported the following amounts in its income statement for the year ended December 31, 2020 (pretax). Income from continuing operations $2.000.000 Loss from discontinued operations 56.000 Required a. Prepare the earnings per share section of the income statement for the year ended December 31, 2020, assuming a tax rate of 25% Use a negative sign to indicate a loss. Round the per share amounts to two decimal places. Per Share: Income from continuing operations 5 Loss from discontinued componentnet of tax savings Net income 5 0 0 0 Required b. Repeat requirement of part a except now assume that the company reported income from discontinued operations of $56,000. Use a negative sign to indicate a loss Round the per share amounts to two decimal places 1 income from continuing operations Income from descontinued component of Net income 5 Check Previous Save Anwwers G O . Type here to search up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts