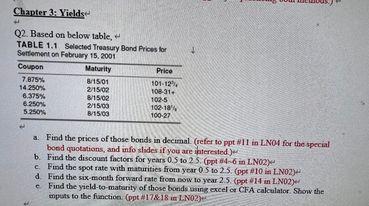

Question: Chapter 3 Yields Q2. Based on below table, TABLE 1.1 Selected Treasury Bond prices for Settement on February 15, 2001 Coupon Maturity Price 7.875% 8/15701

Chapter 3 Yields Q2. Based on below table, TABLE 1.1 Selected Treasury Bond prices for Settement on February 15, 2001 Coupon Maturity Price 7.875% 8/15701 101-12% 14250% 2/15/02 10-31. 6.375% 8/1502 102-5 6.250% 2/1500 102-18 5.250% B/1503 100-27 a. Find the prices of those bonds in decimal (refer to ppt WII in LNO for the special bond quotations, and info slides if you are interested) b. Find the discount factors for years 0.5 to 25 (ppt 4-6 in LN02 c Find the spot rate with maturities from year 05 to 25. (p 10 in LN02) d Find the six month forward rate from now to year 25 (ppt 14 in L.NO2) Find the yield-to-maturity of those bonds using excel or CFA calculator Show the puts to the function (ppt 1718 LNO2 Chapter 3 Yields Q2. Based on below table, TABLE 1.1 Selected Treasury Bond prices for Settement on February 15, 2001 Coupon Maturity Price 7.875% 8/15701 101-12% 14250% 2/15/02 10-31. 6.375% 8/1502 102-5 6.250% 2/1500 102-18 5.250% B/1503 100-27 a. Find the prices of those bonds in decimal (refer to ppt WII in LNO for the special bond quotations, and info slides if you are interested) b. Find the discount factors for years 0.5 to 25 (ppt 4-6 in LN02 c Find the spot rate with maturities from year 05 to 25. (p 10 in LN02) d Find the six month forward rate from now to year 25 (ppt 14 in L.NO2) Find the yield-to-maturity of those bonds using excel or CFA calculator Show the puts to the function (ppt 1718 LNO2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts