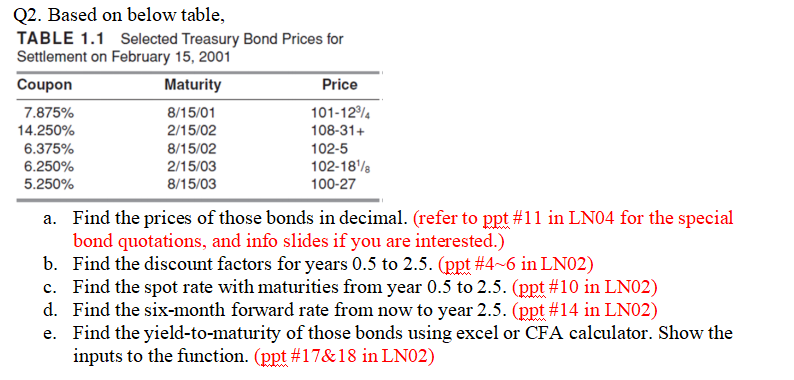

Question: Q2. Based on below table, TABLE 1.1 Selected Treasury Bond Prices for Settlement on February 15, 2001 Coupon Maturity Price 7.875% 8/15/01 101-1214 14.250% 2/15/02

Q2. Based on below table, TABLE 1.1 Selected Treasury Bond Prices for Settlement on February 15, 2001 Coupon Maturity Price 7.875% 8/15/01 101-1214 14.250% 2/15/02 108-31+ 6.375% 8/15/02 102-5 6.250% 2/15/03 102-18/8 5.250% 8/15/03 100-27 a. Find the prices of those bonds in decimal. (refer to ppt #11 in LN04 for the special bond quotations, and info slides if you are interested.) b. Find the discount factors for years 0.5 to 2.5. (ppt #4-6 in LN02) c. Find the spot rate with maturities from year 0.5 to 2.5. (ppt #10 in LN02) d. Find the six-month forward rate from now to year 2.5. (ppt #14 in LN02) e. Find the yield-to-maturity of those bonds using excel or CFA calculator. Show the inputs to the function. (ppt #17&18 in LN02) Q2. Based on below table, TABLE 1.1 Selected Treasury Bond Prices for Settlement on February 15, 2001 Coupon Maturity Price 7.875% 8/15/01 101-1214 14.250% 2/15/02 108-31+ 6.375% 8/15/02 102-5 6.250% 2/15/03 102-18/8 5.250% 8/15/03 100-27 a. Find the prices of those bonds in decimal. (refer to ppt #11 in LN04 for the special bond quotations, and info slides if you are interested.) b. Find the discount factors for years 0.5 to 2.5. (ppt #4-6 in LN02) c. Find the spot rate with maturities from year 0.5 to 2.5. (ppt #10 in LN02) d. Find the six-month forward rate from now to year 2.5. (ppt #14 in LN02) e. Find the yield-to-maturity of those bonds using excel or CFA calculator. Show the inputs to the function. (ppt #17&18 in LN02)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts