Question: Chapter 5 Exercise/Problem #3 A) Financial Statempnts B) Caiculate the current ratio, quick ratio, and NWC-to-total-assets ratio. Current Ratio = Current Assets/Current Liabilities = Quick

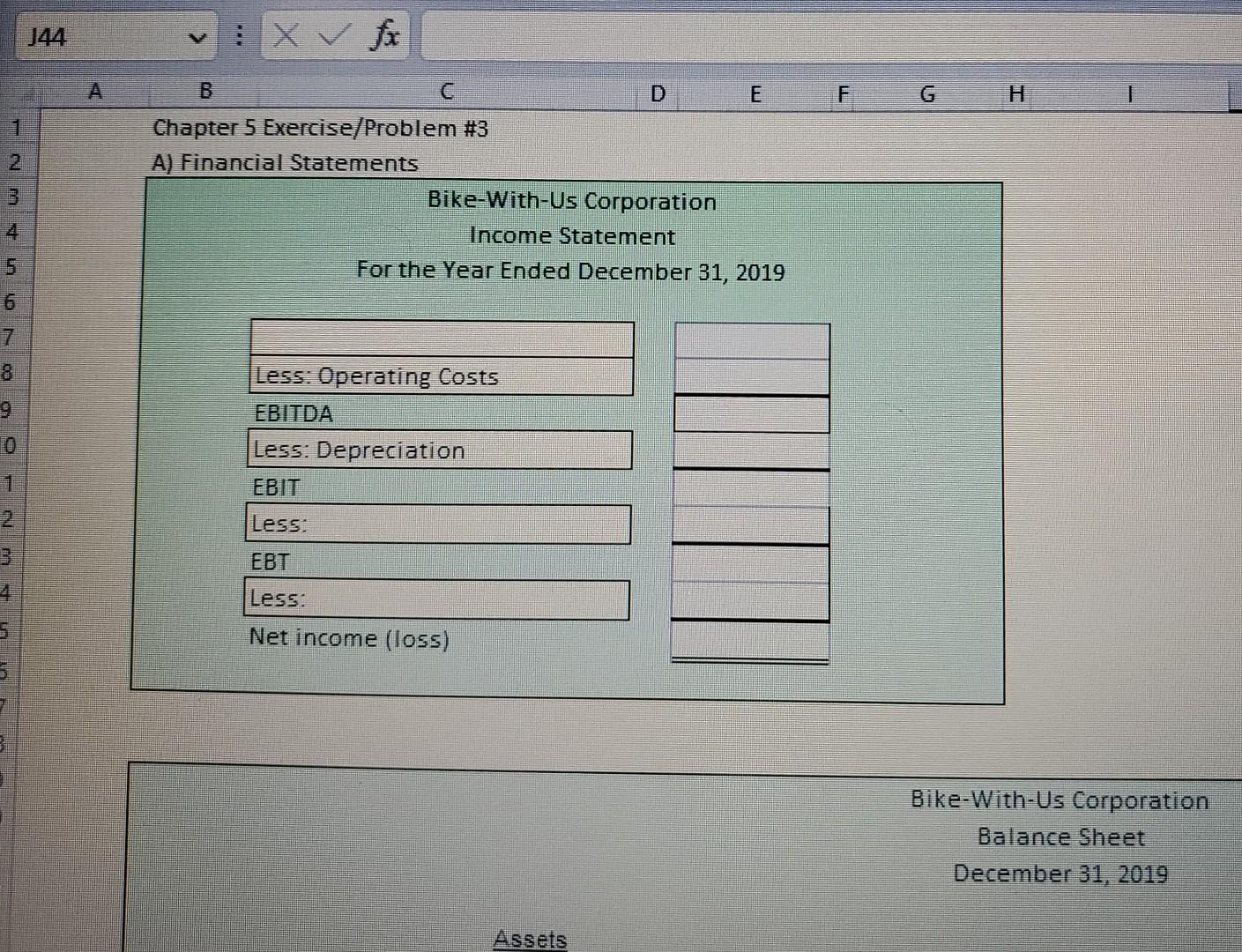

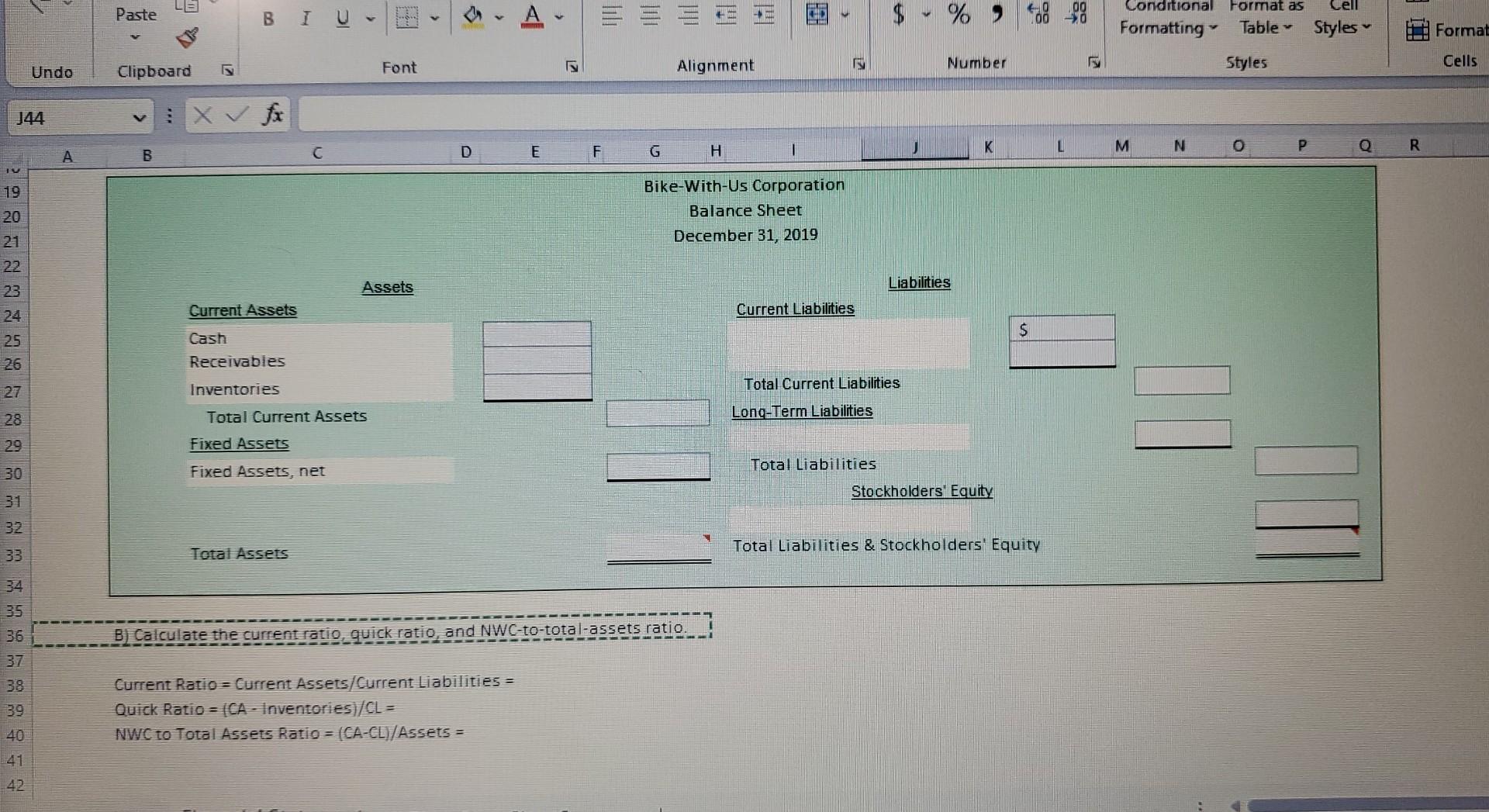

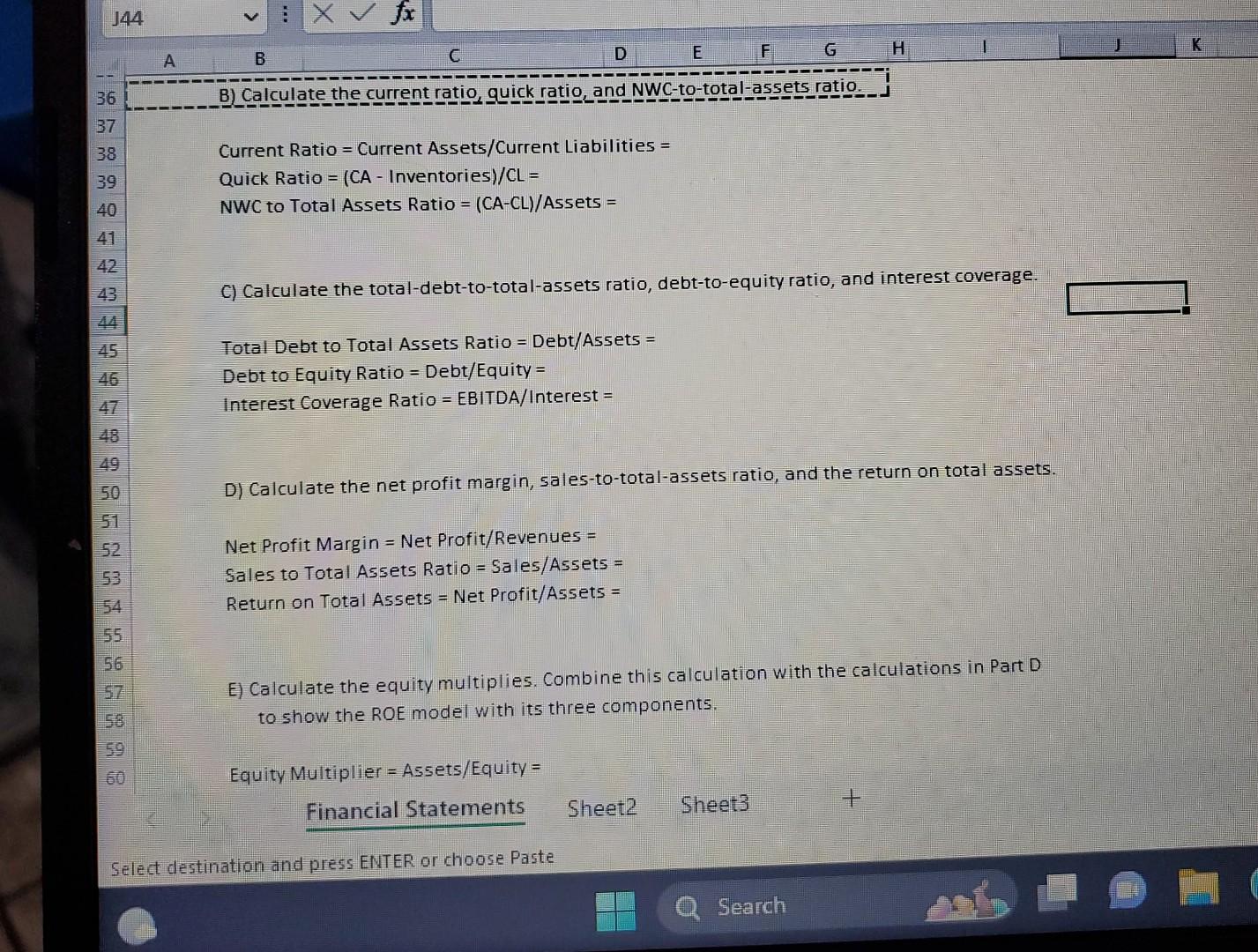

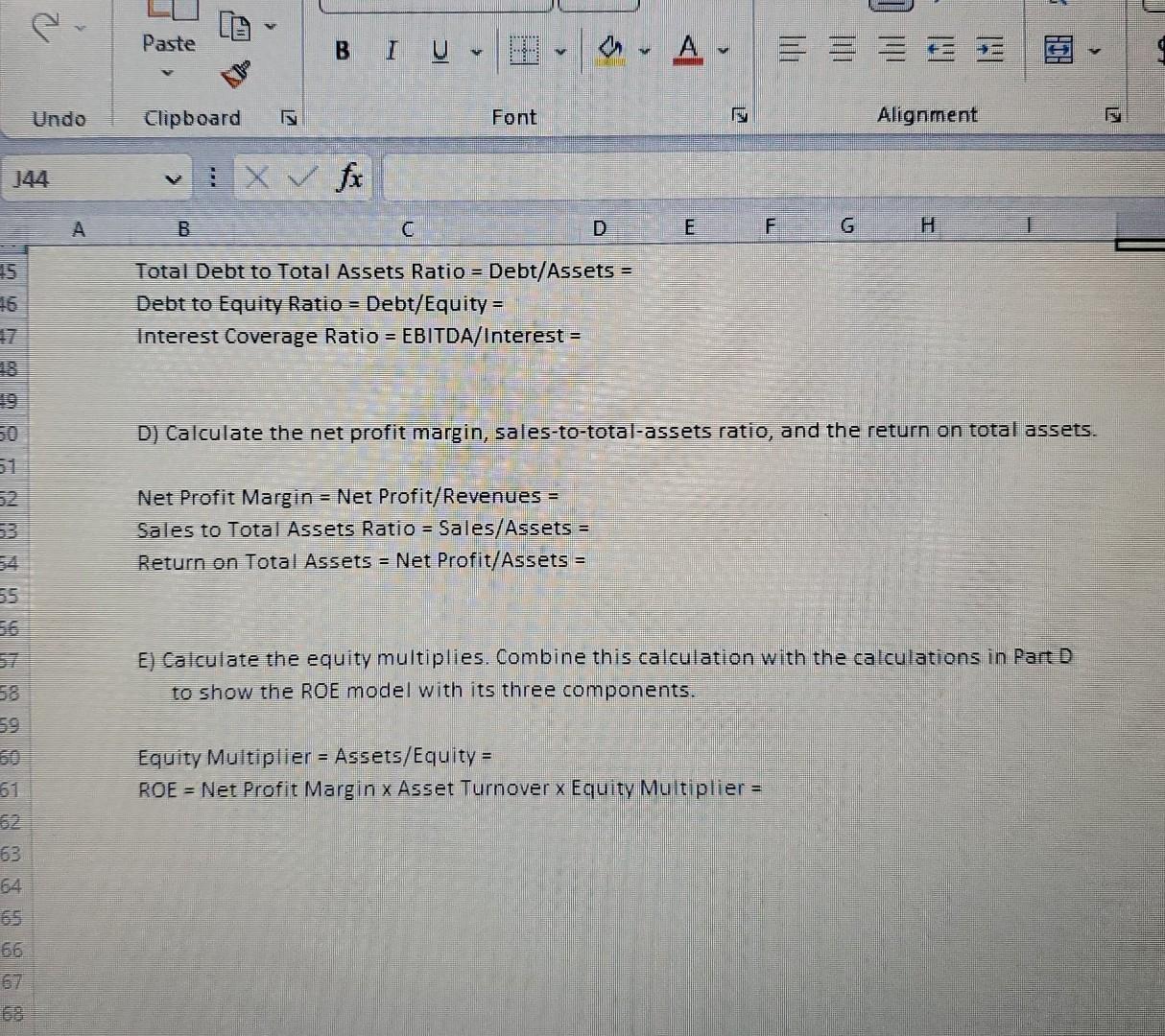

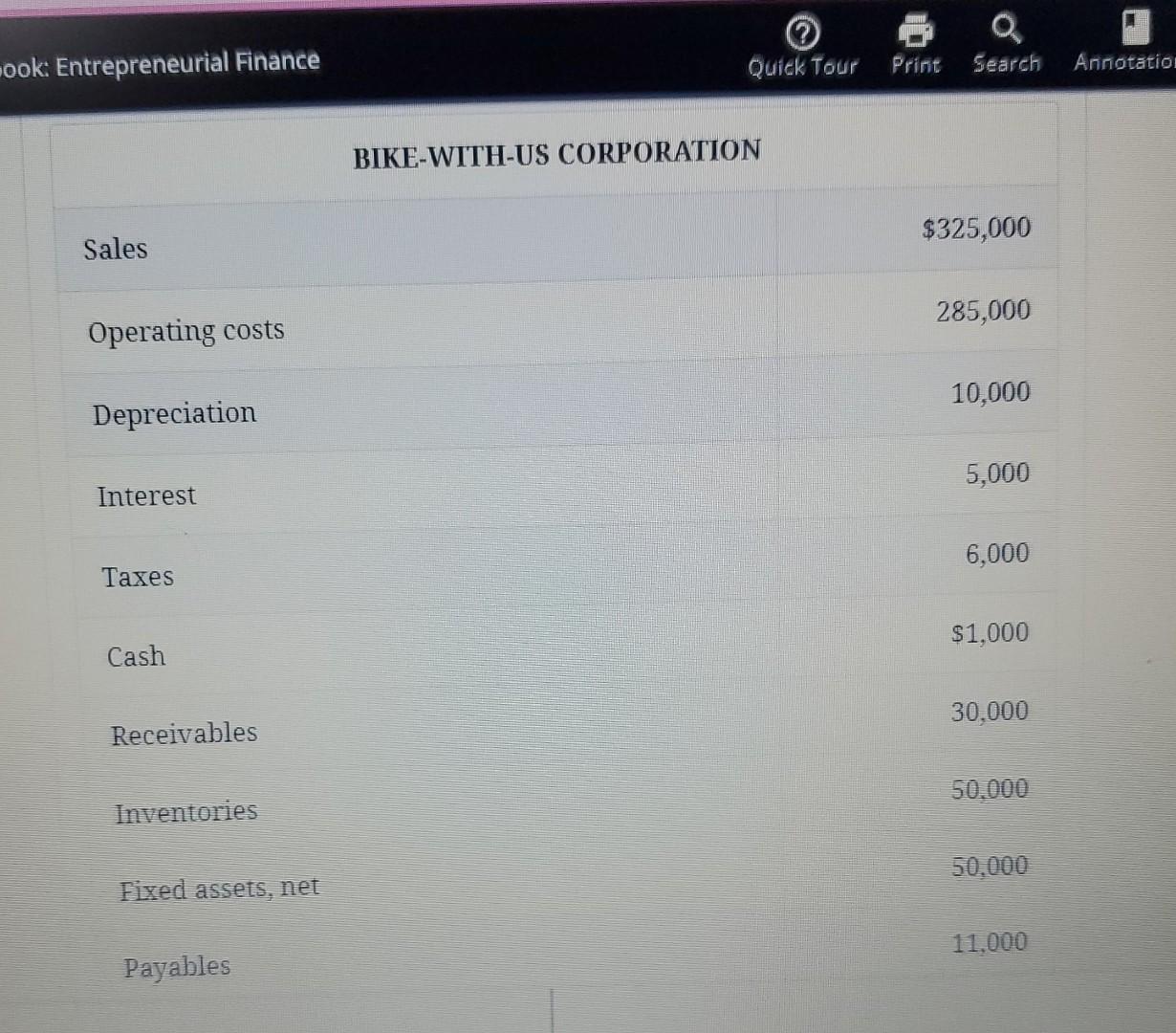

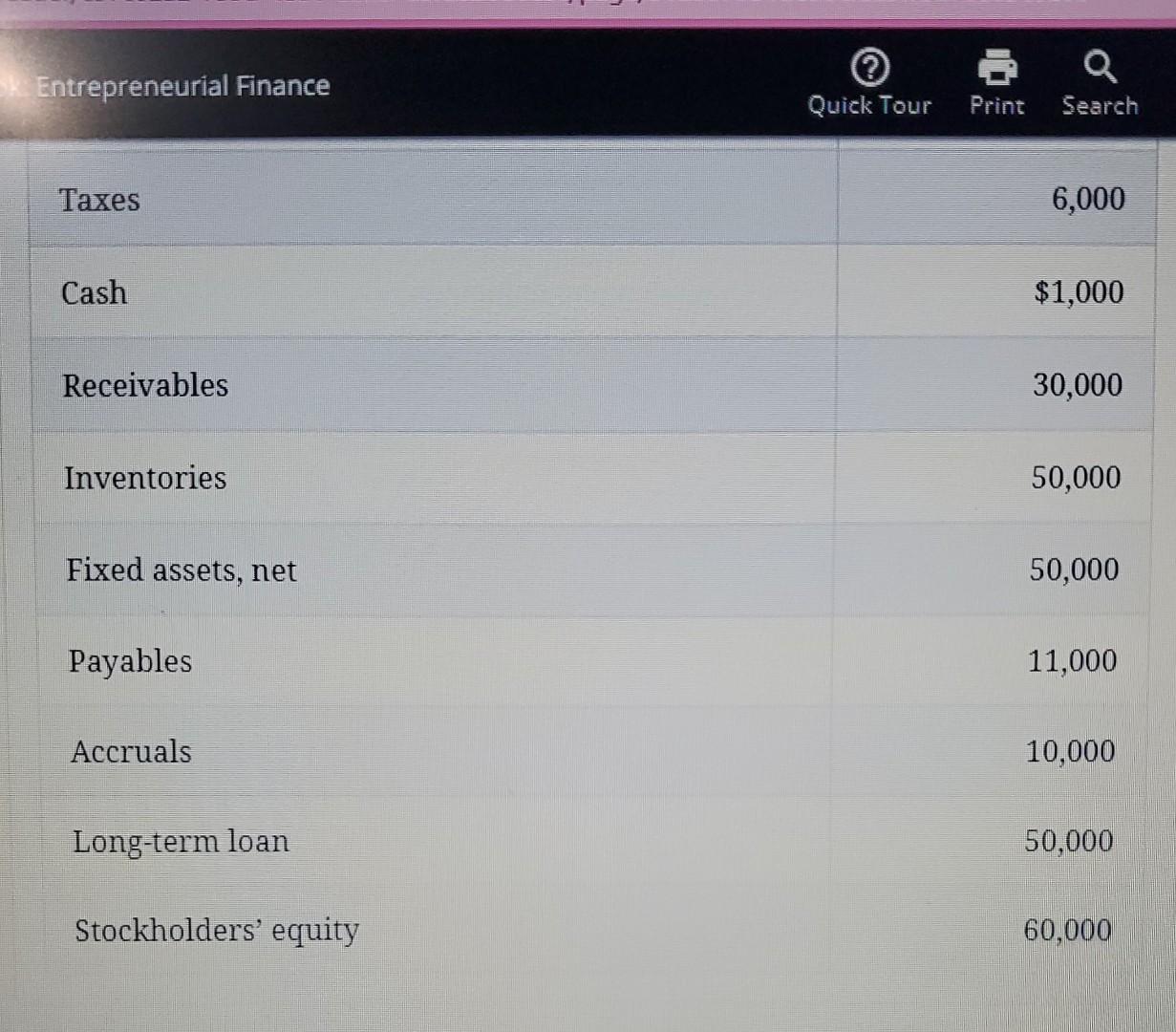

Chapter 5 Exercise/Problem \#3 A) Financial Statempnts B) Caiculate the current ratio, quick ratio, and NWC-to-total-assets ratio. Current Ratio = Current Assets/Current Liabilities = Quick Ratio =(CCA - Inventories )/CCl= NWC to Total Assets Ratio =(CACL)/ Assets = B C E F G J K B) Calculate the current ratio, quick ratio, and NWC-to-total-assets ratio. Current Ratio = Current Assets/Current Liabilities = Quick Ratio =(CA - Inventories )/CL= NWC to Total Assets Ratio =(CACL)/ Assets = C) Calculate the total-debt-to-total-assets ratio, debt-to-equity ratio, and interest coverage. Total Debt to Total Assets Ratio = Debt / Assets = Debt to Equity Ratio = Debt / Equity = Interest Coverage Ratio =EBTDA/ Interest = D) Calculate the net profit margin, sales-to-total-assets ratio, and the return on total assets. Net Profit Margin = Net Profit / Revenues = Sales to Total Assets Ratio = Sales/Assets = Return on Total Assets = Net Profit / Assets = E) Calculate the equity multiplies. Combine this calculation with the calculations in Part D to show the ROE model with its three components. Equity Multiplier = Assets/ / Equity = Botal Debt to Total Assets Ratio = Debt/Assets = Debt to Equity Ratio = Debt / Equity = Interest Coverage Ratio = EBITDA/Interest = D) Calculate the net profit margin, sales-to-total-assets ratio, and the return on total assets. Net Profit Margin = Net Profit / Revenues = Sales to Total Assets Ratio = Sales/Assets = Return on Total Assets = Net Profit / Assets = E) Calculate the equity multiplies. Combine this calculation with the calculations in Part D to show the ROE model with its three components. Equity Multiplier = Assets / Equity = ROE = Net Profit Margin Asset Turnover Equity Multiplier = BIKE-WITH-US CORPORATION Sales Operating costs Depreciation Interest Taxes Cash 30,000 Receivables 50,000 Inventories 50,000 Fixed assets, net 11,000 Payables Entrepreneurial Finance Taxes Cash $1,000 Receivables 30,000 Inventories 50,000 Fixed assets, net 50,000 Payables 11,000 Accruals 10,000 Long-term loan 50,000 Stockholders' equity 60,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts