Question: CHAPTER 5:CONTINUOuS TAX RETURN PROBLEMS Problem Facts. This is a continuation of the tax return problem covering Chapters 3 and 4. See previous facts above.

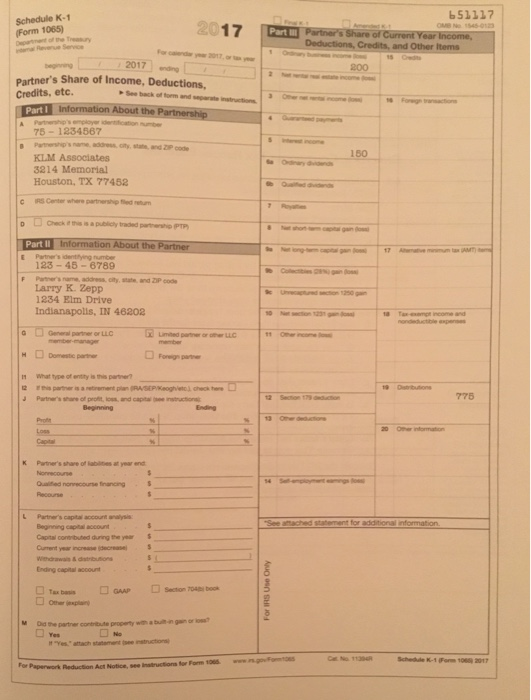

CHAPTER 5:CONTINUOuS TAX RETURN PROBLEMS Problem Facts. This is a continuation of the tax return problem covering Chapters 3 and 4. See previous facts above. New Facts: This morning's mail contained a note from Larry Zepp, including the fol- lowing information a. Cathy forgot to explain several things about her consulting income. First, $2,400 5-1 of the $12.000 she received was for services to be performed in 2017. Second, she performed consulting services in December but was not paid until January when she received $475. She had sent the client a bill for $475 in December and the amount was included in the $12,000 she reported earlier b. Larry paid federal estimated income taxes of $12,000 (S3,000 on each of the due dates). He made no state estimated tax payments. c. A Schedule K-1 from a calendar-year partnership in which Larry is a small inves- tor was included. The relevant portions of the Schedule K-1 are shown below. In addition, Larry received a $775 distribution from the partnership during the year. Prepare the 2017 individual income tax return for the Zepps. Complete Forms 1040, 2210, Schedules A. B. C. E. and SE. Assume that all of the expenses except their busi- ness expenses are incurred jointly 651117 Schedule K-1 Form 1065) 20 17 Part ill 2017 n 200 Partner's Share of Income, Deductions, Credits, etc. See back of form and separate 75- 1234567 180 KLM Associates 3214 Memorial Houston, TX 77452 o L Check e this is a publicly traded parthershio PTP Part I Information About the E Partner's identiying number 123-45-6789 Larry K. Zepp 1234 Elm Drive Indianapolls, IN 46202 11 Oner 1 What type of entity is this par? 2 Section 17 775 Beginning Ending K Patiner's share of labiltes at year end Recourse Partner's capital account analysis Beginning capital account Capital coneibuted during the year Ending capital account Schedule K-1 (Form 16 2017 CHAPTER 5:CONTINUOuS TAX RETURN PROBLEMS Problem Facts. This is a continuation of the tax return problem covering Chapters 3 and 4. See previous facts above. New Facts: This morning's mail contained a note from Larry Zepp, including the fol- lowing information a. Cathy forgot to explain several things about her consulting income. First, $2,400 5-1 of the $12.000 she received was for services to be performed in 2017. Second, she performed consulting services in December but was not paid until January when she received $475. She had sent the client a bill for $475 in December and the amount was included in the $12,000 she reported earlier b. Larry paid federal estimated income taxes of $12,000 (S3,000 on each of the due dates). He made no state estimated tax payments. c. A Schedule K-1 from a calendar-year partnership in which Larry is a small inves- tor was included. The relevant portions of the Schedule K-1 are shown below. In addition, Larry received a $775 distribution from the partnership during the year. Prepare the 2017 individual income tax return for the Zepps. Complete Forms 1040, 2210, Schedules A. B. C. E. and SE. Assume that all of the expenses except their busi- ness expenses are incurred jointly 651117 Schedule K-1 Form 1065) 20 17 Part ill 2017 n 200 Partner's Share of Income, Deductions, Credits, etc. See back of form and separate 75- 1234567 180 KLM Associates 3214 Memorial Houston, TX 77452 o L Check e this is a publicly traded parthershio PTP Part I Information About the E Partner's identiying number 123-45-6789 Larry K. Zepp 1234 Elm Drive Indianapolls, IN 46202 11 Oner 1 What type of entity is this par? 2 Section 17 775 Beginning Ending K Patiner's share of labiltes at year end Recourse Partner's capital account analysis Beginning capital account Capital coneibuted during the year Ending capital account Schedule K-1 (Form 16 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts