Question: CHAPTER 4: CONTINUOUS TAX RETURN PROBLEMS 4-1 Problem Facts. This is a continuation of the tax return problem beginning in Chapter 3. See previous facts

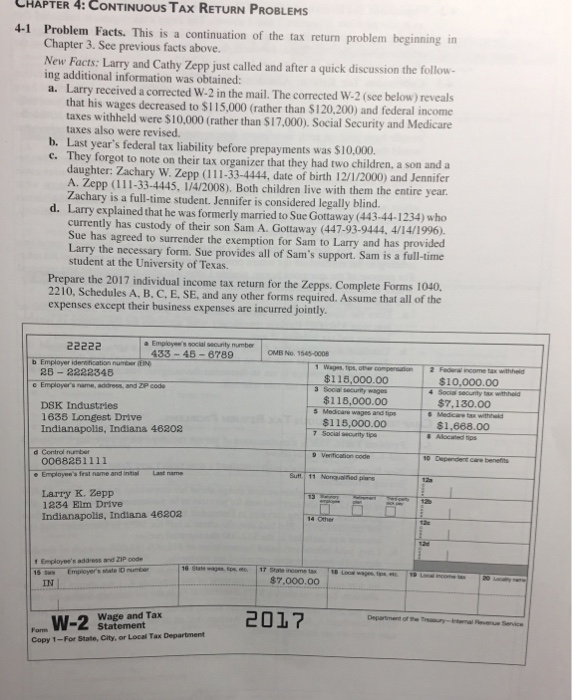

CHAPTER 4: CONTINUOUS TAX RETURN PROBLEMS 4-1 Problem Facts. This is a continuation of the tax return problem beginning in Chapter 3. See previous facts above. New Facts: Larry and Cathy Zepp just called and after a quick discussion the foll ing additional information was obtained: a. Larry received a corrected W-2 in the m ail. The corrected W-2 (see below) reveals that his wages decreased to $115,000 (rather than $120,200) and federal income taxes withheld were $10,000 (rather than $17,000). Social Security and Medicare taxes also were revised. b. Last year's federal tax liability before prepayments was $10,000. c. They forgot to note on their tax organizer that they had two children, a son and a daughter: Zachary W. Zepp (111-33-4444, date of birth 12/1/2000) and Jennifer A. Zepp (111-33-4445, 1/4/2008). Both children live with them the entire year Zachary is a full-time student. Jennifer is considered legally blind explained that he was formerly married to Sue Gottaway (443-44-1234) who currently has custody of their son Sam A. Gottaway (447-93-9444, 4/14/1996). Sue has agreed to surrender the exemption for Sam to Larry and has provided ry the necessary form. Sue provides all of Sam's support. Sam is a full-time student at the University of Texas. Prepare the 2017 individual income tax return for the Zepps. Complete Forms I 2210, Schedules A. B. expenses except their business expenses are incurred jointly C. E, SE, and any other forms required. Assume that all of the a Employee's social seourity number 433-45-6789 OMB No. 1545-0008 26- 2222345 o Employer's name, address, and zP code ncome tax withheid $115,000.00 Social security wages $118,000.00 Medicare wages and tips $115,000.00 $10,000.00 Social security tax $7,130.00 DSK Industries 1635 Longest Drive Indianapolis, Indiana 46202 $1,668.00 7 Social security tips d Control number Verification code 0068261111 Larry K. Zepp 1234 Elm Drive Indianapolis, Indiana 46202 f Employee's address and ZIP code $7.000.00 IN Wage and Tax Statement 2017 Form Copy 1-For State, City, or Local Tax Department CHAPTER 4: CONTINUOUS TAX RETURN PROBLEMS 4-1 Problem Facts. This is a continuation of the tax return problem beginning in Chapter 3. See previous facts above. New Facts: Larry and Cathy Zepp just called and after a quick discussion the foll ing additional information was obtained: a. Larry received a corrected W-2 in the m ail. The corrected W-2 (see below) reveals that his wages decreased to $115,000 (rather than $120,200) and federal income taxes withheld were $10,000 (rather than $17,000). Social Security and Medicare taxes also were revised. b. Last year's federal tax liability before prepayments was $10,000. c. They forgot to note on their tax organizer that they had two children, a son and a daughter: Zachary W. Zepp (111-33-4444, date of birth 12/1/2000) and Jennifer A. Zepp (111-33-4445, 1/4/2008). Both children live with them the entire year Zachary is a full-time student. Jennifer is considered legally blind explained that he was formerly married to Sue Gottaway (443-44-1234) who currently has custody of their son Sam A. Gottaway (447-93-9444, 4/14/1996). Sue has agreed to surrender the exemption for Sam to Larry and has provided ry the necessary form. Sue provides all of Sam's support. Sam is a full-time student at the University of Texas. Prepare the 2017 individual income tax return for the Zepps. Complete Forms I 2210, Schedules A. B. expenses except their business expenses are incurred jointly C. E, SE, and any other forms required. Assume that all of the a Employee's social seourity number 433-45-6789 OMB No. 1545-0008 26- 2222345 o Employer's name, address, and zP code ncome tax withheid $115,000.00 Social security wages $118,000.00 Medicare wages and tips $115,000.00 $10,000.00 Social security tax $7,130.00 DSK Industries 1635 Longest Drive Indianapolis, Indiana 46202 $1,668.00 7 Social security tips d Control number Verification code 0068261111 Larry K. Zepp 1234 Elm Drive Indianapolis, Indiana 46202 f Employee's address and ZIP code $7.000.00 IN Wage and Tax Statement 2017 Form Copy 1-For State, City, or Local Tax Department

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts