Question: I need requirement 3, Please provide answer within the format with supporting calculation seperately Moon Systems specializes in servers for work-group, e-commerce, and enterprise resource

I need requirement 3,

Please provide answer within the format with supporting calculation seperately

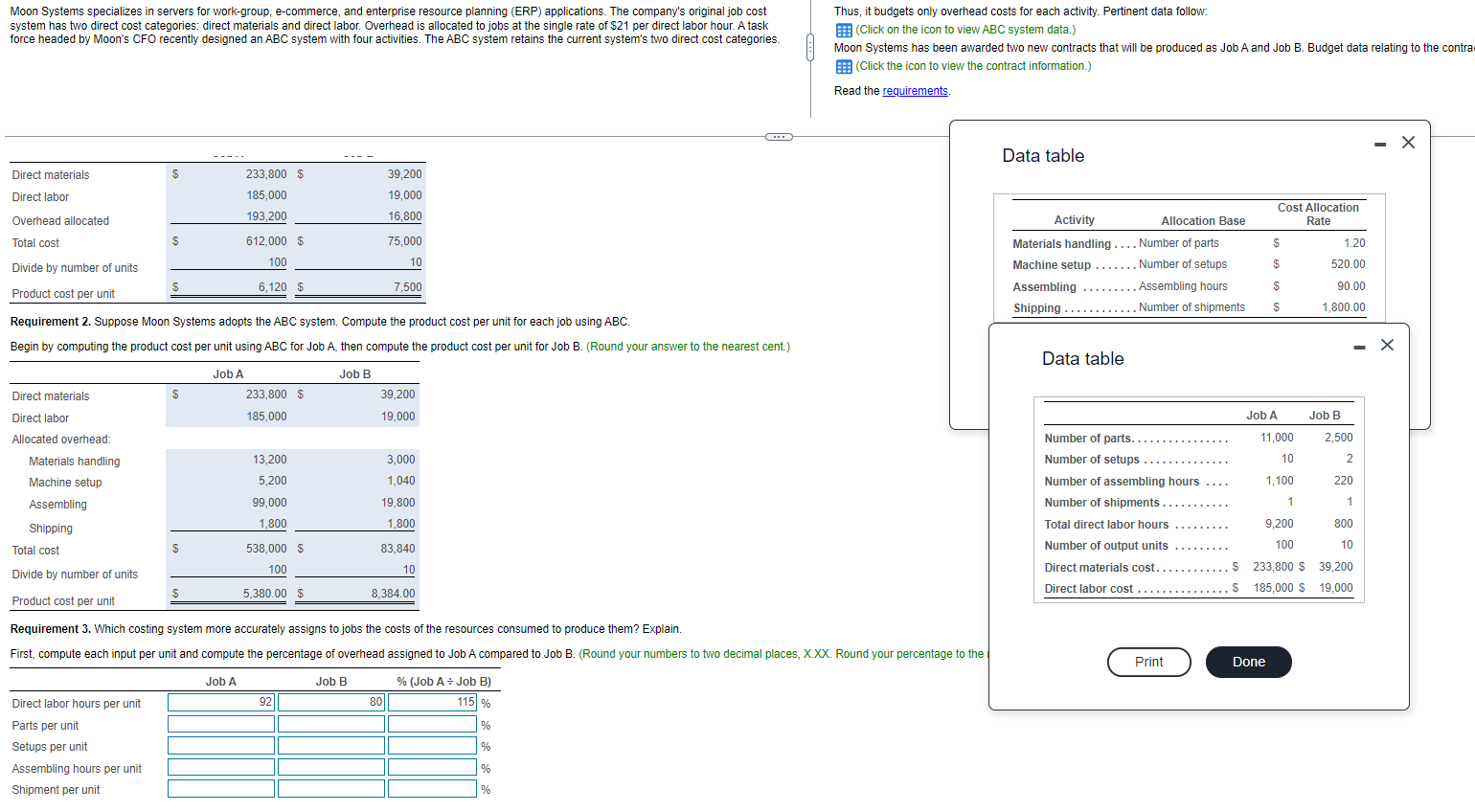

Moon Systems specializes in servers for work-group, e-commerce, and enterprise resource planning (ERP) applications. The company's original job cost Thus, it budgets only overhead costs for each activity. Pertinent data follow. system has two direct cost categories: direct materials and direct labor. Overhead is allocated to jobs at the single rate of $21 per direct labor hour. A task force headed by Moon's CFO recently designed an ABC system with four activities. The ABC system retains the current system's two direct cost categories. (Click on the icon to view ABC system data.) Moon Systems has been awarded two new contracts that will be produced as Job A and Job B. Budget data relating to the contra (Click the icon to view the contract information.) Read the requirements. - X - -- Data table Direct materials 233,800 $ 39,200 Direct labor 185,000 19,000 Overhead allocated 193,200 16.800 Cost Allocation Activity Allocation Base Rate Total cost 612,000 $ 75,000 Materials handling . .. . Number of parts 1.20 Divide by number of units 100 10 Machine setup . . . ... . Number of setups 520.00 Product cost per unit 6,120 $ 7,500 Assembling . ....... . Assembling hours 90.00 Shipping . . . .. .. . . .. . Number of shipments 1,800.00 Requirement 2. Suppose Moon Systems adopts the ABC system. Compute the product cost per unit for each job using ABC Begin by computing the product cost per unit using ABC for Job A, then compute the product cost per unit for Job B. (Round your answer to the nearest cent.) - X Data table Job A Job B Direct materials 233,800 $ 39,200 Direct labor 185,000 19,000 Job A Job B Allocated overhead: Number of parts. . . . . . . . . . . . ... 11,000 2,500 Materials handling 13,200 3,000 Number of setups . . . . .. 10 Machine setup 5,200 1,040 Number of assembling hours . . . . 1.100 220 Assembling 99,000 19,800 Number of shipments . . .. Shipping 1,800 1,800 Total direct labor hours . . . . . 9,200 800 Total cost 538,000 $ 83,840 Number of output units . . . . . 100 Divide by number of units 100 10 Direct materials cost. . . . .. . . $ 233,800 $ 39,200 185,000 $ 19,000 Product cost per unit 5,380.00 $ 8,384.00 Direct labor COST . . . . . . . . . . . .... 5 Requirement 3. Which costing system more accurately assigns to jobs the costs of the resources consumed to produce them? Explain. First, compute each input per unit and compute the percentage of overhead assigned to Job A compared to Job B. (Round your numbers to two decimal places, X.XX. Round your percentage to the Print Done Job A Job B (Job A : Job B) Direct labor hours per unit 92 80 115 % Parts per unit Setups per unit Assembling hours per unit Shipment per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts