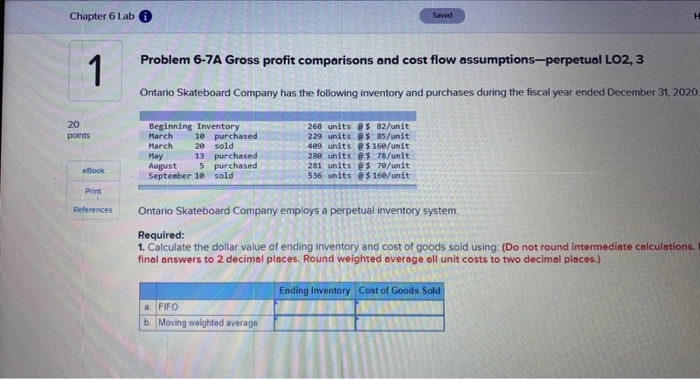

Question: Chapter 6 Lab Saved Problem 6-7A Gross profit comparisons and cost flow assumptions-perpetual LO2, 3 Ontario Skateboard Company has the following inventory and purchases during

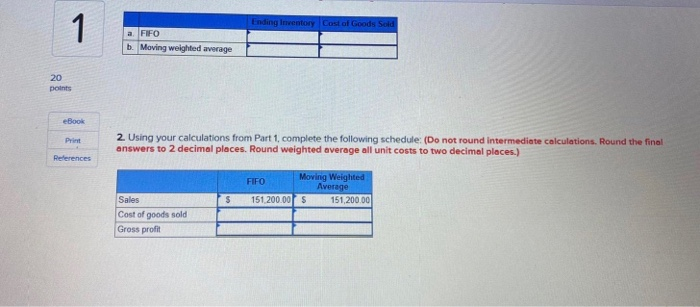

Chapter 6 Lab Saved Problem 6-7A Gross profit comparisons and cost flow assumptions-perpetual LO2, 3 Ontario Skateboard Company has the following inventory and purchases during the fiscal year ended December 31, 2020, points Beginning Inventory March 10 purchased March 20 sold May 13 purchased August 5 purchased September 10 sold 268 units @ $ 82/unit 229 units @ $ 85/unit 409 units $ 160/unit 280 units $ 78/unit 281 units @ $ 70/unit 536 units @ $ 160/unit eBook Print References Ontario Skateboard Company employs a perpetual inventory system Required: 1. Calculate the dollar value of ending inventory and cost of goods sold using: (Do not round intermediate calculations final answers to 2 decimal places. Round weighted average all unit costs to two decimal places.) Ending Inventory Cost of Goods Sold a FIFO b. Moving weighted average Ending Inventory Cost of Goods Sold a FIFO b. Moving weighted average eBook Print 2. Using your calculations from Part 1, complete the following schedule: (Do not round Intermediate calculations. Round the final answers to 2 decimal places. Round weighted average all unit costs to two decimal places.) References Moving Weighted FIFO Average 151.200.001 s 151,200.00 5 Sales Cost of goods sold Gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts